HTC 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

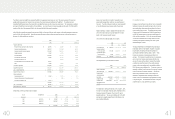

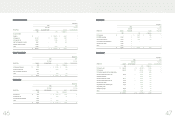

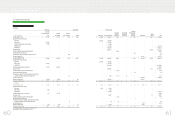

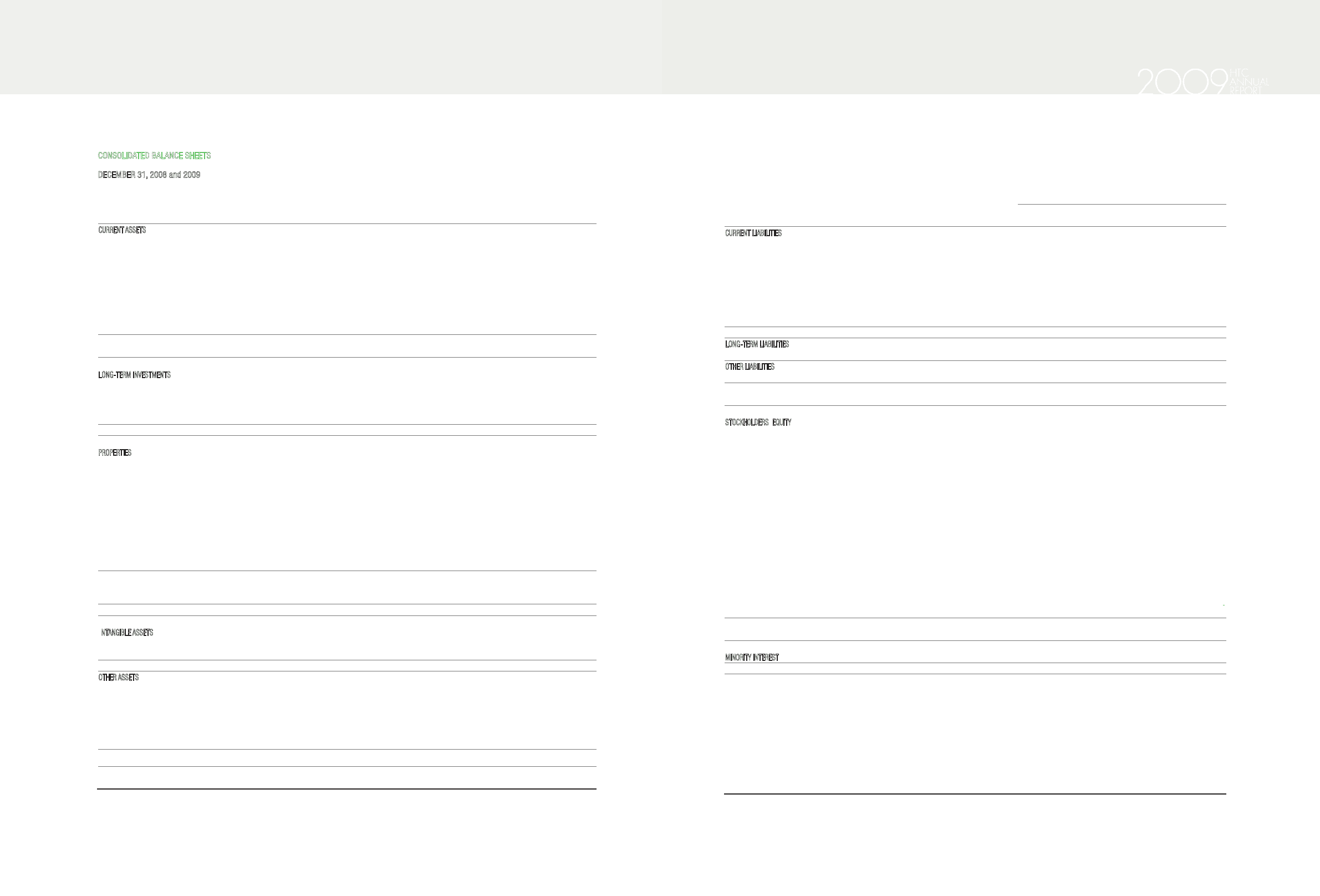

2008 2009

LIABILITIES AND STOCKHOLDERS

¶

EQUITY NT$ NT$ US$

(Note 3)

CURRENT LIABILITIES

Short-term borrowings (Note 16) $ 75,000 $ 72,326 $ 2,261

Financial liabilities at fair value through profit or loss (Notes 2, 6 and 26) 514,083 --

Notes and accounts payable (Note 27) 28,569,935 25,152,521 786,262

Income tax payable (Notes 2 and 24) 4,039,613 4,270,962 133,509

Accrued expenses (Notes 4, 17 and 27) 15,348,770 16,963,888 530,287

Payable for purchase of equipment 314,086 153,551 4,800

Long-term liabilities - current portion (Note 19) 28,750 22,500 703

Other current liabilities (Notes 18 and 27) 6,108,696 6,614,533 206,769

Total current liabilities 54,998,933 53,250,281 1,664,591

LONG-TERM LIABILITIES

Long-term bank loans, net of current portion (Note 19) 46,875 24,375 762

OTHER LIABILITIES

Guarantee deposits received 6,420 1,210 38

Total liabilities 55,052,228 53,275,866 1,665,391

STOCKHOLDERS

¶

EQUITY

(Note 21)

