HTC 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

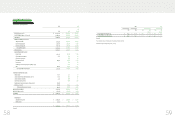

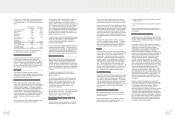

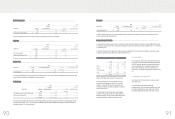

The Company’s net pension costs under the defined benefit plan in

2008 and 2009 were as follows:

2008

2009

NT$ NT$ US$ (Note 3)

Service cost $ 5,194 $ 5,255 $ 164

Interest cost 8,743 9,377 293

Projected return on plan assets ( 9,980 )

(

11,094 ) ( 347

)

Amortization of unrecognized net

transition obligation, net 74 74 3

Amortization 1,487 1,349 42

Curtailment gain ( 211 ) --

Net pension cost

$

5,307 $ 4,961 $ 155

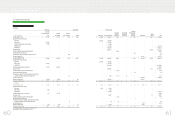

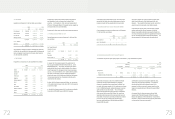

The reconciliations between pension fund status and prepaid pension

cost as of December 31, 2008 and 2009 were as follows:

2008

2009

NT$ NT$

US$ (Note

3)

Present actuarial value

of benefit obligation

Vested benefits $ - $ 1,334 $ 42

Non-vested

benefits 164,214 178,468 5,579

Accumulated

benefit obligation 164,214 179,802 5,621

Additional benefits

on future salaries 176,784 148,200 4,632

Projected benefit

obligation 340,998 328,002 10,253

Plan assets at fair

value ( 389,216 ) ( 417,407 ) ( 13,048 )

Funded status ( 48,218 ) ( 89,405 ) ( 2,795 )

Unrecognized net

transitional obligation ( 564 ) ( 490 ) ( 15 )

Unrecognized pension

loss ( 68,630 )

(

48,090 ) ( 1,503

)

Additional minimum

pension liability 475 523 16

Prepaid pension cost

$

( 116,937 ) $

(

137,462 ) $ ( 4,297

)

Assumptions used in actuarially determining the present value of

the projected benefit obligation were as follows:

2009 2008

Weighted-average discount rate 2.00%

2.75%

Assumed rate of increase in future

compensation 2.0%-3.5%

2%-4%

Expected long-term rate of return on

plan assets 2.00%

2.75%

The vested benefits as of December 31, 2008 and 2009 amounted

to NT$0 thousand and NT$1,511 thousand (US$47 thousand),

respectively.

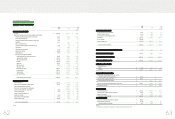

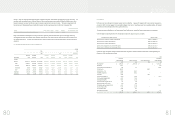

21. STOCKHOLDERS’ EQUITY

Capital Stock

The Company’s outstanding common stock as of January 1, 2008

amounted to NT$5,731,337 thousand, divided into 573,134

thousand common shares at NT$10.00 par value. In June 2008,

the stockholders approved the transfer of retained earnings

amounting to NT$1,719,401 thousand and employee bonuses

amounting to NT$103,200 thousand to capital stock. As a result,

the amount of the Company’s outstanding common stock as of

December 31, 2008 increased to NT$7,553,938 thousand, divided

into 755,394 thousand common shares at NT$10.00 par value.

In January and November 2009, the Company retired 10,000

thousand treasury shares at NT$100,000 thousand (US$3,126

thousand) and 7,085 thousand treasury shares at NT$70,850

thousand (US$2,214 thousand), respectively. Also, in June 2009,

the stockholders approved the transfer of retained earnings

amounting to NT$372,697 thousand (US$11,650 thousand) and

employee bonuses amounting to NT$133,573 thousand (US$4,175

thousand) to capital stock. As a result, the amount of the

Company’s outstanding common stock as of December 31, 2009

increased to NT$7,889,358 thousand (US$246,620 thousand),

divided into 788,936 thousand common shares at NT$10.00

(US$0.31) par value.

)LQDQFLDO,QIRUPDWLRQ

Other payables were payables for contingent loss of purchase orders

which was recognized as other loss. In December 2008, the

Company also estimated a contingent liability of NT$125,663

thousand due to an increased financial risk from the customer. If

the customer cannot pay its payments, the upstream firms might dun

the Company for the customer’s liabilities. The Company is still

negotiating with the customer to resolve this issue.

In October 2008, H.T.C. (B.V.I.) Corp. acquired 100% equity interest of

One & Company Design, Inc., and paid the investment to the original

stockholders of One & Company Design, Inc. in several installments

based on the agreement. In November 2009, One & Company

Design, Inc. was sold to High Tech Computer Asia Pacific Pte. Ltd. in

line with the reorganization of the Company’s overseas subsidiaries’

investment structure. Related liabilities between One & Company

Design, Inc. and H.T.C. (B.V.I.) Corp. were transferred as well. Of the

investment, NT$96,438 thousand (US$3,015 thousand) had not been

paid as of December 31, 2009.

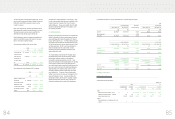

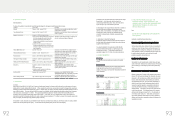

19. LONG-TERM BANK LOANS

Long-term bank loans as of December 31, 2008 and 2009 were as

follows:

2008 2009

NT$ NT$ US$(Note 3)

Secured loans (Note 28)

NT$50,000 thousand,

repayable from July 2006

in 16 quarterly

installments; 1% annual

interest $

18,750 $ 6,250 $ 195

NT$65,000 thousand,

repayable from July 2008

in 16 quarterly

installments; 1% annual

interest 56,875 40,625 1,270

Less: Current portion

(

28,750

)(

22,500 ) ( 703

)

$

46,875 $ 24,375 $ 762

20. PENSION PLAN

The Labor Pension Act (the “Act), which provides for a new defined

contribution plan, took effect on July 1, 2005. Employees

covered by the Labor Standards Law (the “Law”) before the

enforcement of the Act were allowed to choose to remain to be

subject to the defined benefit pension mechanism under the Law

or to be subject instead to the Act. Based on the Act, the rate of

the Company’s required monthly contributions to the employees’

individual pension accounts is at least 6% of monthly wages and

salaries, and these contributions are recognized as pension

expense in the income statement. The pension fund

contributions were NT$162,692 thousand in 2008, and

NT$186,811 thousand (US$5,840 thousand) in 2009.

Under the Law, which provides for a defined benefit pension plan,

retirement payments should be made according to the years of

service, with a payment of two units for each year of service but

only one unit per year after the 15th year; however, total units

should not exceed 45. The rate of the Company’s contributions to a

pension fund was 2% after the Act took effect. The pension fund

is deposited in the Bank of Taiwan in the committee’s name. The

pension fund balances were NT$389,216 thousand and

NT$417,407 thousand (US$13,048 thousand) as of December 31,

2008 and 2009, respectively.

H.T.C. (B.V.I.) Corp., HTC HK, Limited, and High Tech Computer Asia

Pacific Pte. Ltd. have no pension plans.

Under their respective local government regulations, other

subsidiaries have defined contribution pension plans covering all

eligible employees. The pension fund contributions were

NT$41,827 thousand in 2008 and NT$38,234 thousand (US$1,195

thousand) in 2009.

Based on the Statement of Financial Accounting Standards No. 18

- “Accounting for Pensions” issued by the Accounting Research

and Development Foundation of the ROC, pension cost under a

defined benefit pension plan should be calculated by the actuarial

method.

)LQDQFLDO,QIRUPDWLRQ