HTC 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

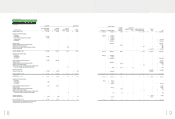

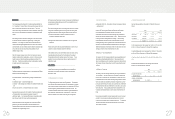

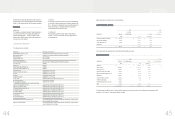

Under the Statute for Upgrading Industries, the Company was granted exemption from corporate income tax as follows:

Item Exempt from Corporate Income Tax Exemption Period

Sales of pocket PCs, pocket PCs (wireless) and Smartphones 2004.09.15-2009.09.14

Sales of pocket PCs (wireless) and Smartphones 2004.11.30-2009.11.29

Sales of pocket PCs (wireless) and Smartphones 2005.12.20-2010.12.19

Sales of wireless or smartphone which has 3G or GPS function 2006.12.20-2011.12.19

Sales of wireless or smartphone which has 3G or GPS function 2007.12.20-2012.12.19

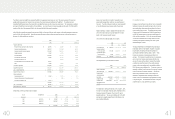

Income taxes payable as of December 31, 2008 and 2009 were computed as follows:

2008 2009

NT$ NT$ US$(Note 3)

Income before income tax $ 31,590,479 $ 25,212,464 $ 788,136

Permanent differences

Loss (gain) on equity-method investments 57,289 ( 273,811 ) ( 8,559 )

Impairment loss - 30,944 967

Other 372,219 82,485 2,579

Temporary differences

Realized pension cost ( 21,951 )( 20,515 ) ( 641 )

Unrealized loss on decline in value of inventory 706,938 1,502,036 46,953

Unrealized royalties 2,104,308 2,312,014 72,273

Unrealized exchange losses, net 6,928 942,915 29,475

Unrealized bad debt expenses 180,011 503,089 15,727

Capitalized expense 74,251 ( 29,095 ) ( 910 )

Unrealized warranty expense 1,755,905 61,700 1,929

Unrealized marketing expenses 2,867,307 3,037,905 94,964

Unrealized valuation loss (gain) on financial instruments 417,827 ( 532,215 ) ( 16,637 )

Realized profit from intercompany transactions ( 40,984 )( 25,941 ) ( 811 )

Other ( 74,922 )196,431 6,140

Total income 39,995,605 33,000,406 1,031,585

Less: Tax-exempt income ( 31,976,991 )( 26,204,796) ) ( 819,156 )

Taxable income 8,018,614 6,795,610 212,429

Tax rate 25% 25% 25%

2,004,654 1,698,903 53,107

Income tax credit ( 10 )(10) -

Estimated income tax provision 2,004,644 1,698,893 53,107

Unappropriated earnings (additional 10% income tax) 352,583 202,145 6,319

Less: Investment research and development tax credits ( 352,583 )( 202,145 ) ( 6,319 )

Income tax payable determined pursuant to the Income Tax Law $ 2,004,644 $ 1,698,893 $ 53,107

Alternative minimum tax $ 3,396,417 $ 3,211,563 $ 100,393

Less: Prepaid and withheld income tax ( 438,747 )( 39,014 ) ( 1,220 )

Prior years¶ income tax payable 980,075 980,075 30,637

Income tax payable $ 3,937,745 $ 4,152,624 $ 129,810

)LQDQFLDO,QIRUPDWLRQ

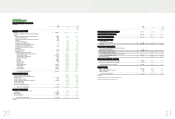

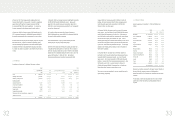

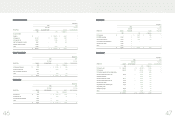

20. TREASURY STOCK

On October 7, 2008, the Company’s board of directors passed a

resolution to buy back 10,000 thousand Company shares from the open

market. The repurchase period was between October 8, 2008 and

December 7, 2008, and the repurchase price ranged from NT$400 to

NT$500 per share. If the Company’s share price was lower than this

price range, the Company might continue to buy back its shares. The

Company bought back 10,000 thousand shares for NT$3,410,277

thousand during the repurchase period and retired them in January

2009.

On July 31, 2009, the Company’s board of directors passed a resolution

to buy back 13,000 thousand Company shares from the open market.

The repurchase period was between August 3, 2009 and October 2,

2009, and the repurchase price ranged from NT$300 to NT$500 per

share. If the Company’s share price was lower than this price range,

the Company might continue to buy back its shares. The Company

bought back 7,085 thousand shares for NT$2,406,930 thousand

(US$75,240 thousand) during the repurchase period and retired them in

November 2009.

(In Thousands of Shares)

Purpose

As of

January

1, 2009 Increase Decrease

As of

December

31, 2009

For maintaining the

Company’s credit and

stockholders’ equity 10,000 7,085 17,085 -

Based on the Securities and Exchange Act of the ROC, the number of

reacquired shares should not exceed 10% of the Company’s issued and

outstanding stocks, and the total purchase amount should not exceed

the sum of the retained earnings, additional paid-in capital in excess of

par, and realized capital reserve. In addition, the Company should not

pledge its treasury shares nor exercise voting rights on the shares

before their reissuance.

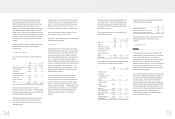

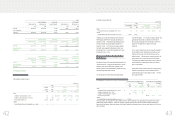

21. PERSONNEL EXPENSES, DEPRECIATION AND AMORTIZATION

Function

2008 2009

NT$ NT$ US$(Note 3)

Expense Item

Operating

Costs

Operating

Expenses Total

Operating

Costs

Operating

Expenses Total

Operating

Costs

Operating

Expenses Total

Personnel expenses $2,960,403 $8,421,017 $11,381,420 $2,498,640 $6,743,119 $9,241,759 $78,108 $210,788 $288,896

Salary 2,602,602 7,961,251 10,563,853 2,110,277 6,209,064 8,319,341 65,967 194,094 260,061

Insurance 123,335 147,065 270,400 150,925 178,655 329,580 4,718 5,584 10,302

Pension cost 48,583 114,880 163,463 57,183 129,967 187,150 1,788 4,063 5,851

Other 185,883 197,821 383,704 180,255 225,433 405,688 5,635 7,047 12,682

Depreciation 271,168 294,434 565,602 294,601 335,536 630,137 9,209 10,489 19,698

Amortization - 35,983 35,983 11,357 28,490 39,847 355 891 1,246

22. INCOME TAX

The Company’s income tax returns through 2003 had been examined by the tax authorities. However, the Company disagreed with the tax authorities’

assessment on its returns for 2001 to 2003 and applied for the administrative litigation of its returns. Nevertheless, under the conservatism guideline, the

Company adjusted its income tax for the tax shortfall stated in the tax assessment notices.

)LQDQFLDO,QIRUPDWLRQ