HTC 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ownership of the goods, primarily upon shipment, because the

earnings process has been completed and the economic benefits

associated with the transaction have been realized or are realizable.

Revenue is measured at the fair value of the consideration received

or receivable and represents amounts agreed between the Company

and the customers for goods sold in the normal course of business,

net of sales discounts and volume rebates. For trade receivables

due within one year from the balance sheet date, as the nominal

value of the consideration to be received approximates its fair value

and transactions are frequent, fair value of the consideration is not

determined by discounting all future receipts using an imputed rate

of interest.

An allowance for doubtful accounts is provided on the basis of a

review of the collectability of accounts receivable. The Company

assesses the probability of collections of accounts receivable by

examining the aging analysis of the outstanding receivables and

assessing the value of the collateral provided by customers.

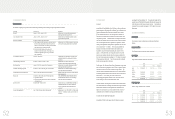

Inventories

Inventories consist of raw materials, supplies, finished goods and

work-in-process. Before January 1, 2008, inventories were stated

at the lower of cost or market value (replacement cost or net

realizable value). Any write-down was made on a category by

category basis. Market value meant replacement cost for raw

materials and supplies and net realizable value for finished goods

and work in process. As stated in Note 4, effective January 1,

2008, inventories are stated at the lower of cost or net realizable

value. Inventory write-downs are made item by item, except

where it may be appropriate to group similar or related items. Net

realizable value is the estimated selling price of inventories less all

estimated costs of completion and costs necessary to make the

sale. Cost is determined using the moving-average method.

Financial Assets Carried at Cost

Investments in equity instruments with no quoted prices in an active

market and with fair values that cannot be reliably measured, such

as non-publicly traded stocks and stocks traded in the emerging

stock market, are measured at their original cost. The accounting

treatment for dividends on financial assets carried at cost is similar

to that for dividends on available-for-sale financial assets. An

impairment loss is recognized when there is objective evidence that

the asset is impaired. A reversal of this impairment loss is

disallowed.

Bond Investments Not Quoted in An Active Market

Bond investments not quoted in an active market are stated at

amortized cost and are classified as current or noncurrent on the

basis of their maturities.

Bond investments not quoted in an active market - current are

investments receiving fixed or determinable amounts. Other

features of these bond investments are as follows:

a. The bond investments have not been designated as at fair value

through profit or loss.

b. The bond investments have not been designated as available for

sale.

Those investments that are noncurrent are classified as bond

investment not quoted in an active market - noncurrent under funds

and investments.

Investments Accounted for by the Equity Method

Investments in which the Company holds 20 percent or more of the

investees’ voting shares or exercises significant influence over the

investees’ operating and financial policy decisions are accounted for

by the equity method.

Prior to January 1, 2006, the difference between the acquisition

cost and the Company’s proportionate share in the investee’s equity

was amortized by the straight-line method over five years.

Effective January 1, 2006, pursuant to the revised Statement of

Financial Accounting Standard (SFAS) No. 5, “Long-term

Investments Accounted for by Equity Method”, the acquisition cost

is allocated to the assets acquired and liabilities assumed based on

their fair values at the date of acquisition, and the excess of the

acquisition cost over the fair value of the identifiable net assets

acquired is recognized as goodwill. Goodwill is not being

amortized. The excess of the fair value of the net identifiable

assets acquired over the acquisition cost is used to reduce the fair

value of each of the noncurrent assets acquired (except for financial

assets other than investments accounted for by the equity method,

noncurrent assets held for sale, deferred income tax assets, prepaid

pension or other postretirement benefit) in proportion to the

respective fair values of the noncurrent assets, with any excess

recognized as an extraordinary gain. Effective January 1, 2006,

the accounting treatment for the unamortized investment premium

arising on acquisitions before January 1, 2006 is the same as that

for goodwill and the premium is no longer being amortized. For

any investment discount arising on acquisitions before January 1,

2006, the unamortized amount continues to be amortized over the

remaining year.

Profits from downstream transactions with an equity-method

investee are eliminated in proportion to the Company’s percentage

of ownership in the investee; however, if the Company has control

over the investee, all the profits are eliminated. Profits from

upstream transactions with an equity-method investee are

eliminated in proportion to the Company’s percentage of ownership

in the investee. When the Company subscribes for its investee’s

newly issued shares at a percentage different from its percentage

of ownership in the investee, the Company records the change in its

equity in the investee’s net assets as an adjustment to investments,

with a corresponding amount credited or charged to capital surplus.

When the adjustment should be debited to capital surplus, but the

capital surplus arising from long-term investments is insufficient,

the shortage is debited to retained earnings.

