HTC 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8382

CAPITAL AND SHARES

(VI) Company's dividend policy and implementation thereof :

1. Dividend policy:

Because the Company is a technology and capital-intensive enterprise in

its growing phase, the Company sets a policy to allocate dividends with

consideration to factors such as the Company's current and future invest-

ment climate, demand for working capital, competitive environment at

home and globally, capital budget, as well as the interests of the share-

holders, balanced dividends, and long-term financial planning of the

Company. Every year, the board of directors shall propose the allocation

ratio and propose it at the shareholders' meeting. The earnings may be

allocated in cash dividends or stock dividends, provided that the ratio of

cash dividends may not be less than 50% of the total dividends.

According to the company's Articles of Incorporation, If the Company has

earnings after the annual final accounting, it shall be allocated in the fol-

lowing order:

>To pay taxes.

>To cover accumulated losses, if any.

>To appropriate 10% legal reserve unless the total legal reserve accu-

mulated has already reached the amount of the Company's authorized

capital.

>To pay remuneration to directors and supervisors at 0.3% maximum

of the balance after withholding the amounts under subparagraphs 1

to 3.

>To pay bonus to employees at 5% minimum of the balance after with-

holding the amounts under subparagraphs 1 to 3, or such balance

plus the unappropriated retained earnings of previous years.

However, the bonus may not exceed the limits on employee bonus

distributions as set out in the Regulations Governing the Offering and

Issuance of Securities by Issuers. Where bonus to employees is allo-

cated by means of new share issuance, the employees to receive

bonus may include employees serving with affiliates who meet spe-

cific requirements. Such specific requirements shall be prescribed by

the board of directors.

>For any remainder, the board of directors shall propose allocation

ratios based on the dividend policy set forth in paragraph 2 of this

Article and propose them at the shareholders' meeting.

2. The dividend distributions proposed at the most recent shareholders'

meeting : (Board of Directors has adopted, 2010 pending on the approval

of the Shareholders General Meeting. )

On April 28, 2010 Company adopted a resolution passed by Board of

Directors for the distribution of 2009 earnings for the proposed allocation

of NTD 386,967,920 in stock dividend and NTD 20,122,331,946 in cash

dividend, propose to distribute NT$0.5 stock dividends and NT$26 cash

dividends per share.(based on book closure date of outstanding shares for

2010 Annual Shareholders' Meeting), the Board of Directors may make the

required adjustments to the actual earnings distribution ratio on the basis

of the number of issued and outstanding stocks registered in the Common

Stockholders' Roster as at the record date.

3. If a material change in dividend policy is expected, provide an explanation:

There is no material change in dividend policy.

(VII) Impact of the Stock Dividend Proposal of this Shareholders

Meeting on Operational Performance and Earnings per Share:

Company is not required to make public Company's 2010 financial fore-

cast information ; therefore it is inapplicable.

(VIII)Information on Employee Profit Sharing & Regular

Compensation for Directors and Supervisors:

1. Company's Articles of Incorporation stipulate the distribution of employ-

ee profit sharing as well as Directors and Supervisors' remuneration in

terms of percentage or scope.

Company's Articles of Incorporation stipulate that for earnings, the order

of distribution shall be followed according to below:

(1) To pay taxes.

(2) To cover accumulated losses, if any.

(3) To appropriate 10% legal reserve unless the total legal reserve accu-

mulated has already reached the amount of the Company's authorized

capital.

(4) To pay remuneration to directors and supervisors at 0.3% maximum of

the balance after withholding the amounts under subparagraphs 1to3.

(5) To pay bonus to employees at 5% minimum of the balance after with-

holding the amounts under subparagraphs 1 to 3, or such balance

plus the unappropriated retained earnings of previous years.

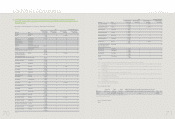

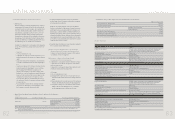

3. Distributions of earnings in 2008 as employees' bonus and remunerations for directors and supervisors:

Distributions of earnings in 2008

Date of the Board of Directors' Meeting resolution 04/30/2009

Date of Regular Shareholders' Meeting 06/19/2009

Total stock bonus as employee bonus Total Number of Shares (1,000 shares) 13,357

Total Amount (NT$1,000) 4,954,889

Total cash bonus as employee bonus (NT$1,000) 1,210,000

Total amount bonus as employee bonus (NT$1,000) 6,164,889

Director' and Supervisors' Remunerations (NT$1,000) 0

Note: For employee stock bonuses NT$4,954,889,133, the total issuance of new shares 13,357,296 shares is calculated based on the closing price (NT$416.50) one day prior to the 2009 Annual General Shareholders'

Meeting on an ex-dividend basis NT$370.95. The amount of NT$ 181 which is calculated less than one share will be distributed in the form of cash.

