HTC 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

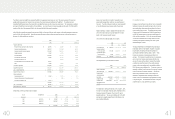

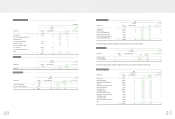

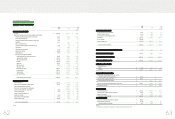

2008 2009

Before Income Tax After Income Tax Before Income Tax After Income Tax

NT$ NT$ NT$ US$ NT$ US$

(Note 3) (Note 3)

BASIC EARNINGS PER SHARE (Note 25)

$ 39.89 $ 36.16 $ 32.02 $ 1.00 $ 28.71 $ 0.9

DILUTED EARNINGS PER SHARE (Note 25)

$ 38.56 $ 34.95 $ 31.42 $ 0.98 $ 28.18 $ 0.88

(Concluded)

The accompanying notes are an integral part of the consolidated financial statements.

(With Deloitte & Touche audit report dated January 18, 2010)

)LQDQFLDO,QIRUPDWLRQ

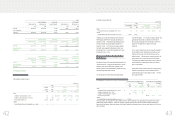

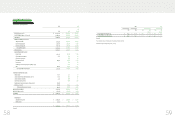

HTC CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

YEARS ENDED DECEMBER 31, 2008 AND 2009

(In Thousands, Except Earnings Per Share)

2008 2009

NT$ NT$

US$

(Note 3)

REVENUES (Notes 2 and 27)

$ 152,353,176 $ 144,492,518 $ 4,516,803

COST OF REVENUES (Notes 4, 10, 23 and 27) 101,362,538 98,329,537 3,073,759

GROSS PROFIT 50,990,638 46,162,981 1,443,044

OPERATING EXPENSES (Notes 23 and 27)

Selling and marketing 9,043,869 10,863,175 339,580

General and administrative 2,250,060 2,304,364 72,034

Research and development 9,351,439 8,372,535 261,724

Total operating expenses 20,645,368 21,540,074 673,338

OPERATING INCOME 30,345,270 24,622,907 769,706

NONOPERATING INCOME AND GAINS

Interest income 1,401,127 362,136 11,320

Gains on disposal of properties 4,521 2,984 93

Gain on sale of investments -3,035 95

Exchange gains (Note 2) 632,969 558,985 17,474

Rental income -5,824 182

Valuation gain on financial instruments, net (Notes 2 and 6) -18,132 567

Other 280,872 468,990 14,661

Total nonoperating income and gains 2,319,489 1,420,086 44,392

NONOPERATING EXPENSES AND LOSSES

Interest expense 10,441 2,174 67

Losses on equity-method investments (Notes 2 and 14) 6,151 3,891 122

Losses on disposal of properties 7,378 2,576 81

Impairment loss (Notes 2 and 14) -78,946 2,467

Valuation loss on financial instruments, net (Notes 2 and 6) 514,083 --

Other (Notes 18 and 27) 390,990 558,994 17,474

Total nonoperating expenses and losses 929,043 646,581 20,211

INCOME BEFORE INCOME TAX 31,735,716 25,396,412 793,887

INCOME TAX (Notes 2 and 24) ( 3,183,190 ) ( 2,781,999 ) ( 86,965 )

NET INCOME $ 28,552,526

$ 22,614,413 $ 706,922

ATTRIBUTABLE TO

Stockholders of the parent $ 28,635,349 $ 22,608,902 $ 706,749

Minority interest ( 82,823 ) 5,511 173

$ 28,552,526 $ 22,614,413 $ 706,922

(Continued)

)LQDQFLDO,QIRUPDWLRQ