Honeywell 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

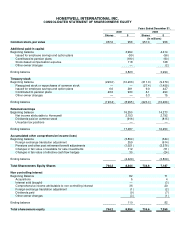

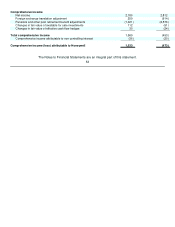

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

environments, inventories and property, plant and equipment, including related expenses, are remeasured at the

exchange rate in effect on the date the assets were acquired, while monetary assets and liabilities are

remeasured at year-end exchange rates. Remeasurement adjustments for these subsidiaries are included in

earnings.

Derivative Financial Instruments—As a result of our global operating and financing activities, we are

exposed to market risks from changes in interest and foreign currency exchange rates and commodity prices,

which may adversely affect our operating results and financial position. We minimize our risks from interest and

foreign currency exchange rate and commodity price fluctuations through our normal operating and financing

activities and, when deemed appropriate through the use of derivative financial instruments. Derivative financial

instruments are used to manage risk and are not used for trading or other speculative purposes and we do not

use leveraged derivative financial instruments. Derivative financial instruments used for hedging purposes must

be designated and effective as a hedge of the identified risk exposure at the inception of the contract.

Accordingly, changes in fair value of the derivative contract must be highly correlated with changes in fair value

of the underlying hedged item at inception of the hedge and over the life of the hedge contract.

All derivatives are recorded on the balance sheet as assets or liabilities and measured at fair value. For

derivatives designated as hedges of the fair value of assets or liabilities, the changes in fair values of both the

derivatives and the hedged items are recorded in current earnings. For derivatives designated as cash flow

hedges, the effective portion of the changes in fair value of the derivatives are recorded in Accumulated Other

Comprehensive Income (Loss) and subsequently recognized in earnings when the hedged items impact

earnings. Cash flows of such derivative financial instruments are classified consistent with the underlying hedged

item.

Transfers of Financial Instruments—Sales, transfers and securitization of financial instruments are

accounted for under authoritative guidance for the transfers and servicing of financial assets and extinguishments

of liabilities. We sell interests in designated pools of trade accounts receivables to third parties. The receivables

are removed from the Consolidated Balance Sheet at the time they are sold. The value assigned to our

subordinated interests and undivided interests retained in trade receivables sold is based on the relative fair

values of the interests retained and sold. The carrying value of the retained interests approximates fair value due

to the short-term nature of the collection period for the receivables.

Income Taxes—Deferred tax liabilities or assets reflect temporary differences between amounts of assets

and liabilities for financial and tax reporting. Such amounts are adjusted, as appropriate, to reflect changes in tax

rates expected to be in effect when the temporary differences reverse. A valuation allowance is established to

offset any deferred tax assets if, based upon the available evidence, it is more likely than not that some or all of

the deferred tax assets will not be realized. The determination of the amount of a valuation allowance to be

provided on recorded deferred tax assets involves estimates regarding (1) the timing and amount of the reversal

of taxable temporary differences, (2) expected future taxable income, and (3) the impact of tax planning

strategies. In assessing the need for a valuation allowance, we consider all available positive and negative

evidence, including past operating results, projections of future taxable income and the feasibility of ongoing tax

planning strategies. The projections of future taxable income include a number of estimates and assumptions

regarding our volume, pricing and costs. Additionally, valuation allowances related to deferred tax assets can be

impacted by changes to tax laws.

Significant judgment is required in determining income tax provisions and in evaluating tax positions. We

establish additional provisions for income taxes when, despite the belief that tax positions are fully supportable,

there remain certain positions that do not meet the minimum probability threshold, as defined by the authoritative

guidance for uncertainty in income taxes, which is a tax position that is more likely than not to be sustained upon

examination by the applicable taxing authority. In the normal course of business, the Company and its

subsidiaries are examined by various

57