HTC 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

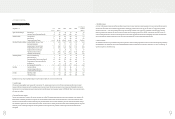

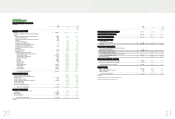

4. ACCOUNTING CHANGES

a. Interpretation 2007-052 - ³Accounting for Bonuses to Employees, Directors

and Supervisors´

In March 2007, the Accounting Research and Development Foundation

issued an interpretation that requires companies to recognize as

compensation expenses bonuses paid to employees and remuneration to

directors and supervisors beginning January 1, 2008. These bonuses were

previously recorded as appropriations from earnings. This accounting

change resulted in a decrease of NT$5,614,036 thousand in net income,

including an employee bonus payable of NT$6,164,889 thousand, minus the

allocation to inventory of NT$34,550 thousand and minus the tax savings of

NT$516,303 thousand; and a decrease of NT$7.44 in after income tax basic

earnings per share for the year ended December 31, 2008.

b. SFAS No. 39 - ³Share-based Payment´

On January 1, 2008, the Company adopted the newly released Statement of

Financial Accounting Standards (SFAS) No. 39 - ³Share-based Payment.´

Except as mentioned above, this accounting change had no material effect on

the Company¶s financial statements as of and for the year ended December

31, 2008.

c. SFAS No. 10 - ³Inventories´

On January 1, 2008, the Company adopted early the newly revised SFAS No.

10- ³Inventories.´The main revisions are (1) inventories are stated at the

lower of cost or net realizable value, and inventories are written down to net

realizable value item-by-item except when the grouping of similar or related

items is appropriate; (2) unallocated overheads are recognized as expenses

in the period in which they are incurred; and (3) abnormal costs, write-downs

of inventories and any reversal of write-downs are recorded as cost of goods

sold for the period. This accounting change had no material effect on the

Company¶s financial statements as of and for the year ended December 31,

2008.

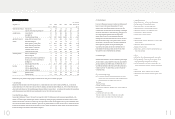

For an enhanced presentation of product-related costs, the cost of revenues

consists of costs of goods sold, unallocated overheads, abnormal costs,

write-downs of inventories and the reversal of write-downs. The provisions

for product warranty are estimated and recorded under cost of revenues

when sales are recognized.

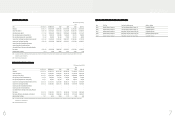

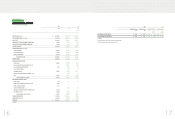

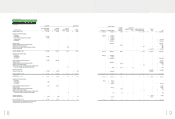

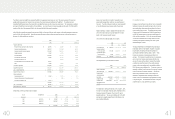

5. CASH AND CASH EQUIVALENTS

Cash and cash equivalents as of December 31, 2008 and 2009 were as

follows:

2008 2009

NT$ NT$ US$(Note 3)

Cash on hand $ 930 $ 1,000 $ 31

Cash in banks 1,774,195 561,516 17,553

Time deposits 60,051,748 61,113,948 1,910,408

$ 61,826,873 $ 61,676,464 $ 1,927,992

On time deposits, interest rates ranged from 0.30% to 2.41% and from

0.10% to 1.03%, as of December 31, 2008 and 2009, respectively.

On preferential deposits, interest rates ranged from 0.02% to 2.71% and from

0.10% to 0.70% as of December 31, 2008 and 2009, respectively.

6. FINANCIAL ASSETS AND LIABILITIES AT FAIR VALUE THROUGH PROFIT OR

LOSS

Financial assets and liabilities at fair value through profit or loss as of

December 31, 2008 and 2009 were as follows:

2008 2009

NT$ NT$ US$(Note 3)

Derivatives - financial assets

Exchange contracts $ - $ 18,132 $ 567

Derivatives - financial liabilities

Exchange contracts $ 514,083 $-$-

)LQDQFLDO,QIRUPDWLRQ

Treasury Stock

The Company adopted the Statement of Financial Accounting Standards No.

30 - ³Accounting for Treasury Stocks,´ which requires the treasury stock held

by the Company to be accounted for by the cost method. The cost of

treasury stock is shown as a deduction to arrive at stockholders¶ equity, while

gain or loss from selling treasury stock is treated as an adjustment to capital

surplus.

When treasury stocks are sold and the selling price is above the book value,

the difference should be credited to the capital surplus - treasury stock

transactions. If the selling price is below the book value, the difference

should first be offset against capital surplus from the same class of treasury

stock transactions, and any remainder should be debited to retained earnings.

The carrying value of treasury stocks should be calculated using the

weighted-average method.

When the Company's treasury stock is retired, the treasury stock account

should be credited, and the capital surplus - premium on stock account and

capital stock account should be debited proportionately according to the

share ratio. The difference should be credited to capital surplus or debited

to capital surplus and/or retained earnings.

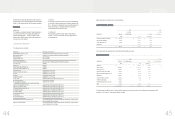

Foreign Currencies

The financial statements of foreign operations are translated into New Taiwan

dollars at the following exchange rates:

a. Assets and liabilities - at exchange rates prevailing on the balance sheet

date;

b. Stockholders¶ equity - at historical exchange rates;

c. Dividends - at the exchange rate prevailing on the dividend declaration date;

and

d. Income and expenses - at average exchange rates for the year.

Exchange differences arising from the translation of the financial statements

of foreign operations are recognized as a separate component of

stockholders¶ equity. Such exchange differences are recognized as gain or

loss in the year in which the foreign operations are disposed of.

Nonderivative foreign-currency transactions are recorded in New Taiwan

dollars at the rates of exchange in effect when the transactions occur.

Exchange differences arising from the settlement of foreign-currency assets

and liabilities are recognized as gain or loss.

At the balance sheet date, foreign-currency monetary assets and liabilities are

revalued using prevailing exchange rates and the exchange differences are

recognized in profit or loss.

At the balance sheet date, foreign-currency nonmonetary assets (such as equity

instruments) and liabilities that are measured at fair value are revalued using

prevailing exchange rates, with the exchange differences treated as follows:

a. Recognized in stockholders¶ equity if the changes in fair value are

recognized in stockholders¶ equity; and

b. Recognized in profit and loss if the changes in fair value is recognized in

profit or loss.

Foreign-currency nonmonetary assets and liabilities that are carried at cost

continue to be stated at exchange rates at the trade dates.

If the functional currency of an equity-method investee is a foreign currency,

translation adjustments will result from the translation of the investee¶s

financial statements into the reporting currency of the Company. These

adjustments are accumulated and reported as a separate component of

stockholders¶ equity.

Reclassifications

Certain 2008 accounts have been reclassified to be consistent with the

presentation of the financial statements as of and for the year ended

December 31, 2009.

3. TRANSLATION INTO U.S. DOLLARS

The financial statements are stated in New Taiwan dollars. The translation

of the 2009 New Taiwan dollar amounts into U.S. dollar amounts are included

solely for the convenience of readers, using the noon buying rate of NT$31.99

to US$1.00 quoted by the Bank of Taiwan on December 31, 2009. The

convenience translation should not be construed as representations that the

New Taiwan dollar amounts have been, could have been, or could in the

future be, converted into U.S. dollars at this or any other exchange rate.

)LQDQFLDO,QIRUPDWLRQ