Honeywell 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

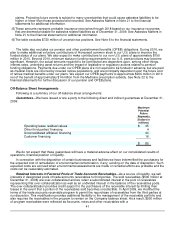

We sell interests in designated pools of trade accounts receivables to third parties. In April 2009, we modified

the terms of the trade accounts receivable program to permit the repurchase of receivables from the third parties

at our discretion. This modification provides additional flexibility in the management of the receivable portfolio and

also requires the receivables in the program to remain on the Company balance sheet. As a result, $500 million

of program receivables were reflected as Accounts, notes and other receivables with a corresponding amount

recorded as Short-term borrowings in the Consolidated Balance Sheet. These short-term borrowings were repaid

as of December 31, 2009.

We monitor the third-party depository institutions that hold our cash and cash equivalents on a daily basis.

Our emphasis is primarily on safety of principal and secondarily on maximizing yield on those funds. We diversify

our cash and cash equivalents among counterparties to minimize exposure to any one of these entities.

Current global economic conditions or the current tightening of credit could adversely affect our customers' or

suppliers' ability to obtain financing, particularly in our long-cycle businesses and airline and automotive end

markets. Customer or supplier bankruptcies, delays in their ability to obtain financing, or the unavailability of

financing could adversely affect our cash flow or results of operations. To date we have not experienced material

impacts from customer or supplier bankruptcy or liquidity issues. We continue to monitor and take measures to

limit our exposure.

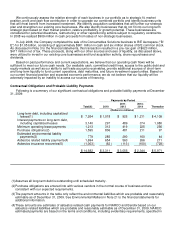

In addition to our normal operating cash requirements, our principal future cash requirements will be to fund

capital expenditures, debt repayments, dividends, employee benefit obligations, environmental remediation

costs, asbestos claims, severance and exit costs related to repositioning actions, share repurchases and any

strategic acquisitions.

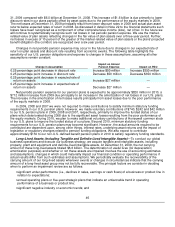

Specifically, we expect our primary cash requirements in 2010 to be as follows:

• Capital expenditures—we expect to spend approximately $700 million for capital expenditures in 2010

primarily for cost reduction, maintenance, replacement, growth, and production and capacity expansion.

•

Debt repayments—there are $1,018 million of scheduled long-term debt maturities in 2010. We expect to

refinance these maturities during 2010 utilizing short-term debt and reduce overall debt balances.

•

Share repurchases—Under the Company's previously announced $3.0 billion share repurchase program,

$1.3 billion remained available as of December 31, 2009 for additional share repurchases. The amount and

timing of repurchases may vary depending on market conditions and the level of operating and other

investing activities. We do not anticipate any share repurchases during 2010.

•

Dividends—we expect to pay approximately $940 million in dividends on our common stock in 2010,

reflecting a 4 percent increase in the number of shares outstanding.

•

Asbestos claims—we expect our cash spending for asbestos claims and our cash receipts for related

insurance recoveries to be approximately $654 and $62 million, respectively, in 2010. See Asbestos Matters

in Note 21 to the financial statements for further discussion.

•

Pension contributions—In 2010, we are not required to make any contributions to our U.S. pension plans to

satisfy minimum statutory funding requirements. However, we presently anticipate making voluntary

contributions of approximately $400 million of Honeywell common stock to the U.S. plan in 2010 to improve

the funded status of our plans. We also expect to make contributions to our non-U.S. plans of approximately

$150 million in 2010. See Note 22 to the financial statements for further discussion of pension contributions.

•

Repositioning actions—we expect that cash spending for severance and other exit costs necessary to

execute the previously announced repositioning actions will approximate $225 million in 2010.

•

Environmental remediation costs—we expect to spend approximately $285 million in 2010 for remedial

response and voluntary clean-up costs. See Environmental Matters in Note 21 to the financial statements

for additional information.

39