HTC 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Based on the Income Tax Act of the ROC, the investment and

research and development tax credits can be carried forward for

four years. The total credits used in each year cannot exceed half

of the estimated income tax provision, except in the last year.

Valuation allowance is based on management’s evaluation of the

amount of tax credits that can be carried forward for four years,

based on the Company’s financial forecasts.

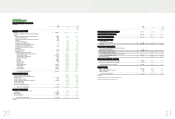

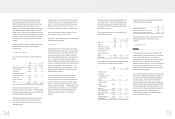

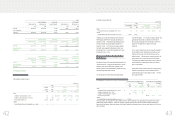

The income taxes in 2008 and 2009 were as follows:

2,008 2,009

NT$ NT$ US$(Note 3)

Current income tax $ 3,396,417 $ 3,211,563 $ 100,393

Increase in deferred

income tax assets (431,528) (503,703) (15,746)

Overestimation of prior

year’s income tax (9,759) (104,298) (3,260)

Income tax $ 2,955,130 $ 2,603,562 $ 81,387

The integrated income tax information is as follows:

2,008 2,009

NT$ NT$ US$(Note 3)

Balance of imputation

credit account (ICA) $ 4,365,460 $ 1,702,246 $ 53,212

Unappropriated

earnings generated

from 1998 44,626,182 38,364,099 1,199,253

Actual/estimated

creditable ratio

(including income tax

payable)

10.55% 12.71% 12.71%

(Actual ratio) (Estimated

ratio)

(Estimated ratio)

For distribution of earnings generated on or after January 1, 1998,

the ratio for the imputation credits allocated to stockholders of the

Company is based on the balance of the ICA as of the date of

dividend distribution. The expected creditable ratio for the 2009

earnings may be adjusted, depending on the ICA balance on the

date of dividend distribution.

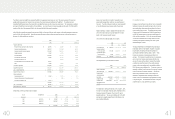

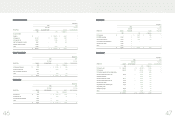

23. EARNINGS PER SHARE

Earnings per share (EPS) before tax and after tax are calculated by

dividing net income by the weighted average number of common

shares outstanding which includes the deduction of the effect of

treasury stock during each year. The weighted average number

of shares used in EPS calculation was 791,855 thousand shares

and 787,367 thousand shares for the years ended December 31,

2008 and 2009, respectively. EPS for the year ended December

31, 2008 were calculated after the average number of shares

outstanding was adjusted retroactively for the effect of stock

dividend distribution in 2009.

The Accounting Research and Development Foundation issued

Interpretation 2007-052 that requires companies to recognize

bonuses paid to employees, directors and supervisors as

compensation expenses beginning January 1, 2008. These

bonuses were previously recorded as appropriations from

earnings. If the Company may settle the bonus to employees by

cash or shares, the Company should presume that the entire

amount of the bonus will be settled in shares and the resulting

potential shares should be included in the weighted average

number of shares outstanding used in the calculation of diluted

EPS, if the shares have a dilutive effect. The number of shares is

estimated by dividing the entire amount of the bonus by the closing

price of the shares at the balance sheet date. Such dilutive

effects of the potential shares needs to be included in the

calculation of diluted EPS until the stockholders resolve the

number of shares to be distributed to employees at their meeting

in the following year. The related EPS information for the years

ended December 31, 2008 and 2009 was as follows:

)LQDQFLDO,QIRUPDWLRQ

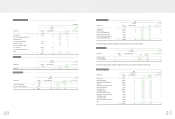

The alternative minimum tax (AMT) imposed under the AMT Act is a supplemental tax levied at a rate of 10% which is payable if the income tax

payable determined pursuant to the Income Tax Law is below the minimum amount prescribed under the AMT Act. The taxable income for

calculating the AMT includes most of the income that is exempted from income tax under various laws and statutes. The Company has considered

the impact of the AMT Act in the determination of its tax liabilities. As a result, the current income tax payable as of December 31, 2008 and 2009

should be NT$3,396,417 thousand and NT$3,211,563 thousand (US$100,393 thousand), respectively.

In May 2009, the Legislative Yuan passed the amendment of Article 5 of the Income Tax Law, which reduces a profit-seeking enterprise’s income tax

rate from 25% to 20%, effective 2010. Deductible temporary differences and tax credit carryforwards that gave rise to deferred tax assets as of

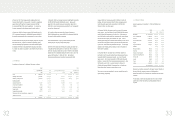

December 31, 2008 and 2009 were as follows:

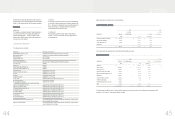

2,008 2,009

NT$ NT$ US$(Note 3)

Temporary differences

Provision for loss on decline in value of inventory $ 405,806 $ 625,052 $ 19,539

Unrealized marketing expenses 1,452,633 1,714,593 53,598

Unrealized reserve for warranty expense 1,306,466 1,057,512 33,057

Capitalized expense 58,190 40,734 1,273

Unrealized royalties 1,535,925 1,691,142 52,865

Unrealized bad-debt expenses 26,503 147,309 4,605

Unrealized exchange loss, net - 155,801 4,870

Unrealized valuation loss on financial instruments 128,521 --

Other 12,465 43,237 1,352

Tax credit carryforwards 2,196,808 3,056,328 95,540

Total deferred tax assets 7,123,317 8,531,708 266,699

Less: Valuation allowance ( 5,679,417 )( 6,623,210 ) ( 207,040 )

Total deferred tax assets, net 1,443,900 1,908,498 59,659

Deferred tax liabilities

Unrealized pension cost ( 29,284 )( 27,531 ) ( 861 )

Unrealized valuation gain on financial instruments - ( 3,626 ) ( 113 )

Unrealized exchange gain, net ( 40,978 )--

1,373,638 1,877,341 58,685

Less: Current portion ( 552,494 )( 811,240 ) ( 25,359 )

Deferred tax assets - noncurrent $ 821,144 $ 1,066,101 $ 33,326

Details of the tax credit carryforwards were as follows:

Year of Validity Period 2008 2009

Occurrence NT$ NT$ US$(Note 3)

2007 2007-2011 $ 201,506 $ 201,506 $ 6,299

2008 2008-2012 1,995,302 831,154 25,982

2009 2009-2013 - 2,023,668 63,259

$ 2,196,808 $ 3,056,328 $ 95,540

)LQDQFLDO,QIRUPDWLRQ