Honeywell 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

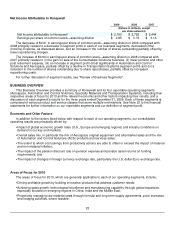

•

Driving cash flow conversion through effective working capital management and capital investment in our

businesses, thereby enabling liquidity, repayment of debt, strategic acquisitions, and the ability to return

value to shareholders;

•

Actively monitoring trends in short-cycle end markets, such as the Transportations Systems Turbo business,

ACS Products businesses, Aerospace commercial aftermarket and Specialty Materials resins and

chemicals, and continuing to take proactive cost actions;

•

Aligning and prioritizing investments in long-term growth vs. short-term demand volatility;

•

Driving productivity savings through execution of repositioning actions;

•

Maintaining reduced discretionary spending levels with focus on non-customer related costs;

•

Ensuring preparedness to maximize performance in response to the end of customer inventory de-stocking

and/or improving end market conditions while controlling costs by proactively managing capacity utilization,

supply chain and inventory demand;

•

Utilizing our enablers Honeywell Operating System (HOS), Functional Transformation and Velocity Product

Development (VPD) to standardize the way we work, increase quality and reduce the costs of product

manufacturing, reduce costs and enhance the quality of our administrative functions and improve business

operations through investments in systems and process improvements;

•

Monitoring both suppliers and customers for signs of liquidity constraints, limiting exposure to any resulting

inability to meet delivery commitments or pay amounts due, and identifying alternate sources of supply as

necessary; and

•

Managing Corporate costs, including costs incurred for asbestos and environmental matters, pension and

other post-retirement expenses and our tax expense.

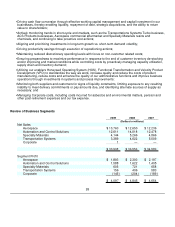

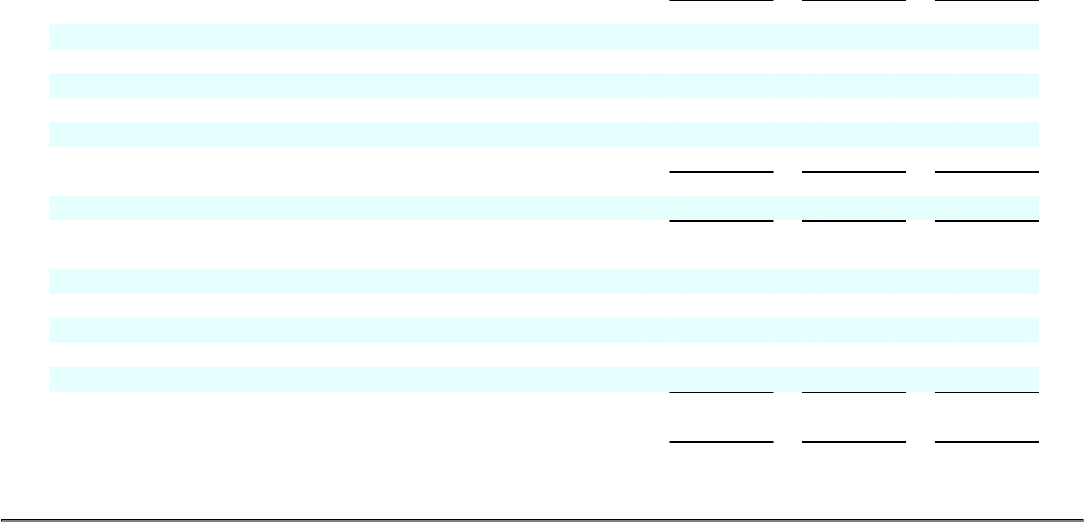

Review of Business Segments

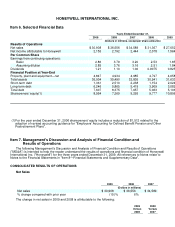

2009 2008 2007

(Dollars in millions)

Net Sales

Aerospace $ 10,763 $ 12,650 $ 12,236

Automation and Control Solutions 12,611 14,018 12,478

Specialty Materials 4,144 5,266 4,866

Transportation Systems 3,389 4,622 5,009

Corporate 1 — —

$ 30,908 $ 36,556 $ 34,589

Segment Profit

Aerospace $ 1,893 $ 2,300 $ 2,197

Automation and Control Solutions 1,588 1,622 1,405

Specialty Materials 605 721 658

Transportation Systems 156 406 583

Corporate (145) (204) (189)

$ 4,097 $ 4,845 $ 4,654

26