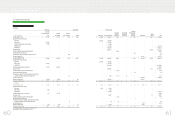

)LQDQFLDO,QIRUPDWLRQ

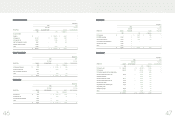

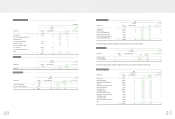

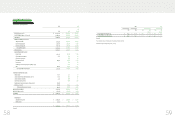

In January 2007 and October 2008, the Company wholly acquired

the shares issued by Communication Global Certification Inc. and

One & Company Design, Inc. The fair values of net assets were as

follows:

Communication Global

Certification Inc.

One & Company

Design, Inc.

Cash on hand and in banks $ 39,961 $ 7,336

Other current assets 40,201 12,378

Property 175,940 16,620

Intangible assets 174,253 115,055

Other assets 3,913 164

Current liabilities ( 63,315 ) ( 15,220 )

Long-term bank loans ( 90,050 ) -

Other liabilities ( 903 ) -

Total consideration $ 280,000 $ 136,333

Total consideration 280,000 $ 136,333

Cash on hand and in banks ( 39,961 ) ( 7,336 )

Net cash outflow on the

acquisition of a subsidiary $ 240,039 $ 128,997

As mentioned in Note 1, HTC and the foregoing subsidiaries are

hereinafter referred to collectively as the “Company.”

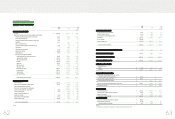

Current/Noncurrent Assets and Liabilities

Current assets include cash, cash equivalents, and those assets

held primarily for trading purposes or to be realized, sold or

consumed within one year from the balance sheet date. All other

assets such as properties and intangible assets are classified as

noncurrent. Current liabilities are obligations incurred for trading

purposes or to be settled within one year from the balance sheet

date. All other liabilities are classified as noncurrent.

Cash Equivalents

Cash equivalents, consisting of repurchase agreements

collateralized by bonds, are highly liquid financial instruments with

maturities of three months or less when acquired and with carrying

amounts that approximates their fair values.

Financial Assets/Liabilities at Fair Value through Profit or Loss

Financial instruments classified as financial assets or financial

liabilities at fair value through profit or loss (FVTPL) include financial

assets or financial liabilities held for trading and those designated

as at FVTPL on initial recognition. The Company recognizes a

financial asset or a financial liability on its balance sheet when the

Company becomes a party to the contractual provisions of the

financial instrument. A financial asset is derecognized when the

Company has lost control of its contractual rights over the financial

asset. A financial liability is derecognized when the obligation

specified in the relevant contract is discharged, cancelled or

expired.

Financial instruments at FVTPL are initially measured at fair value.

Transaction costs directly attributable to the acquisition

of financial assets or financial liabilities at FVTPL are recognized

immediately in profit or loss. At each balance sheet date

subsequent to initial recognition, financial assets or financial

liabilities at FVTPL are remeasured at fair value, with changes in fair

value recognized directly in profit or loss in the year in which they

arise. Cash dividends received subsequently (including those

received in the year of investment) are recognized as income for the

year. On derecognition of a financial asset or a financial liability,

the difference between its carrying amount and the sum of the

consideration received and receivable or consideration paid and

payable is recognized in profit or loss.

A derivative that does not meet the criteria for hedge accounting is

classified as a financial asset or a financial liability held for trading.

If the fair value of the derivative is positive, the derivative is

recognized as a financial asset; otherwise, the derivative is

recognized as a financial liability.

Fair values of financial assets and financial liabilities at the balance

sheet date are determined as follows: Publicly traded stocks - at

closing prices; open-end mutual funds - at net asset values; bonds

- at prices quoted by the Taiwan GreTai Securities Market; and

financial assets and financial liabilities without quoted prices in an

active market - at values determined using valuation techniques.

Available-for-sale Financial Assets

Available-for-sale financial assets are initially measured at fair

value plus transaction costs that are directly attributable to the

acquisition. At each balance sheet date subsequent to initial

recognition, available-for-sale financial assets are remeasured at

fair value, with changes in fair value recognized in equity until the

financial assets are disposed of, at which time, the cumulative gain

or loss previously recognized in equity is included in profit or loss

for the year.

The recognition, derecognition and the fair value bases of

available-for-sale financial assets are the same with those of

financial assets at FVTPL.

Cash dividends are recognized on the stockholders’ resolutions,

except for dividends distributed from the pre-acquisition profit,

which are treated as a reduction of investment cost. Stock

dividends are not recognized as investment income but are

recorded as an increase in the number of shares. The total

number of shares subsequent to the increase is used for

recalculation of cost per share.

An impairment loss is recognized when there is objective evidence

that the financial asset is impaired. Any subsequent decrease in

impairment loss for an equity instrument classified as

available-for-sale is recognized directly in equity.

Revenue Recognition, Accounts Receivable and Allowance for

Doubtful Accounts

Revenue from sales of goods is recognized when the Company

has transferred to the buyer the significant risks and rewards of

)LQDQFLDO,QIRUPDWLRQ