Capital stock - NT$10.00 par value

Authorized: 1,000,000 thousand shares

Issued and outstanding: 755,394 thousand shares in 2008 and

ġ

788,936 thousand shares in 2009

Common stock 7,553,938 7,889,358 246,620

Capital surplus

Additional paid-in capital from share issuance in excess of par 4,374,244 9,056,323 283,099

Long-term equity investments 17,534 18,411 576

Merger 25,756 25,189 787

Retained earnings

Legal reserve 7,410,139 10,273,674 321,152

Accumulated earnings 44,626,182 38,364,099 1,199,253

Cumulative translation adjustments (Note 2) 65,602 15,088 471

Net loss not recognized as pension cost - (34)(1)

Unrealized valuation losses on financial instruments

ġ

(Notes 2 and 7) ( 1,632 ) ( 1,658 ) ( 52 )

Treasury stock (Notes 2 and 22) ( 3,410,277 ) --

Equity attributable to stockholders of the parent 60,661,486 65,640,450 2,051,905

MINORITY INTEREST

28,696 34,207 1,070

Total stockholders' equity 60,690,182 65,674,657 2,052,975

TOTAL $ 115,742,410 $ 118,950,523 $ 3,718,366

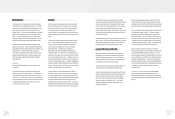

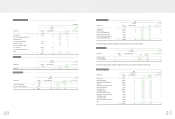

)LQDQFLDO,QIRUPDWLRQ

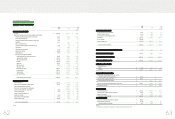

HTC CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

DECEMBER 31, 2008 and 2009

(In Thousands, Except Par Value)

2008 2009

ASSETS NT$ NT$ US$

(Note 3)

CURRENT ASSETS

Cash and cash equivalents (Notes 2 and 5) $ 64,237,728 $ 64,638,290 $ 2,020,578

Financial assets at fair value through profit or loss (Notes 2, 6 and 26) - 18,132 567

Available-for-sale financial assets - current (Notes 2 and 7) - 2,497,394 78,068

Notes and accounts receivable, net (Notes 2, 8 and 27) 29,454,778 27,125,609 847,940

Other current financial assets (Notes 9 and 27) 316,524 258,474 8,080

Inventories (Notes 2, 4 and 10) 8,250,337 5,557,713 173,733

Prepayments (Note 11) 1,285,483 3,341,649 104,459

Deferred income tax assets (Notes 2 and 24) 550,530 812,254 25,391

Other current assets 161,320 172,872 5,404

Total current assets 104,256,700 104,422,387 3,264,220

LONG-TERM INVESTMENTS

Available-for-sale financial assets - noncurrent (Notes 2 and 7) 339 313 10

Financial assets carried at cost (Notes 2 and 12) 501,192 565,172 17,667

Investments accounted for by the equity method (Notes 2 and 14) 39,906 --

Prepayments for long-term investments (Notes 2 and 14) - 245,000 7,659

Total long-term investments 541,437 810,485 25,336

PROPERTIES

(Notes 2, 15 and 27)

Cost

Land 3,568,124 4,719,538 147,532

Buildings and structures 2,856,815 4,218,443 131,867

Machinery and equipment 4,579,241 4,702,420 146,997

Molding equipment 194,320 199,392 6,233

Computer equipment 350,118 411,504 12,863

Transportation equipment 4,605 4,575 143

Furniture and fixtures 462,157 462,664 14,463

Leased assets 5,336 6,327 198

Leasehold improvements 188,182 199,416 6,234

Total cost 12,208,898 14,924,279 466,530

Less: Accumulated depreciation ( 4,243,837 ) ( 5,055,135 ) ( 158,022 )

Prepayments for construction-in-progress and equipment-in-transit 951,289 30,664 958

Properties, net 8,916,350 9,899,808 309,466

,

NTANGIBLE ASSETS

Goodwill (Note 2) 289,308 239,992 7,502

Deferred pension cost 475 490 15

Total intangible assets 289,783 240,482 7,517

OTHER ASSETS

Assets leased to others 309,959 48,135 1,505

Refundable deposits 193,765 128,655 4,021

Deferred charges (Note 2) 253,121 245,996 7,690

Deferred income tax assets (Notes 2 and 22) 822,893 1,067,691 33,376

Restricted assets (Notes 2 and 26) 41,465 106,252 3,321

Other (Notes 2, 11 and 18) 116,937 1,980,632 61,914

Total other assets 1,738,140 3,577,361 111,827

TOTAL $ 115,742,410 $ 118,950,523

$ 3,718,366

The accompanying notes are an integral part of the financial statements.

(With Deloitte & Touche audit report dated January 18, 2010)

)LQDQFLDO,QIRUPDWLRQ