HTC 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8584

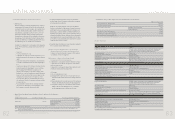

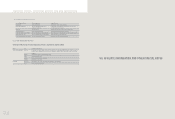

CAPITAL AND SHARES

II. ISSUANCE OF CORPORATE BONDS

None

III. STATUS OF PREFERRED SHARES

None

IV. GLOBAL DEPOSITORY RECEIPTS

03/31/2010

Issuing Date 11/19/2003

Issuance & Listing Luxembourg

Total amount USD 105,182,100.60

Offering price per GDR USD 15.4235

Units issued 8,492,962 (note)

Underlying securities Cash offering and HTC common shares from selling shareholders

Common shares represented 33,971,855 (note)

Rights & obligations of GDR holders Same as those of common share holders

Trustee Not applicable

Depositary bank Citibank, N.A. - New York

Custodian bank Citibank Taiwan Limited

GDRs outstanding 5,104,355

Apportionment of expenses for the issuance & maintenance All fees and expenses such as underwriting fees, legal fees, listing fees and other expenses related to

issuance of GDRS were borne by HTC and the selling shareholders, while maintenance expenses such as

annual listing fees and accountant fees were borne by HTC.

Terms & conditions in the deposit agreement & custody agreement See deposit agreement and custody agreement for details

Closing price per GDR 2009 High USD 66.63

Low USD 37.32

Average USD 47.25

Closing price per GDR 01/01/2010 ~ 03/31/2010 High USD 47.69

Low USD 34.59

Average USD 42.57

Note: The total number of units issued includes additional issuance on 18 August 2004, 12 August 2005, 1 August 2006, 20 August 2007, 21 July 2008 and 9 August 2009 of dividends on the common shares repre-

sented by overseas depositary receipts, in respective amounts of 216,088 units (representing 864,352 common shares), 70,290 units (representing 281,161 common shares), 218,776 units (representing 875,107

common shares), 508,556 units (representing 2,034,224 common shares), 488,656 units (representing 1,954,626 common shares) and 170,996 units (representing 683,985 common shares).

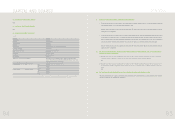

V. STATUS OF EMPLOYEE SHARE SUBSCRIPTION WARRANTS

1. The annual report shall disclose unexpired employee subscription warrants issued by the company in existence as of the date of printing of the annual

report, and shall explain the effect of such warrants upon shareholders' equity:

During the current fiscal year up to the date of printing of the annual report, HTC did not have unexpired employee subscription warrants issued by the

company; therefore it is inapplicable.

2. The annual report shall disclose the names of top-level company executives holding employee share subscription warrants and the cumulative number

of such warrants exercised by said executives as of the date of printing of the annual report. The annual report shall also disclose the names of the ten

employees holding employee subscription warrants authorizing purchase of the most shares where the purchase price of such shares is NT$30 million

or greater, along with the cumulative number of warrants exercised by these ten employees, as of the date of printing of the annual report:

During the current fiscal year up to the date of printing of the annual report, HTC did not have unexpired employee subscription warrants issued by the

company; therefore it is inapplicable.

VI. THE SECTION ON MERGERS, ACQUISITIONS, AND ISSUANCE OF NEW SHARES DUE TO ACQUISITION OF

SHARES OF OTHER COMPANIES

(1) During the most recent fiscal year or during the current fiscal year up to the date of printing of the annual report, the company has

completed a merger, acquisition, or issuance of new shares due to acquisition of shares of other companies:

None

(2) During the most recent fiscal year or during the current fiscal year up to the date of printing of the annual report, the board of direc-

tors has adopted a resolution approving a merger, acquisition, or issuance of new shares due to acquisition of shares of other com-

panies:

None

VII. THE SECTION ON IMPLEMENTATION OF THE COMPANY'S FUNDS UTILIZATION PLANS

HTC did not implementation of the company's funds utilization plans or planned that were completed but have not yet fully yielded the benefits, during the

current fiscal year up to the date of printing of the annual report.