HTC 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

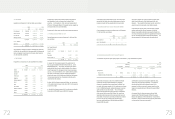

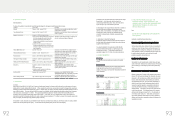

24. INCOME TAX

HTC’s income tax returns through 2003 had been examined by the tax authorities. However, HTC disagreed with the tax authorities’ assessment on

its returns for 2001 to 2003 and applied for the administrative litigation of its returns. Nevertheless, under the conservatism guideline, HTC adjusted

its income tax for the tax shortfall stated in the tax assessment notices.

The income tax returns of BandRich Inc. and Communication Global Certification Inc. through 2007 had been examined by the tax authorities.

Under the Statute for Upgrading Industries, HTC was granted exemption from corporate income tax as follows:

Item Exempt from Corporate Income Tax Exemption Period

Sales of pocket PCs, pocket PCs (wireless) and Smartphones 2004.09.15-2009.09.14

Sales of pocket PCs (wireless) and Smartphones 2004.11.30-2009.11.29

Sales of pocket PCs (wireless) and Smartphones 2005.12.20-2010.12.19

Sales of wireless or smartphone which has 3G or GPS function 2006.12.20-2011.12.19

Sales of wireless or smartphone which has 3G or GPS function 2007.12.20-2012.12.19

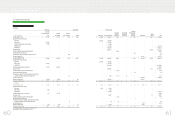

Provision for income tax expense (benefit) in 2008 and 2009; income tax payable, income tax receivables and deferred tax assets (liabilities) as of

December 31, 2008 and 2009 were as follows:

2008

Income Tax

Expense (Benefit) Income Tax Payable Income Tax Receivable

Deferred Tax

Assets (Liabilities)

NT$ NT$ NT$ NT$

HTC Corporation $ 2,955,130 $ 3,937,745 $ - $ 1,373,638

BandRich Inc. 10,071 - - ( 245 )

Communication Global Certification Inc. 539 178 - 2,228

HTC America Inc. 100,493 - 16,400 -

HTC EUROPE CO., LTD. 77,956 63,547 - -

HTC NIPPON Corporation 11,642 12,364 - -

HTC BRASIL 4,505 - 1,882 -

One & Company Design, Inc. ( 2,933 ) 2,489 - ( 4,922 )

HTC Corporation (Shanghai WGQ) 4,583 3,808 - -

HTC Belgium BAVA/SPRL 9,976 9,146 - -

High Tech Computer Singapore Pte. Ltd. 142 494 - -

High Tech Computer (H.K.) Limited ( 245 ) 409 - -

HTC (Australia and New Zealand) Pty. Ltd. 3,823 6,129 - 2,661

HTC India Private Limited 6,177 2,470 - -

HTC (Thailand) Limited 1,002 591 - -

HTC Investment Corporation 329 243 - 63

$ 3,183,190 $ 4,039,613 $ 18,282 $ 1,373,423

)LQDQFLDO,QIRUPDWLRQ

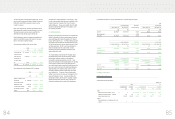

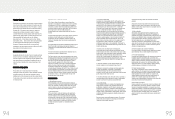

On July 31, 2009, the Company’s board of directors passed a resolution to buy back 13,000 thousand Company shares from the open market. The

repurchase period was between August 3, 2009 and October 2, 2009, and the repurchase price ranged from NT$300 to NT$500 per share. If the

Company’s share price was lower than this price range, the Company might continue to buy back its shares. The Company bought back 7,085

thousand shares for NT$2,406,930 thousand (US$75,240 thousand) during the repurchase period and retired them in November 2009.

(In Thousands of Shares)

Purpose As of January 1, 2009 Increase Decrease As of December 31, 2009

For maintaining the Company’s credit and stockholders’ equity 10,000 7,085 17,085 -

Based on the Securities and Exchange Act of the ROC, the number of reacquired shares should not exceed 10% of the Company’s issued and

outstanding stocks, and the total purchase amount should not exceed the sum of the retained earnings, additional paid-in capital in excess of par,

and realized capital reserve. In addition, the Company should not pledge its treasury shares nor exercise voting rights on the shares before their

reissuance.

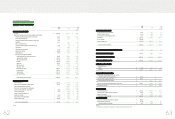

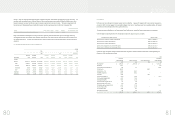

23. PERSONNEL EXPENSES, DEPRECIATION AND AMORTIZATION

Function

2008 2009

NT$ NT$ US$ (Note 3)

Expense Item

Operating

Costs

Operating

Expenses Total

Operating

Costs

Operating

Expenses Total

Operating

Costs

Operating

Expenses Total

Personnel

expenses $3,504,723 $10,041,645 $13,546,368

$2,980,449 $8,964,593 $11,945,042 $93,168 $280,231 $373,399

Salary 3,099,263 9,377,620 12,476,883 2,551,772 8,180,903 10,732,675 79,768 255,733 335,501

Insurance $126,199 $198,891 $325,090 $155,481 $253,081 $408,562 $4,860 $7,911 $12,771

Pension cost 59,935 149,891 209,826 66,029 163,977 230,006 2,064 5,126 7,190

Other 219,326 315,243 534,569 207,167 366,632 573,799 6,476 11,461 17,937

Depreciation 378,836 365,029 743,865 476,585 421,450 898,035 14,898 13,174 28,072

Amortization 20,617 41,160 61,777 34,561 38,053 72,614 1,080 1,190 2,270

)LQDQFLDO,QIRUPDWLRQ