Honeywell 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

Federal, State and foreign tax authorities. We regularly assess the potential outcomes of these examinations and

any future examinations for the current or prior years in determining the adequacy of our provision for income

taxes. We continually assess the likelihood and amount of potential adjustments and adjust the income tax

provision, the current tax liability and deferred taxes in the period in which the facts that give rise to a revision

become known.

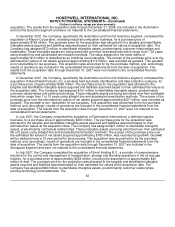

In June 2006, the Financial Accounting Standards Board (FASB) issued guidance for accounting for

uncertainty in income taxes, which establishes a single model to address accounting for uncertain tax positions.

The guidance clarifies the accounting for income taxes by prescribing a minimum recognition threshold a tax

position is required to meet before being recognized in the financial statements. The guidance also provides

guidance on derecognition, measurement classification, interest and penalties, accounting in interim periods,

disclosure and transition. Upon adoption as of January 1, 2007, we reduced our existing reserves for uncertain

tax positions by $33 million, largely related to a reduction in state income tax matters, partially offset by a net

increase for federal and international tax reserves.

Earnings Per Share—Basic earnings per share is based on the weighted average number of common

shares outstanding. Diluted earnings per share is based on the weighted average number of common shares

outstanding and all dilutive potential common shares outstanding.

Use of Estimates—The preparation of consolidated financial statements in conformity with generally

accepted accounting principles requires management to make estimates and assumptions that affect the

reported amounts in the financial statements and related disclosures in the accompanying notes. Actual results

could differ from those estimates. Estimates and assumptions are periodically reviewed and the effects of

revisions are reflected in the consolidated financial statements in the period they are determined to be necessary.

Reclassifications—Certain prior year amounts have been reclassified to conform to the current year

presentation.

Recent Accounting Pronouncements—In September 2006, the Financial Accounting Standards Board

(FASB) issued new accounting guidance on fair value measurements. This guidance establishes a common

definition for fair value to be applied to U.S. GAAP requiring use of fair value, establishes a framework for

measuring fair value, and expands disclosure about such fair value measurements. It is effective for financial

assets and financial liabilities for fiscal years beginning after November 15, 2007. Issued in February 2008, a

FASB staff position removed leasing transactions from the scope of the new fair value guidance. Also in February

2008, the FASB issued authoritative guidance deferring the effective date of the fair value guidance for all

nonfinancial assets and nonfinancial liabilities to fiscal years beginning after November 15, 2008.

In September 2009, the FASB issued additional guidance on measuring the fair value of liabilities effective

for the first reporting period (including interim periods) beginning after issuance. Implementation did not have a

material impact on our consolidated financial position and results of operations.

The implementation of the fair value guidance for nonfinancial assets and nonfinancial liabilities, effective

January 1, 2009, did not have a material impact on our consolidated financial position and results of operations.

See Note 16 for additional fair value information and disclosure for financial and nonfinancial assets and

liabilities.

In December 2007, the FASB issued new guidance on business combinations. The new standard provides

revised guidance on how acquirors recognize and measure the consideration transferred, identifiable assets

acquired, liabilities assumed, noncontrolling interests, and goodwill acquired in a business combination. The new

standard also expands required disclosures surrounding the nature and financial effects of business

combinations. The standard is effective, on a prospective basis, for fiscal years beginning after December 15,

2008. Upon adoption, this standard did not have a material

58