Honeywell 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180

|

|

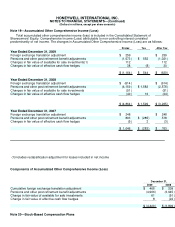

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

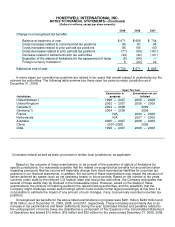

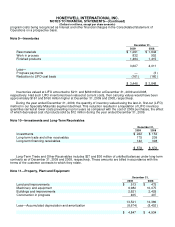

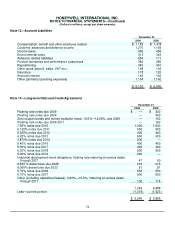

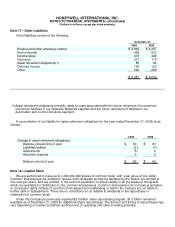

Note 13—Accrued Liabilities

December 31,

2009 2008

Compensation, benefit and other employee related $ 1,183 $ 1,478

Customer advances and deferred income 1,270 1,159

Income taxes 455 456

Environmental costs 314 343

Asbestos related liabilities 654 171

Product warranties and performance guarantees 382 385

Repositioning 340 401

Other taxes (payroll, sales, VAT etc.) 158 139

Insurance 118 120

Accrued interest 145 162

Other (primarily operating expenses) 1,134 1,192

$ 6,153 $ 6,006

Note 14—Long-term Debt and Credit Agreements

December 31,

2009 2008

Floating rate notes due 2009 $ — $ 300

Floating rate notes due 2009 — 500

Zero coupon bonds and money multiplier notes, 13.0%—14.26%, due 2009 — 100

Floating rate notes due 2009-2011 — 193

7.50% notes due 2010 1,000 1,000

6.125% notes due 2011 500 500

5.625% notes due 2012 400 400

4.25% notes due 2013 600 600

3.875% notes due 2014 600 —

5.40% notes due 2016 400 400

5.30% notes due 2017 400 400

5.30% notes due 2018 900 900

5.00% notes due 2019 900 —

Industrial development bond obligations, floating rate maturing at various dates

through 2037 47 60

6.625 % debentures due 2028 216 216

9.065% debentures due 2033 51 51

5.70% notes due 2036 550 550

5.70% notes due 2037 600 600

Other (including capitalized leases), 0.62%—15.5%, maturing at various dates

through 2017 100 118

7,264 6,888

Less—current portion (1,018) (1,023)

$ 6,246 $ 5,865

73