Honeywell 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

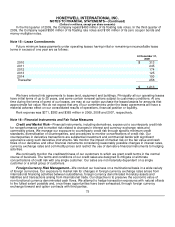

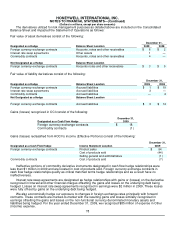

The derivatives utilized for risk management purposes as detailed above are included on the Consolidated

Balance Sheet and impacted the Statement of Operations as follows:

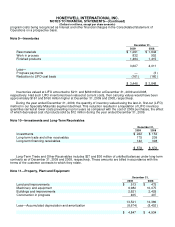

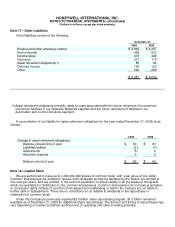

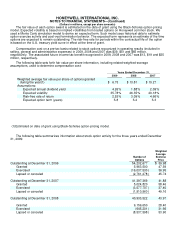

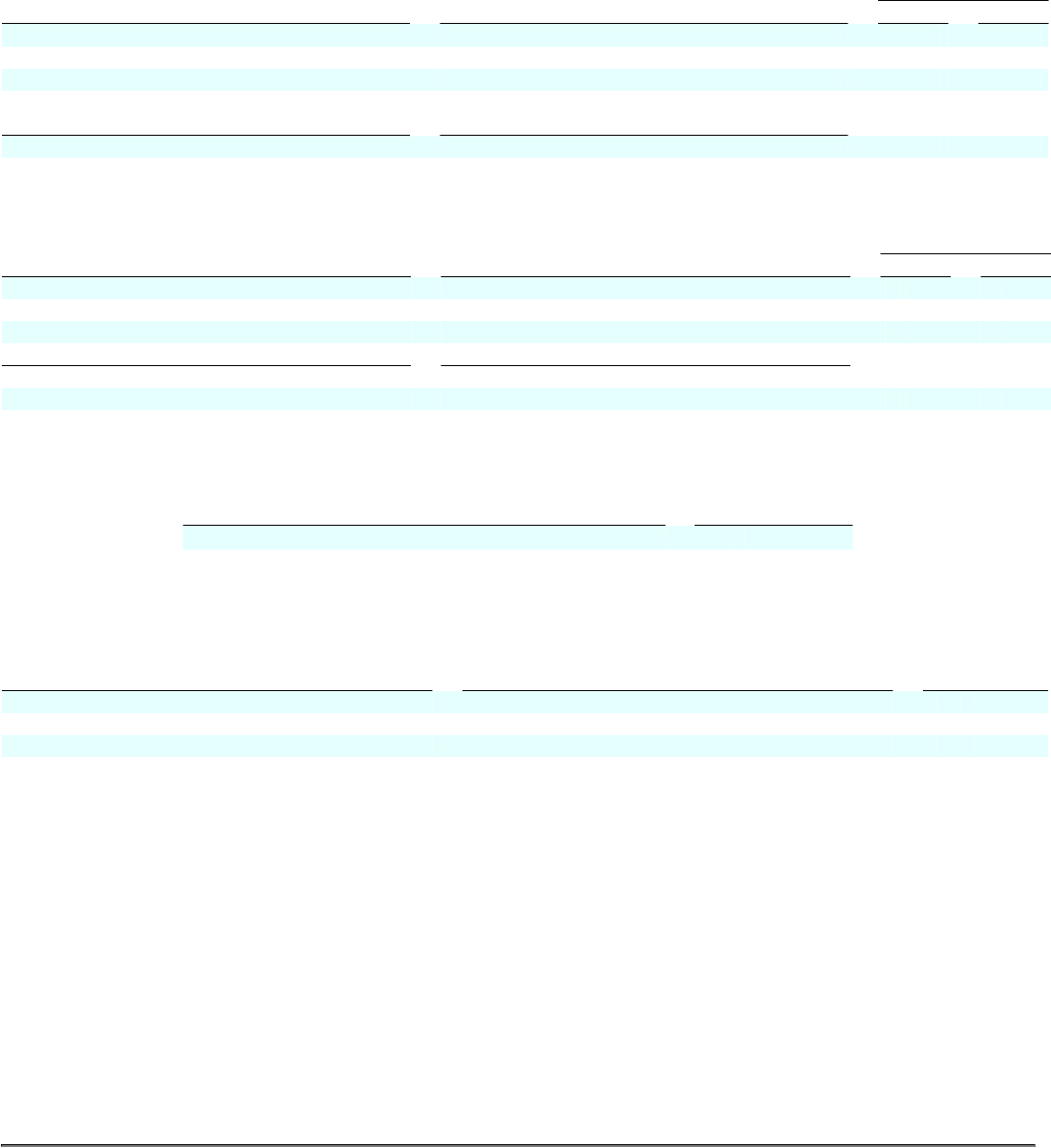

Fair value of asset derivatives consist of the following:

Designated as a Hedge Balance Sheet Location December 31,

2009 2008

Foreign currency exchange contracts Accounts, notes and other receivables $ 8 $ 2

Interest rate swap agreements Other assets 1 —

Commodity contracts Accounts, notes and other receivables 4 —

Not Designated as a Hedge Balance Sheet Location

Foreign currency exchange contracts Accounts notes and other receivables $ 3 $ 5

Fair value of liability derivatives consist of the following:

Designated as a Hedge Balance Sheet Location December 31,

2009 2008

Foreign currency exchange contracts Accrued liabilities $ 1 $ 19

Interest rate swap agreements Accrued liabilities 3 —

Commodity contracts Accrued liabilities — 4

Not Designated as a Hedge Balance Sheet Location

Foreign currency exchange contracts Accrued liabilities $ 3 $ 14

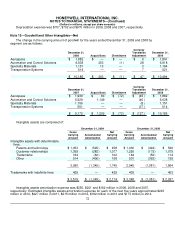

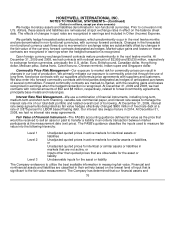

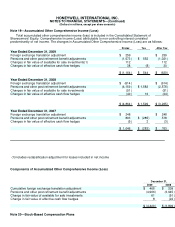

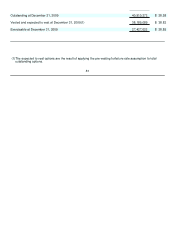

Gains (losses) recognized in OCI consist of the following:

Designated as a Cash Flow Hedge December 31,

