HTC 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

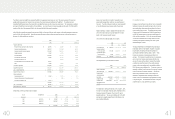

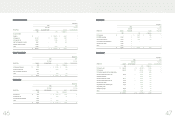

In August 2000, the Company acquired 100% equity interest in H.T.C.

(B.V.I.) Corp. for NT$12,834 thousand and accounted for this

investment by the equity method. The Company increased this

investment by NT$457,727 thousand in 2008 and NT$385,749

thousand (US$12,059 thousand) in 2009. The 2009 additional

investment consisted of NT$316,656 thousand (US$9,899 thousand)

transferred from prepayments for long-term investments because the

registration of the related investment had been completed by the

beginning of 2009 and of a new investment amount of NT$69,093

thousand (US$2,160 thousand).

In addition, the Company reorganized its overseas subsidiaries’

investment structure in the fourth quarter of 2009. Thus, H.T.C. (B.V.I)

Corp. transferred some of its subsidiaries to High Tech Computer Asia

Pacific Pte. Ltd and HTC HK, Limited and reduced its capital by

NT$751,134 thousand (US$23,480 thousand). As of December 31,

2009, the Company’s investment in H.T.C. (B.V.I.) Corp. amounted to

NT$1,178,341 thousand (US$36,834 thousand). H.T.C. (B.V.I.) Corp.

makes investments on behalf of the Company.

In April 2006, the Company acquired 92% equity interest in BandRich

Inc. for NT$135,000 thousand and accounted for this investment by

the equity method. In May 2006, BandRich Inc. issued 12,000

thousand common shares at NT$12.50 per share, of which the

Company did not buy any shares. Thus, the Company’s ownership

percentage declined from 92% to 50.66%, resulting in capital surplus

- long-term equity investments of NT$15,845 thousand.

In September 2006, the Company acquired 100% equity interest in

HTC HK, Limited for NT$1,277 thousand and accounted for this

investment by the equity method. In December 2009, HTC HK,

Limited was sold to High Tech Computer Asia Pacific Pte. Ltd. in line

with the reorganization of the Company’s overseas subsidiaries’

investment structure.

In January 2007, the Company acquired 100% equity interest in

Communication Global Certification Inc. for NT$280,000 thousand and

accounted for this investment by the equity method.

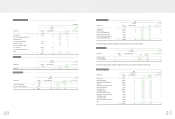

In July 2007, the Company acquired 100% equity interest in High Tech

Computer Asia Pacific Pte. Ltd. (“High Tech Asia”) for NT$560,660

thousand and accounted for this investment by the equity method.

The Company made a new investment of NT$1,463,114 thousand in

2008. In 2009, High Tech Asia increased its capital by NT$1,339,311

thousand (US$41,867 thousand) because of the Company’s new cash

investment and a transfer-in due to the reorganization of the

Company’s overseas subsidiaries’ investment structure. As of

December 31, 2009, the Company’s investment in High Tech Asia had

amounted to NT$3,363,085 thousand (US$105,129 thousand).

However, because the registration of this investment had not been

completed as of December 31, 2009, an amount of NT$209,910

thousand (US$6,562 thousand) was temporarily accounted for under

“prepayments for long-term investments.”

In April 2008, the Company made a new investment of US$350

thousand and transferred its bond investment of US$1,000 thousand

to convertible preferred stocks issued by Vitamin D Inc. As a result,

the Company acquired 27.27% equity interest in Vitamin D Inc. for

NT$40,986 thousand, enabling the Company to exercise significant

influence over this investee. Thus, the Company accounts for this

investment by the equity method. In September 2008, January 2009

and June 2009, Vitamin D Inc. issued new convertible preferred

shares, but the Company did not buy any of these shares. The

Company’s ownership percentage thus declined from 27.27% to

25.59%, and there was a capital surplus - long-term equity

investments of NT$1,689 thousand, NT$187 thousand (US$6

thousand) and NT$484 thousand (US$15 thousand) in September

2008, January 2009 and June 2009, respectively. In addition, the

Company determined that the recoverable amount of this investment

in 2009 was less than its carrying amount and thus recognized an

impairment loss of NT$30,944 thousand (US$967 thousand).

