Honeywell 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

benefits from prior repositioning actions and lower incentive compensation), the positive impact of cost savings

initiatives and increased prices.

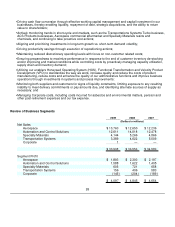

2008 compared with 2007

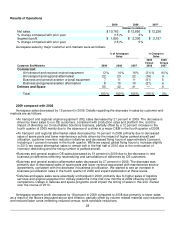

Aerospace sales increased by 3 percent in 2008. Details regarding the net increase in sales by customer

end-markets are as follows:

• Air transport and regional original equipment (OE) sales decreased by 6 percent in 2008. The decrease was

driven by the sale of our Consumables Solutions business, partially offset by increased deliveries to our air

transport customers, notwithstanding a decrease in total aircraft production rates at major OEM's mainly due

to a strike at a major OEM, which was settled in the fourth quarter of 2008.

•

Air transport and regional aftermarket sales increased by 4 percent in 2008 primarily due to increased

volume, the price of spare parts and aftermarket growth driven by flight hour growth. The growth rate in

global flying hours slowed to 3 percent in 2008, including a 2 percent decline in the fourth quarter.

•

Business and general aviation OE sales increased by 5 percent in 2008 due to continued demand in the

business jet end market as evidenced by an increase in new business jet deliveries, improved pricing and

continued additions to the fractional ownership and charter fleets. In 2008, sales to this end- market

primarily consisted of sales of Primus Epic integrated avionics systems and the TFE 731 and HTF 7000

engines.

•

Business and general aviation aftermarket sales increased by 6 percent in 2008. The increase was primarily

due to increased revenue under maintenance service agreements and higher sales of spare parts.

•

Defense and space sales increased by 6 percent in 2008. The increase was primarily due to logistics

services (including the positive impact of the acquisition of Dimensions International, a defense logistics

business), helicopter OE sales, an increase in government funded engineering related to the Orion (CEV)

program, higher sales of specialty foam insulation, certain surface systems and classified space programs.

Aerospace segment profit increased by 5 percent in 2008 compared to 2007 due primarily to increased

prices, productivity and sales volume growth. These increases are partially offset by inflation, the Consumables

Solutions divestiture and higher spending to support new platform growth.

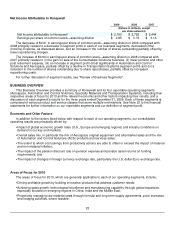

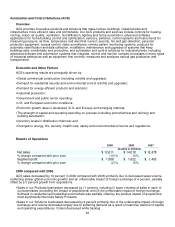

2010 Areas of Focus

Aerospace's primary areas of focus for 2010 include:

• Focus on cost structure initiatives to maintain profitability in the face of challenging commercial aerospace

conditions;

•

Aligning inventory, production and research and development with customer demand and production

schedules;

•

Expanding sales and operations in international locations;

•

Pursuit of new defense and space platforms;

•

Continuing to design equipment that enhances the safety, performance and durability of aerospace and

defense equipment, while reducing weight and operating costs;

•

Delivering world-class customer service and achieving cycle and lead time reduction to improve

responsiveness to customer demand; and

•

Continued deployment of our common enterprise resource planning (ERP) system.

29