2009

Foreign currency exchange contracts $ 18

Commodity contracts (1)

Gains (losses) reclassified from AOCI to income (Effective Portions) consist of the following:

Designated as a Cash Flow Hedge Income Statement Location December 31,

2009

Foreign currency exchange contracts Product sales $ 54

Cost of products sold (44)

Selling general and administrative (1)

Commodity contracts Cost of products sold (7)

Ineffective portions of commodity derivative instruments designated in cash flow hedge relationships were

less than $1 million in 2009 and are located in cost of products sold. Foreign currency exchange contracts in

cash flow hedge relationships qualify as critical matched terms hedge relationships and as a result have no

ineffectiveness.

Interest rate swap agreements are designated as hedge relationships with gains or (losses) on the derivative

recognized in Interest and other financial charges offsetting the gains and losses on the underlying debt being

hedged. Losses on interest rate swap agreements recognized in earnings were $2 million in 2009. These losses

were fully off-set by gains on the underlying debt being hedged.

We also economically hedge our exposure to changes in foreign exchange rates principally with forward

contracts. These contracts are marked-to-market with the resulting gains and losses similarly recognized in

earnings offsetting the gains and losses on the non-functional currency denominated monetary assets and

liabilities being hedged. For the year ended December 31, 2009, we recognized $85 million of expense in Other

(income) expense.

78