Honeywell 2009 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

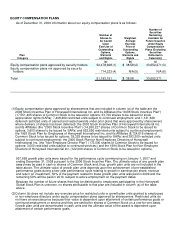

issuance: shares that are settled for cash, expire, are canceled, are tendered in satisfaction of an option

exercise price or tax withholding obligations, are reacquired with cash tendered in satisfaction of an option

exercise price or with monies attributable to any tax deduction enjoyed by Honeywell to the exercise of an

option, and are under any outstanding awards assumed under any equity compensation plan of an entity

acquired by Honeywell.

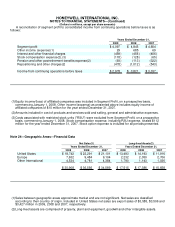

The number of shares that may be issued under the Honeywell Global Stock Plan as of December 31, 2009

is 2,754,730. This plan is an umbrella plan for five plans maintained solely for eligible employees of

participating non-U.S. countries. One sub-plan, the Global Employee Stock Purchase Plan, allows eligible

employees to contribute between 2.2% and 8.8% of base pay from January through September of each year

to purchase shares of Common Stock the following November at the fair market value on the date of

purchase. Participant accounts are credited with matching shares equal to 20% of their contributions that are

subject to continued employment for 3 years; provided that no matching shares will be credited to individuals

participating in this plan during 2010. For 2009, Honeywell used Treasury shares to provide the shares under

this plan. Employees purchased and were credited with 167,751 shares of Common Stock in 2009.

Another sub-plan, the UK Sharebuilder Plan, allows an eligible UK employee to contribute a specified

percentage of taxable earnings that is then invested in shares. The company matches those shares and

dividends paid are used to purchase additional shares; provided that the Company temporarily reduced the

match share to 50 percent in 2009. Matched shares are subject to a three-year vesting schedule. Shares

taken out of the plan before five years lose their tax-favored status. For the year ending December 31, 2009,

145,079 shares were credited to participants' accounts under the UK Sharebuilder Plan.

The remaining three sub-plans, Honeywell International Technologies Employees Share Ownership Plan

(Ireland), the Honeywell Measurex (Ireland) Limited Group Employee Profit Sharing Scheme and the

Honeywell Ireland Software Employees Share Ownership Plan, allow eligible Irish employees to contribute

specified percentages of base pay, bonus or performance pay that are then invested in shares. Shares must

be held in trust for at least two years and lose their tax-favored status if they are taken out of the plan before

three years. For the year ending December 31, 2009, 26,261 shares were credited to participants' accounts

under these three plans.

The remaining 297,000 shares included in column (c) are shares remaining for future grants under the Non-

Employee Director Plan.

(4)

Equity compensation plans not approved by shareowners that are included in the table are the Supplemental

Non-Qualified Savings Plan for Highly Compensated Employees of Honeywell International Inc. and its

Subsidiaries, the AlliedSignal Incentive Compensation Plan for Executive Employees of AlliedSignal Inc. and

its Subsidiaries, and the Deferred Compensation Plan for Non-Employee Directors of Honeywell International

Inc.

The Supplemental Non-Qualified Savings Plan for Highly Compensated Employees of Honeywell

International Inc. and its Subsidiaries is an unfunded, non-tax qualified plan that provides benefits equal to

the employee deferrals and company matching allocations that would have been provided under Honeywell's

U.S. tax-qualified savings plan if the Internal Revenue Code limitations on compensation and contributions

did not apply. The company matching contribution is credited to participants' accounts in the form of notional

shares of Common Stock. Additional notional shares are credited to participants' accounts equal to the value

of any cash dividends payable on actual shares of Common Stock. The notional shares are distributed in the

form of actual shares of Common Stock when payments are made to participants under the plan.

The AlliedSignal Incentive Compensation Plan for Executive Employees of AlliedSignal Inc. and its

Subsidiaries was a cash incentive compensation plan maintained by AlliedSignal Inc. This plan has expired.

Employees were permitted to defer receipt of a cash bonus payable under the plan and invest the deferred

bonus in notional shares of Common Stock. The notional shares are distributed in the form of actual shares of

Common Stock when payments are made to participants under the plan. No further deferrals can be made

under this plan. The number of shares of Common Stock that remain to be issued under this expired plan as

of December 31, 2009 is 46,046.

107