HTC 2009 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 37

influence that mobile internet services have over the smart phone sector.

Trends instigated and promoted by mobile application markets do impact

upon smart phone sector direction and development.

HTC has laid a solid foundation of experience and accomplishment in the

smart phone sector. In addition to exceptional in-house R&D / innovation

capabilities and superior track records for business and sales, we have nour-

ished and now maintain strong long-term partnerships with technology

industry leaders, including Microsoft, Google and Qualcomm, that are

focused on influencing the future development and vision of mobile telecom-

munications. We also enjoy close partner relationships with telecommunica-

tion service providers throughout our major markets - helping HTC better

anticipate and address consumer needs both now and in the future. Shipping

about 11.71 million units in 2009, HTC accounted for some 7% of total glob-

al smart phone units in 2009. In the years ahead, HTC will continue to draw

on its exceptional innovation capabilities to ensure product line comprehen-

siveness, meet consumer demand for greater diversity and personalization in

mobile telecommunications, and raise HTC brand recognition and market

share.

Business Scope

The main focus of HTC's business is on the handheld smart phone sector.

Reflecting quickly maturing wireless communication technologies, 3G mod-

els at now account for better than 95% of all HTC products shipped. Also,

HTC launched new models featuring HTC Sense, which helped push overall

sales to new highs. Verizon, Sprint and T-Mobile, the three largest telecom-

munications service providers in the United States, all designate HTC mobile

phones as flagship offerings in their respective product lineups. In Europe,

HTC mobile phones are featured prominently at sales outlets of leading

telecommunications service providers such as Vodafone, T-Mobile and

Orange. HTC products are currently sold through major telecommunication

service providers and channel retailers in major markets in Europe, the

Americas and Asia. The company is also gradually penetrating smart phone

markets in emerging markets in the Middle East, Central and South America

and Russia.

In-house R&D capabilities nurtured at HTC since its inception have produced

leading edge innovations in mobile phone technology and design. Strategic

alliances with Microsoft, Google and Qualcomm help HTC get first to market

with new generation products and innovations, work with telecom service

providers to raise average revenues per user (ARPU) and realize a worldwide

sales and service network able to deliver on promises of innovation and qual-

ity made to customers.

Business Objectives

HTC will grow to become the world's leading smart phone brand. Following

on high-visibility brand promotion activities during 2009 such as Tour de

France team sponsorship, rollout of "Quietly Brilliant" brand positioning, and

launch worldwide of the YOU campaign, HTC will do even more in terms of

brand promotion during 2010, which, coupled with a competitive pricing

strategy and diverse product range, will work to increase HTC market penetra-

tion and give even more users the opportunity to experience the HTC differ-

ence.

While working aggressively to increase market share in order to achieve sus-

tained sales growth and competitiveness, HTC will work diligently to neither

sacrifice fair profits nor instigate predatory price cutting strategies. Instead, we

will continue to adjust our overall business model to expand HTC's market

share and win a growing number of HTC product users while keeping corpo-

rate fundamentals intact. Such should strongly and positively enhance HTC

brand awareness, enhance operational effectiveness, and raise profitability

over the long term.

HTC's globe market penetration is growing significantly, and HTC believes the

time is ripe for increasing operating scale. HTC is confident about its current

strategy of promoting HTC's brand-recognition and products, and will definite-

ly continue to implement and invest such strategy to maintain its competitive-

ness. Seizing the right opportunity to invest the rightstuff is HTC's commit-

ment to all the long-term investors.

In terms of investments in China market, HTC is engaged in cooperative initia-

tives related to the all 3G standards in that market as well as in building part-

nerships with major Chinese telecommunication service providers. In August

2009, we signed a memorandum of understanding covering "substantive

cooperation on TD-SCDMA" with China Mobile, Ltd. The MOU establishes a

long-term, in-depth cooperative partnership between the two parties in the

realms of technology and product R&D, market research and customer service.

While 3G infrastructure in China market remains in its infancy, its manifest

potential for rapid growth is expected to be an engine of forward momentum

for HTC in the future. The HTC-China Mobile provides a solid platform for

future HTC growth in the China mobile phone market.

European and North American markets remained the focus of HTC business

expansion in 2009. North America and Europe accounted for 48.8% and

30.4%, respectively, of HTC sales worldwide. Asia and other regions account-

ed for the remainder (20.8%). HTC business in North America market strongly

grew 28.6% in 2009 compared to other regions. HTC will continue to launch

new, institutive mobile phone products to win even more consumers as HTC

users.

