HTC 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

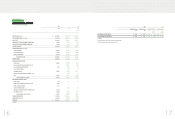

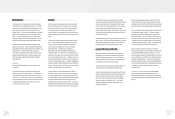

Based on the Statement of Financial Accounting Standards No. 18 -

“Accounting for Pensions,” issued by the Accounting Research and

Development Foundation of the ROC, pension cost under a defined

benefit pension plan should be calculated by the actuarial method.

Related disclosure is as follows:

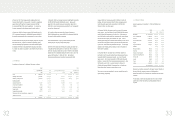

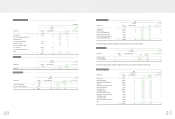

The Company’s net pension costs under the defined benefit plan in

2008 and 2009 were as follows:

2008 2009

NT$ NT$ US$(Note 3)

Service cost $ 5,194 $ 5,255 $ 164

Interest cost 8,699 9,351 293

Projected return on plan assets ( 9,967 ) ( 11,076 ) ( 346 )

Amortization of unrecognized net

transition obligation, net - --

Amortization of net pension

benefit 1,487 1,349 42

Net pension cost $ 5,413 $ 4,879 $ 153

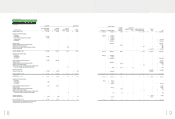

The reconciliations between pension fund status and prepaid pension

cost as of December 31, 2008 and 2009 were as follows:

2008 2009

NT$ NT$ US$(Note 3)

Present actuarial value of

benefit obligation

Vested benefit obligation $ - $ 1,334 $ 42

Non-vested benefit

obligation 163,438 177,557 5,550

Accumulated benefit

obligation 163,438 178,891 5,592

Additional benefits on

future salaries 176,609 148,040 4,628

Projected benefit obligation 340,047 326,931 10,220

Fair value of plan assets ( 388,641 ) ( 416,688 ) ( 13,025 )

Funded status ( 48,594 ) ( 89,757 ) ( 2,805 )

Unrecognized pension loss ( 68,544 ) ( 47,896 ) ( 1,498 )

Prepaid pension cost $ ( 117,138 ) $ ( 137,653 ) $ ( 4,303 )

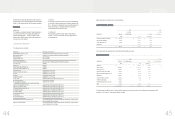

Assumptions used in actuarially determining the present value of the

projected benefit obligation were as follows:

2008 2009

Weighted-average discount rate 2.75% 2.00%

Assumed rate of increase in future compensation 4.00% 3.50%

Expected long-term rate of return on plan assets 2.75% 2.00%

The vested benefits as of December 31, 2008 and 2009 amounted to

NT$0 thousand and NT$1,511 thousand (US$47 thousand),

respectively.

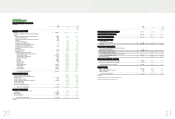

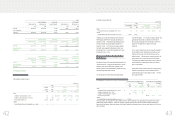

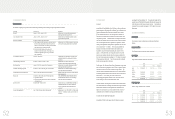

19. STOCKHOLDERS’ EQUITY

Capital Stock

The Company’s outstanding common stock as of January 1, 2008

amounted to NT$5,731,337 thousand, divided into 573,134 thousand

common shares at NT$10.00 par value. In June 2008, the

stockholders approved the transfer of retained earnings amounting to

NT$1,719,401 thousand and employee bonuses amounting to

NT$103,200 thousand to capital stock. As a result, the amount of the

Company’s outstanding common stock as of December 31, 2008

increased to NT$7,553,938 thousand, divided into 755,394 thousand

common shares at NT$10.00 par value.

In January and November 2009, the Company retired 10,000 thousand

treasury shares at NT$100,000 thousand (US$3,126 thousand) and

7,085 thousand treasury shares at NT$70,850 thousand (US$2,214

thousand), respectively. Also, in June 2009, the stockholders

approved the transfer of retained earnings amounting to NT$372,697

thousand (US$11,650 thousand) and employee bonuses amounting to

NT$133,573 thousand (US$4,175 thousand) to capital stock. As a

result, the amount of the Company’s outstanding common stock as of

December 31, 2009 increased to NT$7,889,358 thousand

(US$246,620 thousand), divided into 788,936 thousand common

shares at NT$10.00 (US$0.31) par value.

