HTC 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

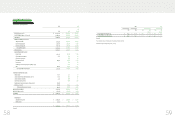

capital surplus amounting to NT$2,566 thousand (US$80 thousand).

As of December 31, 2009, the total capital surplus from long-term

equity-method investments was NT$18,411 thousand (US$576

thousand).

The additional paid-in capital from a merger was NT$25,756

thousand as of January 1, 2008. Then because of treasury stock

retirement in January and November 2009, the additional paid-in

capital from a merger decreased to NT$25,189 thousand (US$787

thousand) as of December 31, 2009.

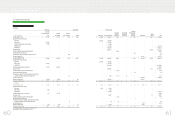

Appropriation of Retained Earnings and Dividend Policy

Based on the Company Law of the ROC and the Company’s Articles of

Incorporation, 10% of the Company’s annual net income less any

deficit should first be appropriated as legal reserve. From the

remainder, there should be appropriations of not more than 3‰ as

remuneration to directors and supervisors and at least 5% as

bonuses to employees.

The appropriation of retained earnings should be proposed by the

board of directors and approved by the stockholders in their annual

meeting.

As part of a high-technology industry and a growing enterprise, the

Company considers its operating environment, industry

developments, and long-term interests of stockholders as well as its

programs to maintain operating efficiency and meet its capital

expenditure budget and financial goals in determining the stock or

cash dividends to be paid. The Company’s dividend policy

stipulates that at least 50% of total dividends may be distributed as

cash dividends.

Had the Company recognized the employees’ bonuses of

NT$1,313,200 thousand as expenses in 2007, the pro forma

earnings per share in 2007 would have decreased from NT$50.48 to

NT$48.19, which were not adjusted retroactively for the effect of

stock dividend distribution in the following year.

The bonus to employees of NT$6,164,889 thousand for 2008 were

approved in the stockholders’ meeting in June 2009. The bonus

to employees included a cash bonus of NT$1,210,000 thousand

and a share bonus of NT$4,954,889 thousand. The number of

shares of 13,357 thousand was determined by dividing the amount

of share bonus by the closing price (after considering the effect of

cash and stock dividends) of the shares of the day immediately

preceding the stockholders’ meeting. The approved amounts of

the bonus to employees were the same as the accrued amounts.

Based on a resolution passed by the Company’s board of directors

in February 2009, the employee bonus for 2009 should be

appropriated at 18% of net income before deducting employee

bonus expenses. If the actual amounts subsequently resolved by

the stockholders differ from the proposed amounts, the differences

are recorded in the year of stockholders’ resolution as a change in

accounting estimate. If bonus shares are resolved to be

distributed to employees, the number of shares is determined by

dividing the amount of bonus by the closing price (after

considering the effect of cash and stock dividends) of the shares of

the day immediately preceding the stockholders’ meeting.

As of January 18, 2010, the date of the accompanying

independent auditors’ report, the appropriation of the 2009

earnings had not been proposed by the Board of Directors.

Information on earnings appropriation can be accessed online

through the Market Observation Post System on the Web site.

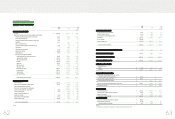

22. TREASURY STOCK

On October 7, 2008, the Company’s board of directors passed a

resolution to buy back 10,000 thousand company shares from the

open market. The repurchase period was between October 8,

2008 and December 7, 2008, and the repurchase price ranged

from NT$400 to NT$500 per share. If the Company’s share price

was lower than this price range, the Company might continue to

buy back its shares. The Company bought back 10,000 thousand

shares for NT$3,410,277 thousand during the repurchase period

and retired them in January 2009.

)LQDQFLDO,QIRUPDWLRQ

Global Depositary Receipts

The Company issued 14,400 thousand common shares

corresponding to 3,600 thousand units of Global Depositary Receipts

(GDRs). For this GDR issuance, the Company’s stockholders,

including Via Technologies, Inc., also issued 12,878.4 thousand

common shares, corresponding to 3,219.6 thousand GDR units.

Thus, the entire offering consisted of 6,819.6 thousand GDR units.

Each GDR represents four common shares, with par value of

NT$131.1. For this common share issuance, net of related

expenses, NT$1,696,855 thousand was accounted for as capital

surplus. This share issuance for cash was completed and

registered on November 19, 2003.

The holders of these GDRs have the same rights and obligations as

the stockholders of the Company. However, the distribution of the

offering and sales of GDRs and the shares represented thereby in

certain jurisdictions may be restricted by law. In addition, the GDRs

offered and the shares represented are not transferable, except in

accordance with the restrictions described in the GDR offering

circular and related laws applied in Taiwan. Through the depositary

custodian in Taiwan, GDR holders are entitled to exercise these

rights:

a.To vote; and

b.To receive dividends and participate in new share issuance for cash

subscription.

Taking into account the effect of stock dividends, the GDRs increased

to 8,493 thousand units (33,971.9 thousand shares). The holders of

these GDRs requested the Company to redeem the GDRs to get the

Company’s common shares. As of December 31, 2009, there were

3,067.4 thousand units of GDRs redeemed, representing 12,270

thousand common shares, and the outstanding GDRs represented

21,702 thousand common shares or 2.75% of the Company’s

common shares.

Capital Surplus

Under the Company Law, capital surplus can only be used to offset a

deficit. However, the capital surplus from share

issued in excess of par (additional paid-in capital from issuance of

common shares, conversion of bonds and treasury stock

transactions) and donations may be capitalized, which however is

limited to a certain percentage of the Company’s paid-in capital.

Also, the capital surplus from long-term investments may not be

used for any purpose.

The additional paid-in capital was NT$4,374,244 thousand as of

January 1, 2008. In January and November 2009, the retirement

of treasury stock caused a decrease of additional paid-in capital

amounted to NT$57,907 thousand (US$1,810 thousand) and

NT$81,330 thousand (US$2,542 thousand), respectively. In

addition, the bonus to employees of NT$6,164,889 thousand for

2008 were approved in the stockholders’ meeting in June 2009.

Of the approved amount, NT$4,954,889 thousand, representing

13,357 thousand common shares which was determined by fair

value, would be distributed by common stock. The difference

between par value and fair value of NT$4,821,316 thousand

(US$150,713 thousand) was accounted for as additional paid-in

capital. As a result, the additional paid-in capital as of December

31, 2009 was NT$9,056,323 thousand (US$283,099 thousand).

Under the Company Law, the Company may transfer the capital

surplus to common stock if there is no accumulated deficit.

The capital surplus from long-term equity investments was

NT$15,845 thousand as of January 1, 2008. When the Company

did not subscribe for the new shares issued by Vitamin D Inc. in

September 2008, January 2009 and June 2009, adjustments of

NT$1,689 thousand, NT$187 thousand (US$6 thousand) and

NT$484 thousand (US$15 thousand) were made to the investment

carrying value and capital surplus, respectively. The Company

also determined that the recoverable amount of this investment

was less than its carrying amount and recognized an impairment

loss on its carrying value. As a result, the carrying value of this

investment became zero and the Company reversed a capital

surplus of NT$2,360 thousand (US$74 thousand) that was

recognized in prior years for the movement of Vitamin D’s capital

surplus in proportion to the Company’s equivalent stock. Also

recognized was the movement of other investees’

)LQDQFLDO,QIRUPDWLRQ