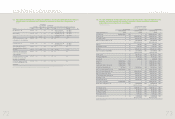

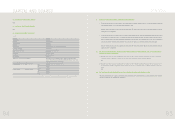

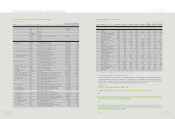

(IX) Share Repurchases:

Topic Explanation

Initial Estimation of Share Buy-back Status

Board of Director resolution 07/31/2009

Purpose of the share buy-back To stabilize stock price by maintaining company credibility and shareholders rights.

According to the Regulations Governing Share Repurchase by Listed and OTC

Companies, Article 2 requires off-setting of buy-back Treasury stocks.

Type of share buy-back Common stock

Total amount allocated for share buy-back NTD 6,500,000,000

Buy-back period 08/03/2009~10/02/2009

Estimated number of buy-back shares (as percentage of total outstanding shares) 13,000,000 shares (1.744%)

Estimated buy-back price interval Buy-back stock price is between NTD 300 to NTD 500. It is further resolved by the Board

of Directors to continue buy-back of shares if the stock price falls under NTD 300.

Method of Buy-back Buy-back shares from stock exchange

Actual Stock Buy-back Status

Buy-back period 08/05/2009~10/02/2009

Number of buy-back shares (as a percentage of total shares outstanding) 7,085,000 shares (0.89%)

Total amount for buy-back shares NTD 2,405,587,000 (Note: Excluding handling fee)

Average price per buy-back share NTD 339.53

Number of Shares Cancelled or Transferred Cancelled 7,085,000 shares

Cumulative number of own shares held 0 shares

Ratio of cumulative number of own shares held during the repurchase period to the

total number of the Company's issued shares 0%

Initial Estimation of Share Buy-back Status

Board of Director resolution 02/09/2010

Purpose of the share buy-back To stabilize stock price by maintaining company credibility and shareholders rights.

According to the Regulations Governing Share Repurchase by Listed and OTC

Companies, Article 2 requires off-setting of buy-back Treasury stocks.

Type of share buy-back Common stock

Total amount allocated for share buy-back NTD 7,500,000,000

Buy-back period 02/10/2010~04/09/2010

Estimated number of buy-back shares (as percentage of total outstanding shares) 15,000,000 shares (1.90%)

Estimated buy-back price interval Buy-back stock price is between NTD 280 to NTD 500. It is further resolved by the Board

of Directors to continue buy-back of shares if the stock price falls under NTD 280.

Method of Buy-back Buy-back shares from stock exchange

Actual Stock Buy-back Status

Buy-back period 02/10/2010~03/05/2010

Number of buy-back shares (as a percentage of total shares outstanding) 15,000,000 shares (1.90%)

Total amount for buy-back share NTD 4,832,242,000 (Note: Excluding handling fee)

Average price per buy-back share NTD 322.15

Number of Shares Cancelled or Transferred Cancelled 15,000,000 shares

Cumulative number of own shares held 0 shares

Ratio of cumulative number of own shares held during the repurchase period to the

total number of the Company's issued shares 0%

2. Board of Directors has adopted the proposed distribution of bonus for employees in the following manner:

Unit: NT$ 1,000

Distributions of Earnings in 2009 Accrued Expenses for Employee Bonus Resolution Approved by the Board of Directors

April 28, 2010

Employee Bonus 4,859,236 Employee Stock Bonus (Note) 1,943,694

Employee Cash Bonus 2,915,542

Total Amount 4,859,236

Directors' and Supervisors' Remunerations 0 0

Note: The value of employee cash/stock bonuses and director/supervisor remunerations proposals approved by the board of directors is the same as the Company's accrued

expenses in the financial reporting period.

Note:For employee stock bonuses NT$1,943,694, the number of shares shall be calculated based on the closing price one day prior to the 2010 annual general shareholders' meeting on an ex-dividend

basis. For employees receiving less than one share, bonuses will be distributed in the form of cash.