)LQDQFLDO,QIRUPDWLRQ

In September 2009, the Company’s board of directors resolved to

donate to the HTC Education Foundation NT$300,000 thousand

(US$9,378 thousand), consisting of (a) the second and third floors of

Taipei’s R&D headquarters, with these two floors to be built at an

estimated cost of NT$217,800 thousand (US$6,808 thousand), and (b)

cash of NT$82,200 thousand (US$2,570 thousand). This donation

excludes the land, of which the ownership remains with the Company.

The difference between the estimated building donation and the actual

construction cost will be treated as an adjustment in the year when

the completed floors are actually turned over to the HTC Education

Foundation.

Services fees accrued were mainly from authorizing related parties to

do marketing activities and research and design and provide

consulting services.

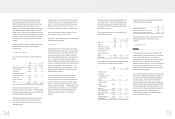

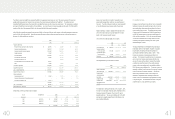

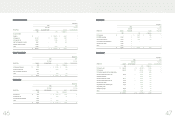

17. OTHER CURRENT LIABILITIES

Other current liabilities as of December 31, 2008 and 2009 were as

follows:

2008 2009

NT$ NT$ US$(Note 3)

Reserve for warranty expenses $ 5,225,862 $ 5,287,562 $ 165,288

Other payables (Note 25) 634,417 905,908 28,318

Agency receipts 255,853 576,891 18,033

Deferred credits - profit from

intercompany transactions 134,091 108,150 3,381

Advance receipts 120,504 195,678 6,117

Directors’ remuneration 21,842 --

Others 16,207 195,773 6,120

$ 6,408,776 $ 7,269,962 $ 227,257

The Company provides warranty service for one to two years

depending on the contract with our customers. The warranty liability

is estimated based on management’s evaluation of the products under

warranty and recognized as warranty liability.

Other payables were payables for investments accounted for by the

equity method, miscellaneous expenses of overseas sales offices,

repair materials and contingent loss of purchase orders which was

recognized as other loss.

In December 2008, the Company also estimated a contingent liability

of NT$125,663 thousand due to an increased financial risk from the

customer. If the customer cannot pay its payments, the upstream

firms might dun the Company for the customer’s liabilities. The

Company is still negotiating with the customer to resolve this issue.

Agency receipts were primarily employees’ income tax, insurance,

royalties, overseas value-added tax, and other items.

Deferred credits - gains on intercompany transactions were unrealized

profit from intercompany transactions.

18. PENSION PLAN

The Labor Pension Act (the “Act), which provides for a new defined

contribution plan, took effect on July 1, 2005. Employees covered by

the Labor Standards Law (the “Law”) before the enforcement of the

Act were allowed to choose to remain to be subject to the defined

benefit pension mechanism under the Law or to be subject instead to

the Act. Based on the Act, the rate of the Company’s required

monthly contributions to the employees’ individual pension accounts is

at least 6% of monthly wages and salaries, and these contributions are

recognized as pension expense in the income statement. The

pension fund contributions for the years ended December 31, 2008

and 2009 were NT$158,050 thousand and NT$182,271 thousand

(US$5,698 thousand), respectively.

Under the Law, which provides for a defined benefit pension plan,

retirement payments should be made according to the years of

service, with a payment of two units for each year of service but only

one unit per year after the 15th year; however, total units should not

exceed 45. The rate of the Company’s contributions to a pension

fund was 2% after the Act took effect. The pension fund is deposited

in the Bank of Taiwan in the committee’s name. The pension fund

balances were NT$388,641 thousand and NT$416,688 thousand

(US$13,025 thousand) as of December 31, 2008 and 2009,

respectively.

)LQDQFLDO,QIRUPDWLRQ