Honeywell 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

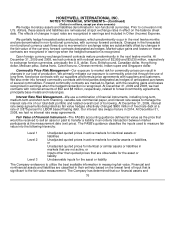

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

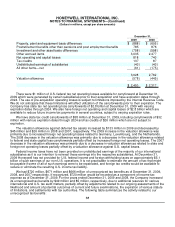

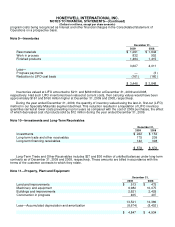

Depreciation expense was $707, $702 and $675 million in 2009, 2008 and 2007, respectively.

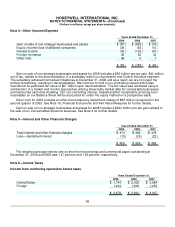

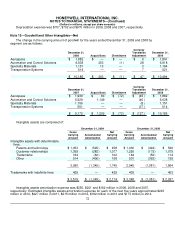

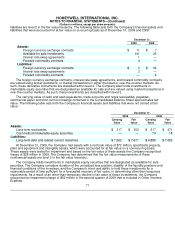

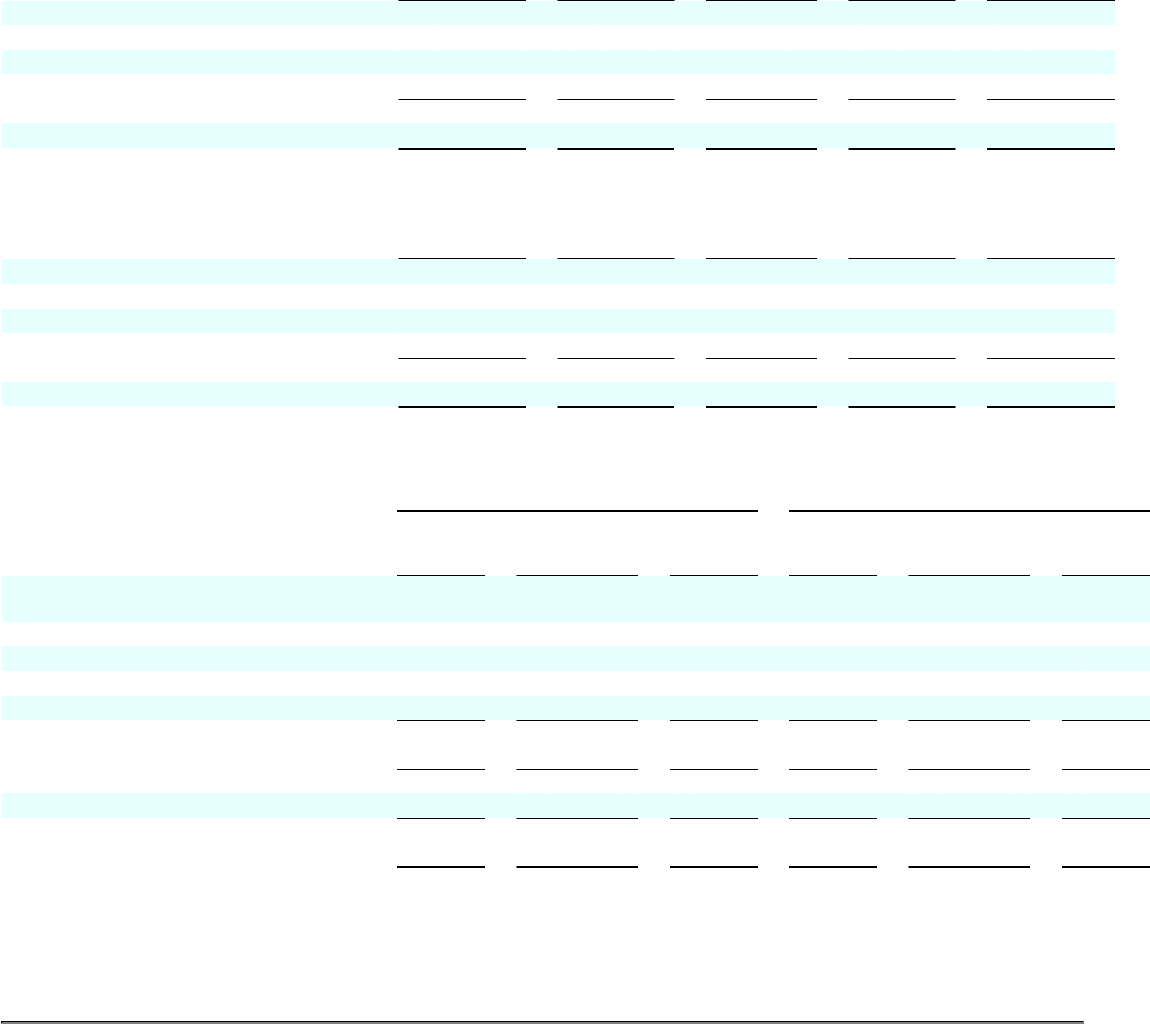

Note 12—Goodwill and Other Intangibles—Net

The change in the carrying amount of goodwill for the years ended December 31, 2009 and 2008 by

segment are as follows:

December 31,

2008 Acquisitions Divestitures

Currency

Translation

Adjustment December 31,

2009

Aerospace $ 1,882 $ — $ — $ 9 $ 1,891

Automation and Control Solutions 6,638 253 (1) 28 6,918

Specialty Materials 1,151 10 — 3 1,164

Transportation Systems 514 — — 7 521

$ 10,185 $ 263 $ (1) $ 47 $ 10,494

December 31,

2007 Acquisitions Divestitures

Currency

Translation

Adjustment December 31,

2008

Aerospace $ 1,939 $ 60 $ (72) $ (45) $ 1,882

Automation and Control Solutions 5,529 1,149 — (40) 6,638

Specialty Materials 1,156 — — (5) 1,151

Transportation Systems 551 — — (37) 514

$ 9,175 $ 1,209 $ (72) $ (127) $ 10,185

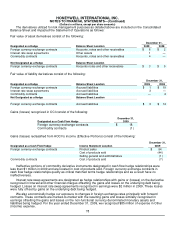

Intangible assets are comprised of:

December 31, 2009 December 31, 2008

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Amount

Intangible assets with determinable

lives:

Patents and technology $ 1,053 $ (595) $ 458 $ 1,030 $ (494) $ 536

Customer relationships 1,359 (282) 1,077 1,250 (175) 1,075

Trademarks 164 (62) 102 164 (50) 114

Other 514 (406) 108 501 (362) 139

3,090 (1,345) 1,745 2,945 (1,081) 1,864

Trademarks with indefinite lives 429 — 429 403 — 403

$ 3,519 $ (1,345) $ 2,174 $ 3,348 $ (1,081) $ 2,267

Intangible assets amortization expense was $250, $201 and $162 million in 2009, 2008 and 2007,

respectively. Estimated intangible assets amortization expense for each of the next five years approximates $245

million in 2010, $227 million in 2011, $215 million in 2012, $192 million in 2013 and $173 million in 2014.

72