HTC 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

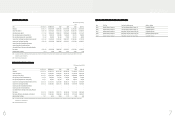

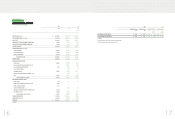

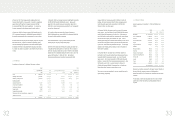

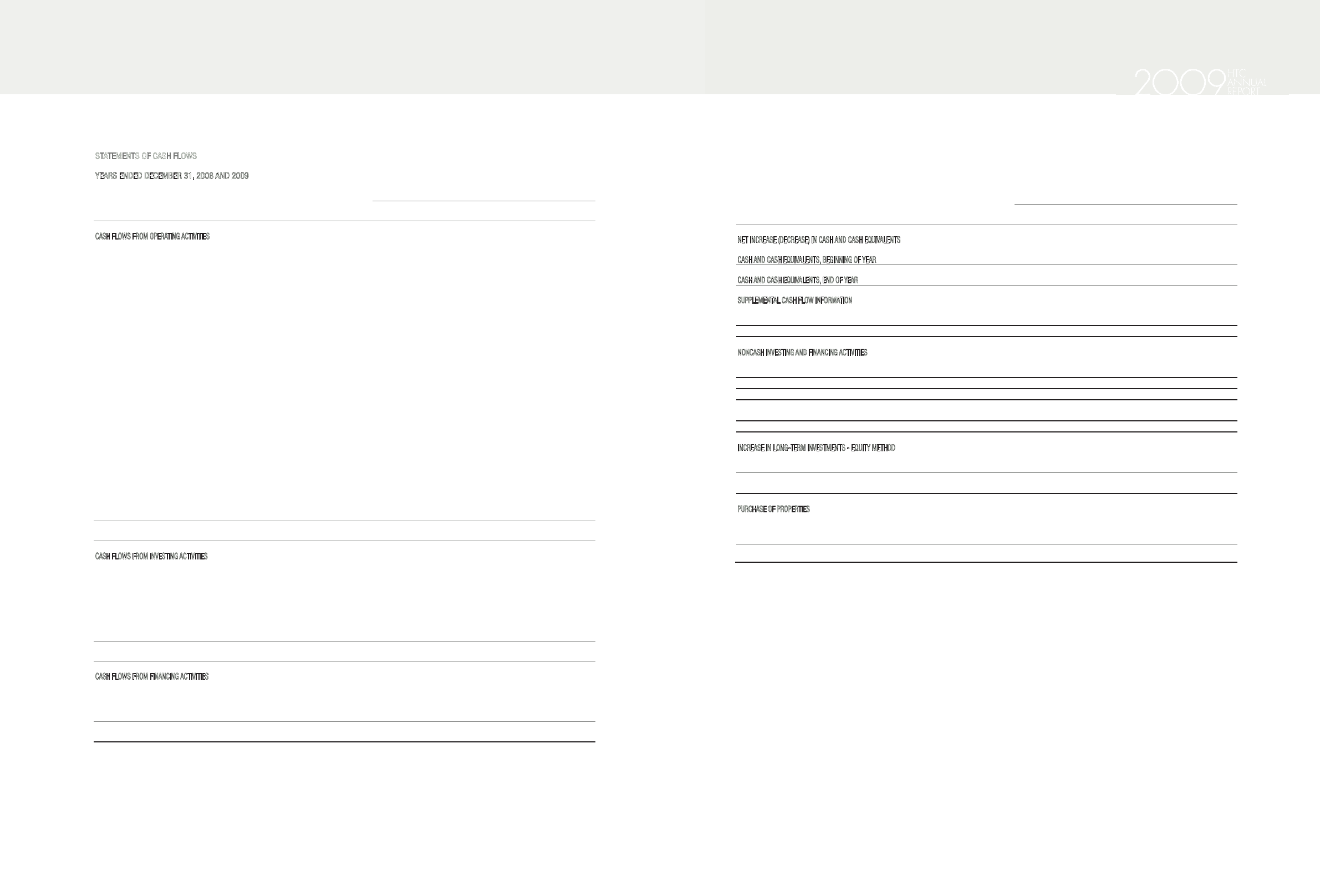

2008 2009

NT$ NT$ US$

(Note 3)

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

$ 6,790,641 $ ( 150,409 ) $ ( 4,702 )

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR

55,036,232 61,826,873 1,932,694

CASH AND CASH EQUIVALENTS, END OF YEAR

$ 61,826,873 $ 61,676,464 $ 1,927,992

SUPPLEMENTAL CASH FLOW INFORMATION

Cash paid during the year

Interest (net of amounts capitalized) $ 232 $ 131 $ 4

Income tax $ 1,963,307 $ 2,892,386 $ 90,415

NONCASH INVESTING AND FINANCING ACTIVITIES

Transfer of bond investment not quoted in an active market to investments

accounted for by the equity method $ 33,030 $ -$ -

Transfer of properties to assets leased to others $ 309,959 $-$-

Transfer of assets leased to others to properties $ - $ 261,824 $ 8,185

Transfer of retained earnings and accrued stock bonuses to employees to

common stock and additional paid-in capital $ 1,822,601 $ 5,327,586 $ 166,538

Retirement of treasury stock $ - $ 5,817,207 $ 181,844

INCREASE IN LONG-TERM INVESTMENTS - EQUITY METHOD

Increase in investments accounted for by the equity method $ 2,231,529 $ 1,137,873 $ 35,570

