HTC 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

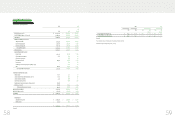

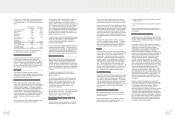

16. SHORT-TERM BORROWINGS

Short-term borrowings as of December 31, 2008 and 2009 were as

follows:

2008 2009

NT$ NT$ US$ (Note 3)

Working capital loans,

annual interest at

1.27%-3.00% $ 75,000 $ 75,326 $ 2,261

17. ACCRUED EXPENSES

Accrued expenses as of December 31, 2008 and 2009 were as

follows:

2008 2009

NT$ NT$ US$ (Note 3)

Marketing $ 5,790,466 $ 8,784,378 $ 274,598

Bonus to employees 6,164,889 4,859,236 151,899

Salaries and bonuses 1,220,533 1,001,358 31,302

Research materials 539,071 529,935 16,566

Export 460,724 473,910 14,814

Services 520,383 458,735 14,340

Donation - 217,800 6,808

Meals and welfare 101,563 114,030 3,565

Insurance 74,061 78,411 2,451

Repairs and

maintenance 82,096 64,893 2,029

Research and

development 65,600 49,200 1,538

Pension cost 49,630 48,939 1,530

Freight 13,808 27,678 865

Travel 32,507 24,385 762

Others 233,439 231,000 7,220

$ 15,348,770 $ 16,963,888 $ 530,287

Based on the resolution passed by the Company’s board of directors

in February 2009, the employee bonuses for 2009 should be

appropriated at 18% of net income before deducting employee bonus

expenses.

The Company accrued marketing expenses on the basis of related

agreements and other factors that would significantly affect the

accruals.

In September 2009, the Company’s board of directors resolved to

donate to the HTC Education Foundation NT$300,000 thousand

(US$9,378 thousand), consisting of (a) the second and third floors of

Taipei’s R&D headquarters, with these two floors to be built at an

estimated cost of NT$217,800 thousand (US$6,808 thousand), and

(b) cash of NT$82,200 thousand (US$2,570 thousand). This

donation excludes the land, of which the ownership remains with

the Company. The difference between the estimated building

donation and the actual construction cost will be treated as an

adjustment in the year when the completed floors are actually

turned over to the HTC Education Foundation.

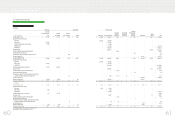

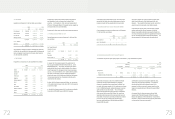

18. OTHER CURRENT LIABILITIES

Other current liabilities as of December 31, 2008 and 2009 were as

follows:

2008 2009

NT$ NT$ US$(Note 3)

Reserve for warranty

expenses

$5,228,603 $ 5,265,463 $ 164,597

Agency receipts

260,802 524,156 16,385

Other payable

389,103 474,908 14,846

Advance receipts

180,504 152,907 4,780

Directors’ remuneration

21,842 --

Others

27,842 197,099 6,161

$6,108,696 $ 6,614,533 $ 206,769

The Company provides warranty service for one to two years

depending on the contract with our customers. The warranty

liability is estimated based on management’s evaluation of the

products under warranty and recognized as warranty liability.

Agency receipts were primarily employees’ income tax, insurance,

royalties, overseas value-added tax, and other items.

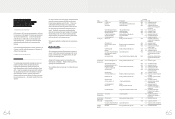

)LQDQFLDO,QIRUPDWLRQ

On its equity-method investments, the Company had losses of

NT$6,151 thousand and NT$3,891 thousand (US$122 thousand) in

2008 and 2009, respectively.

The financial statements of equity-method investees had been

examined by the Company’s independent auditors.

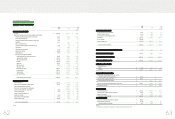

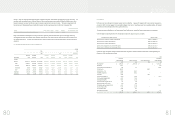

15. PROPERTIES

Properties as of December 31, 2008 and 2009 were as follows:

In December 2008, the Company’s board of directors resolved to

participate in the third auction held by Taiwan Financial Asset

Service Corporation (TFASC) and acquired the land - about 16.5

thousand square meters - from Hualon Corporation for NT$355,620

thousand. Besides, in January 2009, the Company acquired

another land - about 39 thousand square meters - near the

Company in Taoyuan for NT$791,910 thousand (US$24,755

thousand) from a related party, Syuda Construction Company, to

expand factory area.

2008 2009

Carrying Value Cost

Accumulated

Depreciation Carrying Value

NT$ NT$ NT$ NT$ US$ (Notes3)

Land $ 3,568,124 $ 4,719,538 $ - $ 4,719,538 $ 147,532

Buildings and structures 2,331,630 4,218,443 667,553 3,550,890 111,000

Machinery and equipment 1,493,038 4,702,420 3,580,896 1,121,524 35,058

Molding equipment 14,326 199,392 187,772 11,620 363

Computer equipment 120,789 411,504 275,343 136,161 4,257

Transportation equipment 1,593 4,575 3,237 1,338 42

Furniture and fixtures 307,346 462,664 236,379 226,285 7,074

Leased assets 2,980 6,327 3,341 2,986 93

Leasehold improvements 125,235 199,416 100,614 98,802 3,089

Prepayments for land, construction-in- progress and

equipment-in-transit 951,289 30,664 - 30,664 958

$ 8,916,350 $ 14,954,943 $ 5,055,135 $ 9,899,808 $ 309,466

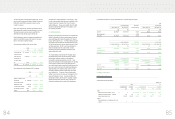

In August 2008, the Company acquired from Runtop Inc. land and

building, with areas of approximately 10.6 thousand square meters

and 40 thousand square meters, respectively, for NT$900,000

thousand to have more office space.

In December 2008, the Company bought land - about 8.3 thousand

square meters - from Yulon Motors Ltd. for NT$3,335,000 thousand

to build the Taipei R&D headquarter in Xindian City. Of the purchase

price, 80% had been paid and 80% of ownership of the land had

been transferred to the Company as of December 31, 2009. Under

a revised agreement signed in December 2009, Yulon Motors Ltd.

should transfer to the Company the remaining 20% of ownership of

the land by March 31, 2010 instead of by December 20, 2009. The

Company should pay the remaining 20% purchase price after

completing the land transfer registration.

The construction of a new office building and employees’ dormitory

on HTC Electronics (Shanghai)’s land was completed in December

2009. As a result, a construction amount of NT$894,252 thousand

(US$27,954 thousand) was transferred to “buildings and structures”

from “prepayments for construction-in-progress and

equipment-in-transit”.

There were no interests capitalized for the years ended December

31, 2008 and 2009, respectively.

)LQDQFLDO,QIRUPDWLRQ