HTC 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

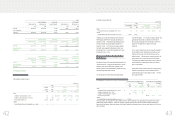

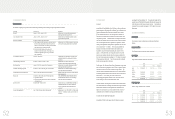

In August 2008, the Company acquired from Runtop Inc. land and

building, with areas of approximately 10.6 thousand square meters

and 40 thousand square meters, respectively, for NT$900,000

thousand to have more office space.

In December 2008, the Company bought land - about 8.3 thousand

square meters - from Yulon Motors Ltd. for NT$3,335,000 thousand to

build the Taipei R&D headquarter in Xindian City. Of the purchase

price, 80% had been paid and 80% of ownership of the land had been

transferred to the Company as of December 31, 2009. Under a

revised agreement signed in December 2009, Yulon Motors Ltd. should

transfer to the Company the remaining 20% of ownership of the land

by March 31, 2010 instead of by December 20, 2009. The Company

should pay the remaining 20% purchase price after completing the

land transfer registration.

In December 2008, the Company’s board of directors resolved to

participate in the third auction held by Taiwan Financial Asset Service

Corporation (TFASC) and acquired the land - about 16.5 thousand

square meters - from Hualon Corporation for NT$355,620 thousand.

Besides, in January 2009, the Company acquired another land - about

39 thousand square meters - near the Company in Taoyuan for

NT$791,910 thousand (US$24,755 thousand) from a related party,

Syuda Construction Company, to expand factory area.

There were no interests capitalized for the years ended December 31,

2008 and 2009, respectively.

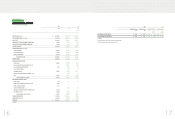

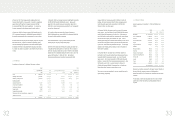

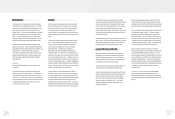

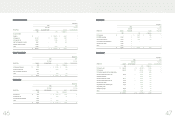

16. ACCRUED EXPENSES

Accrued expenses as of December 31, 2008 and 2009 were as

follows:

2008 2009

NT$ NT$ US$(Note 3)

Marketing $ 5,810,533 $ 8,572,963 $ 267,989

Bonus to employees 6,164,889 4,859,236 151,899

Services 1,180,716 1,115,099 34,858

Salaries and bonuses 1,012,048 820,342 25,644

Export 447,814 460,401 14,392

Research materials 397,075 405,916 12,689

Donation - 217,800 6,808

Meals and welfare 99,952 111,745 3,493

Insurance 69,978 74,607 2,332

Repairs and maintenance 76,171 63,957 1,999

Research and development 65,600 49,200 1,538

Pension cost 48,405 47,860 1,496

Freight 13,808 27,312 854

Travel 30,714 22,325 698

Others 215,233 279,211 8,728

$ 15,632,936 $ 17,127,974 $ 535,417

Based on the resolution passed by the Company’s board of directors in

February 2009, the employee bonuses for 2009 should be

appropriated at 18% of net income before deducting employee bonus

expenses.

The Company accrued marketing expenses on the basis of related

agreements and other factors that would significantly affect the

accruals.

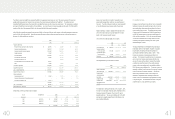

)LQDQFLDO,QIRUPDWLRQ

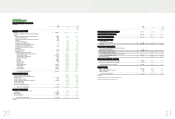

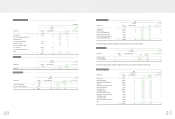

In December 2007, the Company and its subsidiary, High Tech

Computer Asia Pacific Pte. Ltd., acquired 1% and 99%, respectively,

equity interest in PT. High Tech Computer Indonesia for NT$62

thousand and NT$6,122 thousand, respectively. As a result, the

Company accounted for this investment by the equity method.

In September 2009, the Company acquired 100% equity interest in

HTC I Investment Corporation for NT$295,000 thousand (US$9,222

thousand) and accounted for this investment by the equity method.

In October 2009, the Company and its subsidiary, High Tech Computer

Asia Pacific Pte. Ltd., acquired 1% and 99%, respectively, equity

interest in HTC Holding Cooperatief U.A. for NT$13 thousand (US$0

thousand) and NT$1,325 thousand (US$41 thousand), respectively.

As a result, the Company accounted for this investment by the equity

method.

In December 2009, the Company invested in Huada Digital Corporation

for NT$245,000 thousand (US$7,659 thousand). Because the

registration of the investment was not completed on December 31,

2009, the investment was temporarily accounted for as “prepayments

for long-term investments.”

On its equity-method investments, the Company had a loss of

NT$57,289 thousand and a gain of NT$273,811 thousand (US$8,559

thousand) in 2008 and 2009, respectively.

The financial statements of equity-method investees had been

examined by the Company’s independent auditors.

Under the revised Statement of Financial Accounting Standards No. 7,

“Consolidated Financial Statements,” which took effect on January 1,

2005, the Company included the accounts of all its direct and indirect

subsidiaries in the consolidated financial statements as of and for the

years ended December 31, 2008 and 2009. All significant

intercompany balances and transactions have been eliminated.

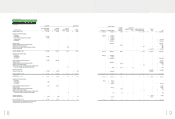

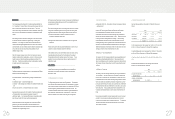

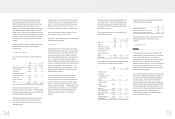

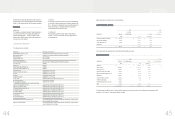

15. PROPERTIES

Properties as of December 31, 2008 and 2009 were as follows:

2008 2009

Carrying Value Cost Accumulated Depreciation Carrying Value

NT$ NT$ NT$ NT$ US$(Notes3)

Land $ 3,568,124 $ 4,719,538 $ - $ 4,719,538 $ 147,532

Buildings and structures 2,329,081 3,174,986 652,346 2,522,640 78,857

Machinery and equipment 1,226,172 4,003,941 3,103,473 900,468 28,148

Molding equipment - 172,632 172,632 - -

Computer equipment 72,187 302,213 224,299 77,914 2,436

Transportation equipment 1,675 2,732 1,394 1,338 42

Furniture and fixtures 28,409 129,533 110,330 19,203 600

Leased assets 2,356 4,712 3,141 1,571 49

Leasehold improvements 58,772 96,014 54,240 41,774 1,306

Prepayments for land, construction-in- progress and

equipment-in-transit 88,875

29,731 - 29,731 929

$ 7,375,651 $ 12,636,032 $ 4,321,855 $ 8,314,177 $ 259,899

)LQDQFLDO,QIRUPDWLRQ