Honeywell 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

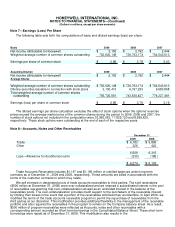

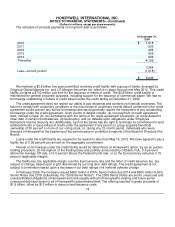

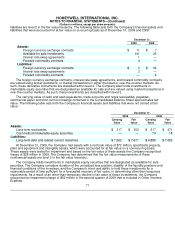

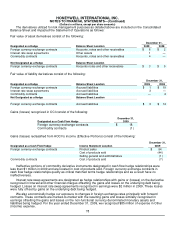

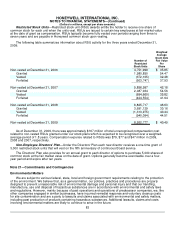

liabilities are level 2 in the fair value hierarchy. The following table sets forth the Company's financial assets and

liabilities that were accounted for at fair value on a recurring basis as of December 31, 2009 and 2008:

December 31,

2009 2008

Assets:

Foreign currency exchange contracts $ 11 $ 7

Available for sale investments 141 23

Interest rate swap agreements 1 —

Forward commodity contracts 4 —

Liabilities:

Foreign currency exchange contracts $ 3 $ 34

Interest rate swap agreements 3 —

Forward commodity contracts — 4

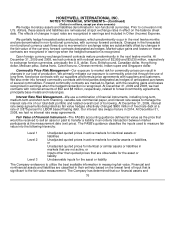

The foreign currency exchange contracts, interest rate swap agreements, and forward commodity contracts

are valued using broker quotations, or market transactions in either the listed or over-the-counter markets. As

such, these derivative instruments are classified within level 2. The Company also holds investments in

marketable equity securities that are designated as available for sale and are valued using market transactions in

over-the-counter markets. As such, these investments are classified within level 2.

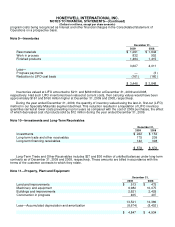

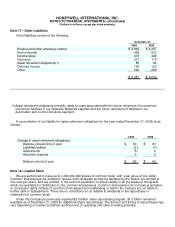

The carrying value of cash and cash equivalents, trade accounts and notes receivables, payables,

commercial paper and short-term borrowings contained in the Consolidated Balance Sheet approximates fair

