HTC 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

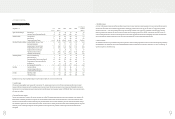

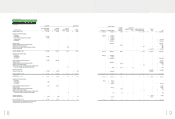

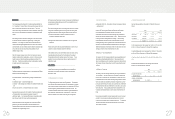

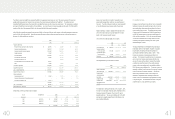

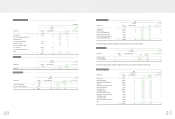

9. OTHER CURRENT FINANCIAL ASSETS

Other current financial assets as of December 31, 2008 and 2009

were as follows:

2008 2009

NT$ NT$ US$(Note 3)

Other receivables $ 193,092 $ 118,321 $ 3,699

Interest receivables 40,026 11,226 351

Agency payments 28,519 23,517 735

Other receivables from

related parties (Note 25) 13,869 81,137 2,536

$ 275,506 $ 234,201 $ 7,321

Other receivables were primarily overseas value-added tax

receivables from customers, prepayment for withholding income tax

of employees’ bonuses and travel expenses and proceeds of the

sales of properties.

10. INVENTORIES

Inventories as of December 31, 2008 and 2009 were as follows:

2008 2009

NT$ NT$ US$(Note 3)

Finished goods $ 1,302,917 $ 1,227,468 $ 38,371

Work-in-process 2,435,581 1,784,531 55,784

Raw materials 5,303,195 4,233,948 132,352

Goods in transit - 618,013 19,319

9,041,693 7,863,960 245,826

Less: Valuation

allowance (1,623,226 )( 3,125,261 ) ( 97,695 )

$ 7,418,467 $ 4,738,699 $ 148,131

The write-down of inventories to their net realizable value amounted

to NT$1,111,843 and NT$1,934,360 thousand (US$60,468

thousand) and was recognized as cost of sales for the years ended

December 31, 2008 and 2009, respectively.

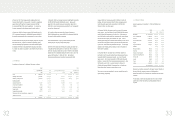

11. PREPAYMENTS

Prepayments as of December 31, 2008 and 2009 were as follows:

2008 2009

NT$ NT$ US$(Note 3)

Royalty $ 976,824 $ 3,044,563 $ 95,173

Services 89,181 121,600 3,801

Molding equipment 80,420 37,052 1,158

Software and hardware

maintenance 73,218 68,937 2,155

Export 6,420 21,219 663

Others 11,568 58,120 1,817

$ 1,237,631 $ 3,351,491 $ 104,767

Prepayments for royalty were primarily for discount purposes and

were classified as current or noncurrent on the basis of their

maturities. As of December 31, 2009, noncurrent prepayments of

NT$1,843,170 thousand (US$57,617 thousand) had been classified

as other assets (Note 28 has more information).

Prepayments for others were primarily rent, travel and insurance

expenses.

12. FINANCIAL ASSETS CARRIED AT COST

Financial assets carried at cost as of December 31, 2008 and 2009

were as follows:

2008 2009

NT$ NT$ US$(Note 3)

Hua-Chuang Automobile

Information Technical Center

Co., Ltd. $ 500,000 $ 500,000 $ 15,630

Answer Online, Inc. 1,192 1,192 37

$ 501,192 $ 501,192 $ 15,667

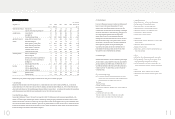

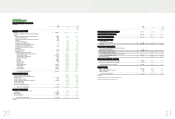

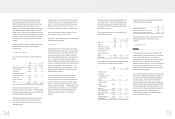

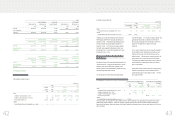

)LQDQFLDO,QIRUPDWLRQ

The Company had derivative transactions in 2008 and 2009 to manage exposures related to exchange rate fluctuations. However, these

transactions did not meet the criteria for hedge accounting under Statement of Financial Accounting Standards No. 34 - ³Financial Instruments:

Recognition and Measurement.´Thus, the Company had no hedge accounting in 2008 and 2009. Outstanding forward exchange contracts as of

December 31, 2008 and 2009 were as follows:

Forward Exchange Contracts

2008

Buy/Sell Currency Settlement Period/Date Contract Amount

Forward exchange contracts Sell AUD/USD 2009.01.07-2009.01.16 AUD 17,000

Forward exchange contracts Sell EUR/USD 2009.01.07-2009.02.27 EUR 141,000

Forward exchange contracts Sell GBP/USD 2009.01.07-2009.02.18 GBP 3,870

Forward exchange contracts Sell JPY/NTD 2009.01.16 JPY 95,000

Forward exchange contracts Buy USD/JPY 2009.01.07-2009.02.13 USD 16,726

Forward exchange contracts Sell USD/NTD 2009.01.07-2009.01.23 USD 37,000

Forward exchange contracts Buy USD/CAD 2009.01.16 USD 618

2009

Buy/Sell Currency Settlement Period/Date Contract Amount

Forward exchange contracts Sell EUR/USD 2010.01.15-2010.02.26 EUR 76,000

Net loss on derivative financial instruments in 2009 was NT$749,476 thousand (US$23,428 thousand), including realized settlement loss of

NT$767,608 thousand (US$23,995 thousand) and valuation gain of NT$18,132 thousand (US$567 thousand).

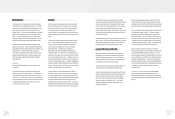

7. AVAILABLE-FOR-SALE FINANCIAL ASSETS

Available-for-sale financial assets as of December 31, 2008 and

2009 were as follows:

2008 2009

NT$ NT$ US$(Note 3)

Mutual funds $ - $ 2,497,394 $ 78,068

Domestic quoted stocks 339 313 10

Less: Current portion - ( 2,497,394 ) ( 78,068 )

$ 339 $ 313 $ 10

8. NOTES AND ACCOUNTS RECEIVABLE

Notes and accounts receivable as of December 31, 2008 and 2009

were as follows:

2008 2009

NT$ NT$ US$(Note 3)

Notes receivable

$ 3,456 $-$-

Accounts receivable

29,407,383 26,334,719 823,217

Less:

Allowance for

doubtful

accounts

( 550,597 ) ( 1,008,491 ) ( 31,525 )

$ 28,860,242 $ 25,326,228 $ 791,692

)LQDQFLDO,QIRUPDWLRQ