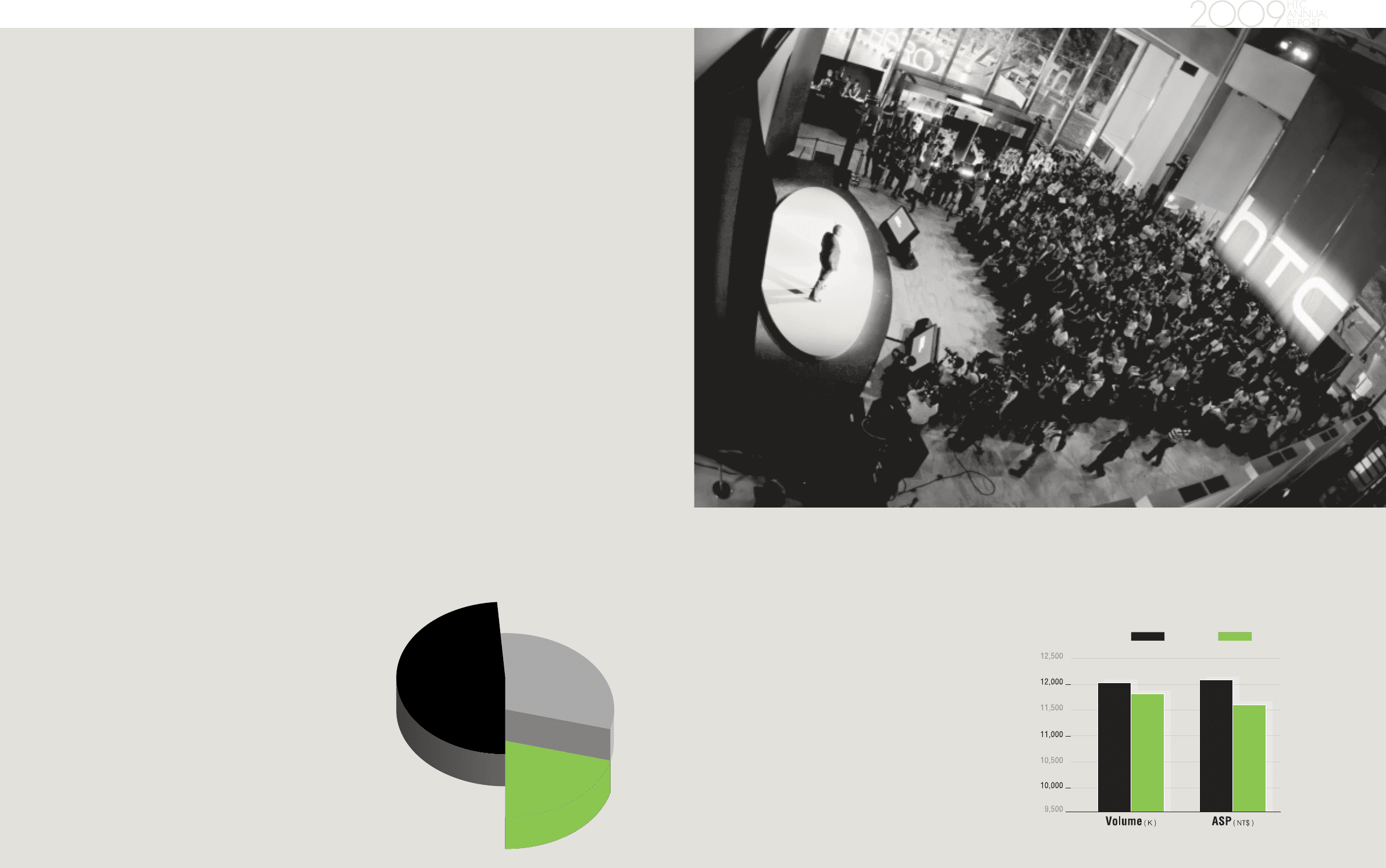

2009 HTC Revenue by Region:

Analysis of Business Results

2009 was a year of rapid and remarkable change for HTC. In addition to

growing challenges in the economics environment as well as from develop-

ments among various mobile phone operating systems, 2009 marked a

redoubling of efforts to manage and extend the HTC brand.

In 2009, we promoted aggressively our Android-based product line - the

first model of which was launched in 2008 as the world's first Android OS

mobile phone - to telecommunication service providers in Europe and the

Americas. Our goal was to turn this line quickly into a strong engine of HTC

business growth. However, consumer acceptance of Android, while relative-

ly strong in our American markets, lagged in Europe and Asia. Thus, our

management team chose to work on raising market awareness of the HTC

brand. As the number of major mobile phone makers marketing Android-

based products increased, consumers would have an inbuilt knowledge of

and preference for HTC's Android offering. While sales volumes did end up

eroding by 2.6% in 2009 (to 11.71 million units), HTC leadership in the

Android OS is gradually being understood and recognized by consumers.

Looking at our products in terms of average selling price (ASP), HTC has

beefed up its product offering considerably. HTC's flagship high-end

model, HTC HD2, is joined by mid-price range offerings in HTC Tattoo and

HTC Touch2 models. All are competitively priced for their market segment.

HTC's ASP in 2009 was NT$11,661 - a 3.5% drop from 2008. The NT$144.9

billion earned in revenue for 2009 represented a drop of 5.0% from 2008 rev-

enues.

48.8% 30.4%

20.8%

Europe

NT$44.0 billion

North American

NT$70.7 billion

Asia & Other

NT$30.2 billion

2008 2009

12,027 12,085

11,711

11,661

BUSINESS OPERATIONS