HTC 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

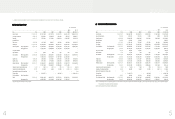

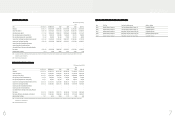

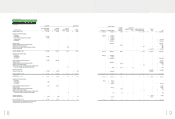

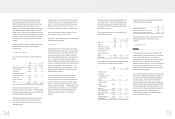

2008 2009

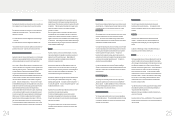

LIABILITIES AND STOCKHOLDERS

¶

EQUITY NT$ NT$ US$

(Note 3)

CURRENT LIABILITIES

Financial liabilities at fair value through profit or

ġ

loss (Notes 2, 6 and 24) $ 514,083 $ -$-

Notes and accounts payable (Note 25) 27,907,144 24,882,322 777,816

Income tax payable (Notes 2 and 22) 3,937,745 4,152,624 129,810

Accrued expenses (Notes 4, 16 and 25) 15,632,936 17,127,974 535,417

Payable for purchase of equipment 157,786 68,906 2,154

Other current liabilities (Notes 2, 17 and 25) 6,408,776 7,269,962 227,257

Total current liabilities 54,558,470 53,501,788 1,672,454

OTHER LIABILITIES

Guarantee deposits received 6,406 1,210 38

Total liabilities 54,564,876 53,502,998 1,672,492

STOCKHOLDERS

¶

EQUITY

(Note 19)

Capital stock

Common stock at par value of NT$10.00; authorized: 1,000,000

ġ

thousand shares; issued and outstanding: 755,394 thousand

ġ

shares in 2008 and 788,936 thousand shares in 2009 7,553,938 7,889,358 246,620

Capital surplus

Additional paid-in capital from share issuance in excess of par 4,374,244 9,056,323 283,099

Long-term equity investments 17,534 18,411 576

Merger 25,756 25,189 787

Retained earnings

Legal reserve 7,410,139 10,273,674 321,152

Accumulated earnings 44,626,182 38,364,099 1,199,253

Cumulative translation adjustments (Note 2) 65,602 15,088 471

Net loss not recognized as pension cost - (34)(1)

Unrealized valuation losses on financial instruments ( 1,632 ) ( 1,658 ) ( 52 )

ġ

(Notes 2 and 7)

Treasury stock (Notes 2 and 20) ( 3,410,277 ) --

Total stockholders

¶

equity 60,661,486 65,640,450 2,051,905

TOTAL $ 115,226,362 $ 119,143,448 $ 3,724,397

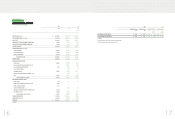

)LQDQFLDO,QIRUPDWLRQ

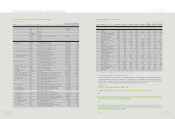

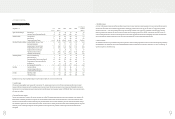

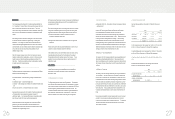

HTC CORPORATION

BALANCE SHEETS

DECEMBER 31, 2008 and 2009

(In Thousands, Except Par Value)

2008 2009

ASSETS NT$ NT$ US$

(Note 3)

CURRENT ASSETS

Cash and cash equivalents (Notes 2 and 5) $ 61,826,873 $ 61,676,464 $ 1,927,992

Financial assets at fair value through profit or loss (Notes 2, 6 and 24) - 18,132 567

Available-for-sale financial assets - current (Notes 2 and 7) - 2,497,394 78,068

Notes and accounts receivable, net (Notes 2 and 8) 28,860,242 25,326,228 791,692

Accounts receivable from related parties, net (Notes 2 and 25) 938,770 2,244,550 70,164

Other current financial assets (Notes 9 and 25) 275,506 234,201 7,321

Inventories (Notes 2, 4 and 10) 7,418,467 4,738,699 148,131

Prepayments (Notes 11 and 25) 1,237,631 3,351,491 104,767

Deferred income tax assets (Notes 2 and 22) 552,494 811,240 25,359

Other current assets 162,007 126,780 3,963

Total current assets 101,271,990 101,025,179 3,158,024

LONG-TERM INVESTMENTS

Available-for-sale financial assets - noncurrent (Notes 2 and 7) 339 313 10

Financial assets carried at cost (Notes 2 and 12) 501,192 501,192 15,667

Investments accounted for by the equity method (Notes 2 and 14) 4,342,704 5,549,766 173,484

Prepayments for long-term investments (Notes 2 and 14) 316,656 454,923 14,221

Total long-term investments 5,160,891 6,506,194 203,382

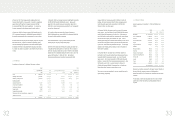

PROPERTIES

(Notes 2, 15 and 25)

Cost

Land 3,568,124 4,719,538 147,532

Buildings and structures 2,853,645 3,174,986 99,249

Machinery and equipment 3,927,100 4,003,941 125,162

Molding equipment 172,632 172,632 5,397

Computer equipment 264,248 302,213 9,447

Transportation equipment 2,732 2,732 86

Furniture and fixtures 127,202 129,533 4,049

Leased assets 4,712 4,712 147

Leasehold improvements 95,208 96,014 3,001

Total cost 11,015,603 12,606,301 394,070

Less: Accumulated depreciation ( 3,728,827 ) ( 4,321,855 ) ( 135,100 )

Prepayments for construction-in-progress and equipment-in-transit 88,875 29,731 929

Properties, net 7,375,651 8,314,177 259,899

OTHER ASSETS

Assets leased to others 309,959 48,135 1,505

Refundable deposits 117,464 69,166 2,163

Deferred charges (Note 2) 52,125 69,773 2,181

Deferred income tax assets (Notes 2 and 22) 821,144 1,066,101 33,326

Restricted assets (Notes 2 and 26) - 63,900 1,997

Other (Notes 2, 11 and 18) 117,138 1,980,823 61,920

Total other assets 1,417,830 3,297,898 103,092

TOTAL $ 115,226,362 $ 119,143,448 $ $3,724,397

The accompanying notes are an integral part of the financial statements.

(With Deloitte & Touche audit report dated January 18, 2010)

)LQDQFLDO,QIRUPDWLRQ