HTC 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

These unquoted equity instruments were not carried at fair value

because their fair value could not be reliably measured; thus, the

Company accounted for these investments by the cost method.

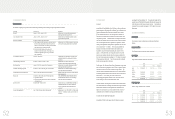

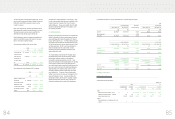

13. BOND INVESTMENTS NOT QUOTED IN AN ACTIVE MARKET

A bond investment not quoted in an active market as of December

31, 2008 and 2009 was as follows:

2008 2009

NT$ NT$ US$(Note 3)

Bond investment $ - $- $ -

Less: Current portion - --

$-$- $ -

The Company bought a 12-month bond issued by Vitamin D Inc.

with 6% annual interest for NT$33,030 thousand (US$1,000

thousand). The unquoted debt instrument was not carried at fair

value because its fair value could not be reliably measured.

In April 2008, the Company made a new investment of US$350

thousand and transferred its bond investment of US$1,000

thousand to convertible preferred stocks issued by Vitamin D Inc.

As a result, the Company acquired 27% equity interest in Vitamin D

Inc. and can exercise significant influence over this investee. The

Company accounts for this investment by the equity method.

14. INVESTMENTS ACCOUNTED FOR BY THE EQUITY METHOD

The investment accounted for by the equity method as of December 31, 2008 and 2009 was as follows:

2008 2009

Carrying Value

Ownership

Percentage Original Cost Carrying Value

Ownership

Percentage

NT$ NT$ US$ (Note 3) NT$ US$ (Note 3)

Equity method

Vitamin D Inc. $ 39,906 26.02 $ 40,986 $ 1,281 $ - $ - 25.59

Prepayment of long-term investment - 245,000 7,659 245,000 7,659

$ 39,906 $ 285,986 $ 8,940 $ 245,000 $ 7,659

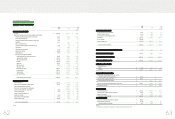

In April 2008, the Company made a new investment of US$350

thousand and transferred its bond investment of US$1,000

thousand to convertible preferred stocks issued by Vitamin D Inc.

As a result, the Company acquired 27.27% equity interest in Vitamin

D Inc. for NT$40,986 thousand, enabling the Company to exercise

significant influence over this investee. Thus, the Company

accounts for this investment by the equity method. In September

2008, January 2009 and June 2009, Vitamin D Inc. issued new

convertible preferred shares, but the Company did not buy any of

these shares. The Company’s ownership percentage thus declined

from 27.27% to 25.59%, and there was a capital surplus -

long-term equity investments of NT$1,689 thousand, NT$187

thousand (US$6 thousand)

and NT$484 thousand (US$15 thousand) in September 2008,

January 2009 and June 2009, respectively. In addition, the

Company determined that the recoverable amount of this

investment in 2009 was less than its carrying amount and thus

recognized an impairment loss of NT$30,944 thousand (US$967

thousand).

In December 2009, the Company invested in Huada Digital

Corporation for NT$245,000 thousand (US$7,659 thousand).

Because the registration of the investment was not completed on

December 31, 2009, the investment was temporarily accounted for

as “prepayments for long-term investments.”

)LQDQFLDO,QIRUPDWLRQ

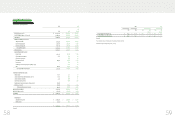

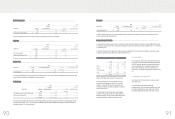

10. INVENTORIES

Inventories as of December 31, 2008 and 2009 were as follows:

2008 2009

NT$ NT$ US$(Note 3)

Finished goods $ 1,666,089 $ 1,518,702 $ 47,474

Work-in-process 2,472,925 1,832,625 57,287

Raw materials 6,019,910 4,805,209 150,210

Inventory in transit - 650,222 20,326

10,158,924 8,806,758 275,297

Less: Valuation

allowance (1,908,587 )( 3,249,045 ) ( 101,564 )

$ 8,250,337 $ 5,557,713 $ 173,733

The write-down of inventories to their net realizable value amounted

to NT$1,258,148 and NT$1,853,579 thousand (US$57,942 thousand)

and was recognized as cost of sales for the years ended December

31, 2008 and 2009, respectively.

11. PREPAYMENTS

Prepayments as of December 31, 2008 and 2009 were as follows:

2008 2009

NT$ NT$ US$(Note 3)

Royalty $ 976,824 $ 3,044,563 $ 95,173

Software and

hardware

maintenance 88,554

85,797 2,682

Marketing 1,234 41,707 1,304

Molding equipment 80,420 37,052 1,158

Export 6,420 21,219 663

Rent 8,885 15,318 479

Net input VAT 35,517 15,301 478

Materials purchases 16,440 13,084 409

Service 27,322 3,294 103

Others 43,867 64,314 2,010

$ 1,285,483 $ 3,341,649 $ 104,459

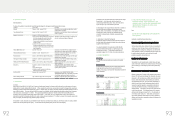

Prepayments for royalty were primarily for discount purposes and

were classified as current or noncurrent on the basis of their

maturities. As of December 31, 2009, noncurrent prepayments of

NT$1,843,170 thousand (US$57,617 thousand) had been classified as

other assets (Note 30 has more information).

Prepayments for others were primarily travel and insurance expenses.

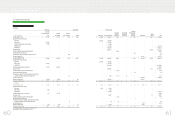

12. FINANCIAL ASSETS CARRIED AT COST

Financial assets carried at cost as of December 31, 2008 and 2009

were as follows:

2008 2009

NT$ NT$

US$ (Note

3)

Hua-Chuang Automobile

Information Technical

Center Co., Ltd. $ 500,000 $ 500,000 $ 15,630

Melodis

Corporation. -

63,980 2,000

Answer Online, Inc. 1,192 1,192 37

$ 501,192 $ 565,172 $ 17,667

In January 2007, the Company acquired 10% equity interest in

Hua-Chuang Automobile Information Technical Center Co., Ltd. for

NT$500,000 thousand. The Company also signed a joint venture

agreement with Yulon Group, the main stockholder of Hua-Chuang.

Under the agreement, the Company and Yulon Group may, between

January 1, 2010 and December 31, 2011, submit written requests to

each other for Yulon Group to buy back NT$300,000 thousand at

original price, some of Hua-Chuang’s shares bought by the Company.

The buy-back proposed by Yulon Group becomes effective with a

consensus from the Company.

In March 2004, the Company merged with IA Style, Inc. and acquired

1.82% equity interest in Answer Online, Inc for NT$1,192 thousand as

a result of the merger.

In July 2009, the Company acquired 4.37% equity interest in Melodis

Corporation for NT$63,980 thousand (US$2,000 thousand).

)LQDQFLDO,QIRUPDWLRQ