Honeywell 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

impact on our consolidated financial position and results of operations. However, if the Company enters into any

business combinations after the adoption of the new guidance on business combinations, a transaction may

significantly impact the Company's consolidated financial position and results of operations as compared to the

Company's recent acquisitions, accounted for under prior GAAP requirements, due to the changes described

above.

In April 2009, the FASB issued a staff position amending and clarifying the new business combination

standard to address application issues associated with initial recognition and measurement, subsequent

measurement and accounting, and disclosure of assets and liabilities arising from contingencies in a business

combination. The staff position is effective for assets or liabilities arising from contingencies in business

combinations for which the acquisition date is on or after the beginning of the first annual reporting period

beginning on or after December 15, 2008. The implementation of this standard did not have a material impact on

our consolidated financial position and results of operations.

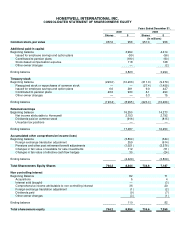

In December 2007, the FASB issued new guidance on noncontrolling interests which establishes

requirements for ownership interests in subsidiaries held by parties other than the Company (sometimes called

"minority interests") be clearly identified, presented, and disclosed in the consolidated statement of financial

position within equity, but separate from the parent's equity. All changes in the parent's ownership interests are

required to be accounted for consistently as equity transactions and any noncontrolling equity investments in

unconsolidated subsidiaries must be measured initially at fair value. The new guidance is effective, on a

prospective basis, for fiscal years beginning after December 15, 2008. However, presentation and disclosure

requirements must be retrospectively applied to comparative financial statements. Upon adoption of the new

guidance on noncontrolling interest the Company reclassified $82 million and $71 million of noncontrolling

interest from other liabilities to noncontrolling interest as a separate component of shareholders equity in our

consolidated balance sheet as of December 31, 2008 and 2007, respectively and $20 million and $16 million of

noncontrolling interest expense to net income attributable to noncontrolling interest in our statement of operations

for the years ended December 31, 2008 and 2007, respectively. See statement of shareholders' equity for

additional disclosures regarding noncontrolling interest components of other comprehensive income. The

implementation of this standard did not have a material impact on our consolidated financial position and results

of operations.

In November 2008, the FASB ratified an issue providing guidance for accounting for defensive intangible

assets subsequent to their acquisition in accordance with the new business combination and fair value

standards, including the estimated useful life that should be assigned to such assets. The new guidance is

effective for intangible assets acquired on or after the beginning of the first annual reporting period beginning on

or after December 15, 2008. The implementation of this standard did not have a material impact on our

consolidated financial position and results of operations.

In April 2009, the FASB issued a staff position which changes the method for determining whether an other-

than-temporary impairment exists for debt securities and the amount of the impairment to be recorded in

earnings. The guidance is effective for interim and annual periods ending after June 15, 2009. The

implementation of this standard did not have a material impact on our consolidated financial position and results

of operations.

In May 2009, the FASB issued new guidance on subsequent events. The standard provides guidance on

management's assessment of subsequent events and incorporates this guidance into accounting literature. The

standard is effective prospectively for interim and annual periods ending after June 15, 2009. The implementation

of this standard did not have a material impact on our consolidated financial position and results of operations.

The Company has evaluated subsequent events through February 12, 2010, the date of issuance of our

consolidated financial statements.

In June 2009, the FASB issued an amendment to the accounting and disclosure requirements for transfers of

financial assets. The guidance requires additional disclosures for transfers of financial

59