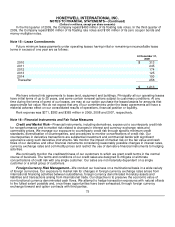

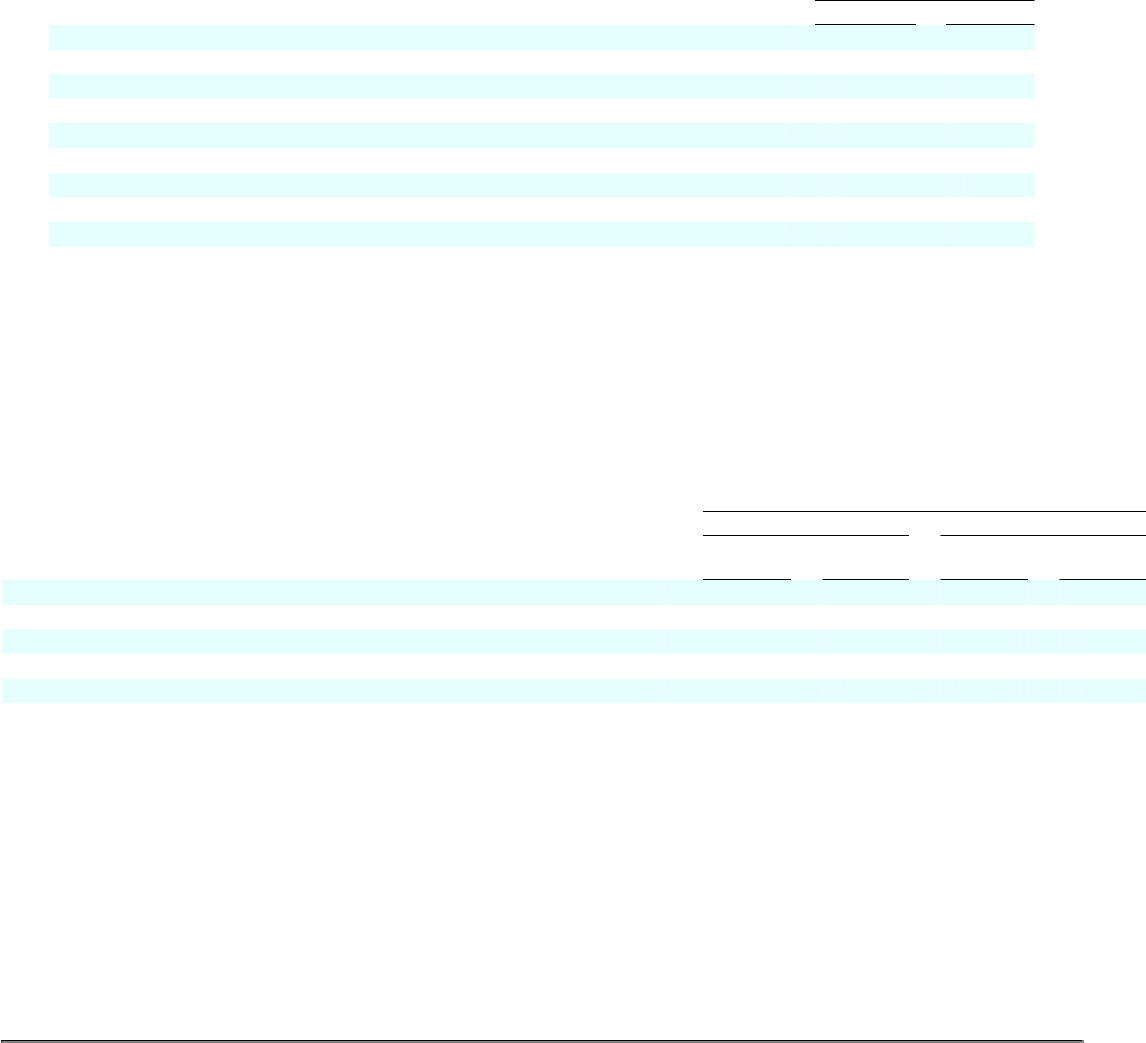

value. The following table sets forth the Company's financial assets and liabilities that were not carried at fair

value:

December 31,

2009 2008

Carrying

Value Fair

Value Carrying

Value Fair

Value

Assets:

Long-term receivables $ 317 $ 303 $ 517 $ 471

Cost method marketable equity securities — — 74 18

Liabilities:

Long-term debt and related current maturities. $ 7,262 $ 7,677 $ 6,888 $ 7,082

At December 31, 2009, the Company had assets with a net book value of $72 million, specifically property,

plant and equipment and intangible assets, which were accounted for at fair value on a nonrecurring basis.

These assets were tested for impairment and based on the fair value of these assets the Company recognized

losses of $28 million in 2009. The Company has determined that the fair value measurements of these

nonfinancial assets are level 3 in the fair value hierarchy.

The Company holds investments in marketable equity securities that are designated as available for sale

securities. The Company considers duration of the unrealized loss position, stability of the liquidity positions and

financial conditions of the investees, and the Company's intent and ability to hold these investments for a

reasonable period of time sufficient for a forecasted recovery of fair value, in determining other than temporary

impairments. As a result of an other-than-temporary decline in fair value of these investments, the Company

recognized an impairment charge of $62 million in the second quarter of 2009 that is included in Other (Income)

Expense.

77