(Increase) decrease in payable for purchase of investments ( 122,700 ) 26,262 821

Cash paid for increase in long-term investments $ 2,108,829 $ 1,164,135 $ 36,391

PURCHASE OF PROPERTIES

Cost of properties purchased $ 4,564,155 $ 1,336,787 $ 41,788

Decrease in payable for purchase of equipment 12,398 88,880 2,778

Decrease in lease payable 938 1,004 31

Cash paid for purchase of properties $ 4,577,491 $ 1,426,671 $ 44,597

(Concluded)

The accompanying notes are an integral part of the financial statements.

(With Deloitte & Touche audit report dated January 18, 2010)

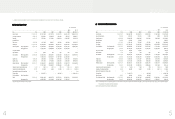

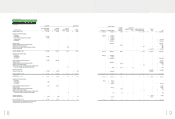

)LQDQFLDO,QIRUPDWLRQ

HTC CORPORATION

STATEMENTS OF CASH FLOWS

YEARS ENDED DECEMBER 31, 2008 AND 2009

(In Thousands)

2008 2009

NT$ NT$ US$

(Note 3)

CASH FLOWS FROM OPERATING ACTIVITIES

Net income $ 28,635,349 $ 22,608,902 $ $706,749

Adjustments to reconcile net income to net cash provided by operating

activities

Depreciation (including depreciation of assets leased to others) 568,208 633,950 19,817

Transfer of properties to expenses 18,059 7,021 219

Exchange loss on bond investments not quoted in an active market 2,670 --

Amortization 35,983 39,847 1,246

Gain on sale of investments, net -( 3,035 ) ( 95 )

Loss (gain) on disposal of properties, net 300 ( 2,984 ) ( 93 )

Cash dividends received from equity-method investees - 905 28

Losses (gains) on equity-method investments 57,289 ( 273,811 ) ( 8,559 )

Distribution of bonuses to employees of subsidiaries - ( 17,731 ) ( 554 )

Impairment loss -30,944 967

Deferred income tax assets ( 431,528 ) ( 503,703 ) ( 15,746 )

Prepaid pension costs ( 21,951 ) ( 20,515 ) ( 641 )

Net changes in operating assets and liabilities

Financial instruments at fair value through profit or loss 417,827 ( 532,215 ) ( 16,637 )

Notes and accounts receivable ( 9,913,317 ) 3,534,014 110,472

Accounts receivable from related parties ( 401,895 ) ( 1,305,780 ) ( 40,818 )

Other current financial assets 8,545 41,305 1,291

Inventories ( 1,299,054 ) 2,679,768 83,769

Prepayments 299,696 (2,095,767 ) ( 65,513 )

Other current assets ( 45,166 ) 35,227 1,101

Other assets - other ( 1,843,170 ) ( 57,617 )

Notes and accounts payable 5,887,026 ( 3,024,822 ) ( 94,555 )

Income tax payable 1,423,351 214,879 6,717

Accrued expenses 10,363,107 6,449,927 201,623

Other current liabilities 1,989,656 888,452 27,773

Net cash provided by operating activities 37,594,155 27,541,608 860,944

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of available-for-sale financial assets - ( 8,105,512 ) ( 253,376 )

Proceeds of the sale of available-for-sale financial assets - 5,611,153 175,403

Purchase of properties ( 4,577,491 ) ( 1,426,671 ) ( 44,597 )

Proceeds of the sales of properties 7,879 4,005 125

Increase in investments accounted for by the equity method ( 2,108,829 ) ( 1,164,135 ) ( 36,391 )

Increase in restricted assets -( 63,900 ) ( 1,997 )

Increase in deferred charges -( 57,495 ) ( 1,797 )

Increase (decrease) in refundable deposits ( 24,027 ) 48,298 1,509

Net cash used in investing activities ( 6,702,468 ) ( 5,154,257 ) ( 161,121 )

CASH FLOWS FROM FINANCING ACTIVITIES

Increase (decrease) in guarantee deposits received 5,778 ( 5,196 ) ( 162 )

Cash dividends ( 19,486,547 ) ( 20,125,634 ) ( 629,123 )

Bonus to employees ( 1,210,000 ) --

Purchase of treasury stock ( 3,410,277 ) ( 2,406,930 ) ( 75,240 )

Net cash used in financing activities ( 24,101,046 ) ( 22,537,760 ) ( 704,525 )

(Continued)

)LQDQFLDO,QIRUPDWLRQ