Honeywell 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

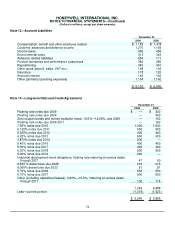

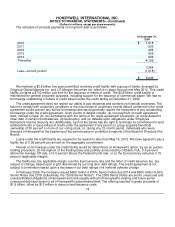

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

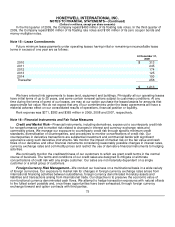

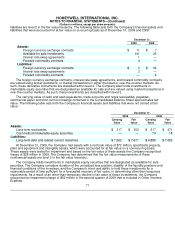

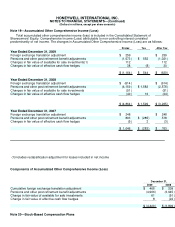

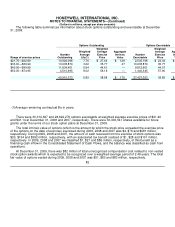

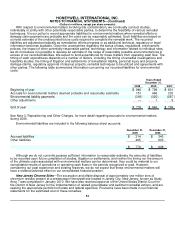

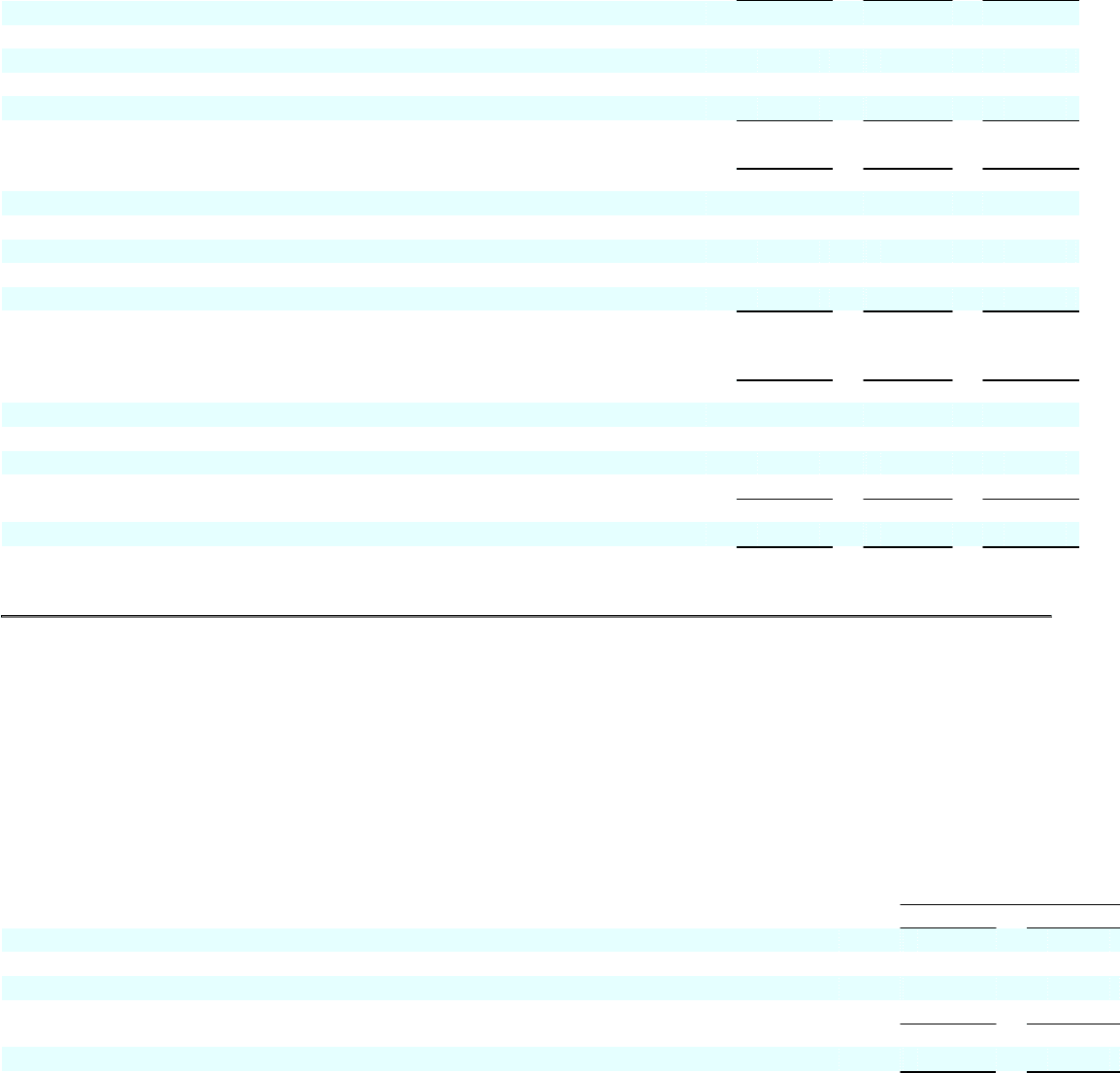

Note 19—Accumulated Other Comprehensive Income (Loss)

Total accumulated other comprehensive income (loss) is included in the Consolidated Statement of

Shareowners' Equity. Comprehensive Income (Loss) attributable to non-controlling interest consisted

predominantly of net income. The changes in Accumulated Other Comprehensive Income (Loss) are as follows:

Pretax Tax After Tax

Year Ended December 31, 2009

Foreign exchange translation adjustment $ 259 $ 259

Pensions and other post retirement benefit adjustments (1,573) $ 552 (1,021)

Changes in fair value of available for sale investments(1) 112 112

Changes in fair value of effective cash flow hedges 38 (8) 30

$ (1,164) $ 544 $ (620)

Year Ended December 31, 2008

Foreign exchange translation adjustment $ (614) $ (614)

Pensions and other post retirement benefit adjustments (4,159) $ 1,583 (2,576)

Changes in fair value of available for sale investments (51) (51)

Changes in fair value of effective cash flow hedges (40) 16 (24)

$ (4,864) $

1,599 $ (3,265)

Year Ended December 31, 2007

Foreign exchange translation adjustment $ 248 $ 248

Pensions and other post retirement benefit adjustments 803 $ (285) 518

Changes in fair value of effective cash flow hedges (5) 2 (3)

$ 1,046 $ (283) $ 763

(1) includes reclassification adjustment for losses included in net income

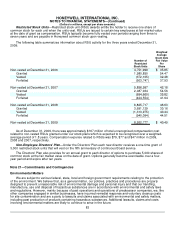

Components of Accumulated Other Comprehensive Income (Loss)

December 31,

2009 2008

Cumulative foreign exchange translation adjustment $ 468 $ 209

Pensions and other post retirement benefit adjustments (4,966) (3,945)

Change in fair value of available for sale investments 61 (51)

Change in fair value of effective cash flow hedges 8 (22)

$ (4,429) $ (3,809)

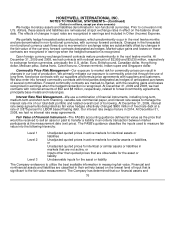

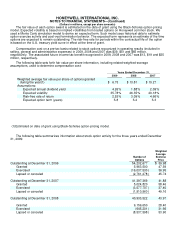

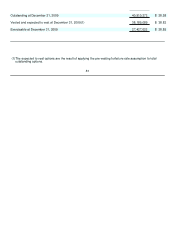

Note 20—Stock-Based Compensation Plans