In July 2008, the Company acquired 100% equity interest in HTC

Investment Corporation for NT$300,000 thousand and accounted for

this investment by the equity method.

)LQDQFLDO,QIRUPDWLRQ

In January 2007, the Company acquired 10% equity interest in

Hua-Chuang Automobile Information Technical Center Co., Ltd. for

NT$500,000 thousand. The Company also signed a joint venture

agreement with Yulon Group, the main stockholder of Hua-Chuang.

Under the agreement, the Company and Yulon Group may, between

January 1, 2010 and December 31, 2011, submit written requests to

each other for Yulon Group to buy back NT$300,000 thousand at

original price, some of Hua-Chuang’s shares bought by the Company.

The buy-back proposed by Yulon Group becomes effective with a

consensus from the Company.

In March 2004, the Company merged with IA Style, Inc. and acquired

1.82% equity interest in Answer Online, Inc. as a result of the merger.

These unquoted equity instruments were not carried at fair value

because their fair value could not be reliably measured; thus, the

Company accounted for these investments by the cost method.

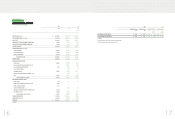

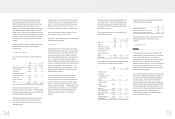

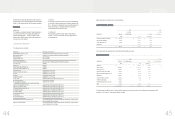

13. BOND INVESTMENTS NOT QUOTED IN AN ACTIVE MARKET

A bond investment not quoted in an active market as of December 31,

2008 and 2009 was as follows:

2008 2009

NT$ NT$ US$(Note 3)

Bond investment $ - $-$ -

Less: Current portion - --

$ - $-$ -

The Company bought a 12-month bond issued by Vitamin D Inc. with

6% annual interest for NT$33,030 thousand (US$1,000 thousand).

The unquoted debt instrument was not carried at fair value because its

fair value could not be reliably measured.

In April 2008, the Company made a new investment of US$350

thousand and transferred its bond investment of US$1,000 thousand

to convertible preferred stocks issued by Vitamin D Inc. As a result,

the Company acquired 27.27% equity interest in Vitamin D Inc. and

can exercise significant influence over this investee. The Company

accounts for this investment by the equity method.

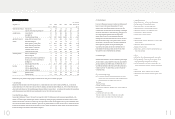

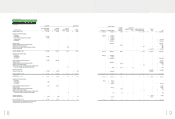

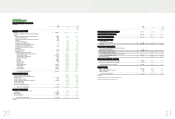

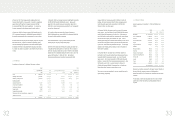

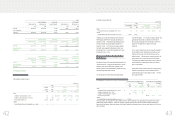

14. INVESTMENTS ACCOUNTED FOR BY THE EQUITY METHOD

Investments accounted for by the equity method as of December 31, 2008 and 2009 were as follows:

2008 2009

Carrying Value

Ownership

Percentage Original Cost Carrying Value

Ownership

Percentage

NT$ NT$ US$(Note 3) NT$ US$(Note 3)

Equity method

H.T.C. (B.V.I.) Corp. $ 1,557,022 100.00 $ 1,178,341 $ 36,834 $ 1,408,470 $ 44,028 100.00

BandRich Inc. 29,460 50.66 135,000 4,220 35,117 1,098 50.66

HTC HK, Limited 46,743 100.00 -- - --

Communication Global 273,583 100.00 280,000 8,753 286,957 8,970 100.00

High Tech Computer Asia Pacific 2,094,922 100.00 3,153,175 98,567 3,223,526 100,767 100.00

Vitamin D Inc. 39,906 26.02 40,986 1,281 - - 25.59

HTC Investment Corporation 301,006 100.00 300,000 9,378 300,563 9,395 100.00

PT. High Tech Computer 62 1.00 62 2 62 2 1.00

HTC I Investment Corporation - 100.00 295,000 9,222 295,071 9,224 100.00

Prepayments for

long-term investments 316,656 454,923 14,221 454,923 14,221

$ 4,659,360 $ 5,837,487 $ 182,478 $ 6,004,689 $ 187,705

)LQDQFLDO,QIRUPDWLRQ