HTC 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8180

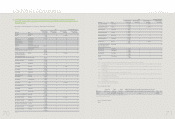

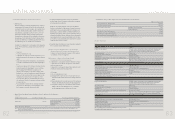

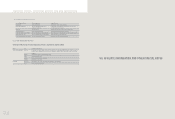

CAPITAL AND SHARES

I. CAPITAL AND SHARES

(I) Capitalization:

04/30/2010 Unit: Share; NT$

Remark

Authorized Paid-in Capital increase by

Month/Year Price Shares Amount Shares Amount Sources of capital assets other than cash Other

1998.03 10 19,500,000 195,000,000 19,500,000 195,000,000

Cash offering None

-

1998.10 10 200,000,000 2,000,000,000 100,000,000 1,000,000,000

Cash offering None Note

1

2000.08 40 200,000,000 2,000,000,000 125,000,000 1,250,000,000

Cash offering None Note

2

2001.04 163.5 200,000,000 2,000,000,000 127,600,000 1,276,000,000

Cash offering None Note

3

2002.06 10 200,000,000 2,000,000,000 162,720,000 1,627,200,000

Capitalization of profits None Note

4

2003.09 10 270,000,000 2,700,000,000 202,764,000 2,027,640,000

Capitalization of profits None Note

5

2003.11 131.1 270,000,000 2,700,000,000 217,164,000 2,171,640,000

Cash offering None Note

6

2004.03 10 270,000,000 2,700,000,000 218,731,347 2,187,313,470

Merger offering None Note

7

2004.08 10 450,000,000 4,500,000,000 271,427,616 2,714,276,160

Capitalization of profits None Note

8

2005.01 127.95 450,000,000 4,500,000,000 276,311,395 2,763,113,950

Conversion of ECB None Note

9

2005.04 127.95 450,000,000 4,500,000,000 288,763,321 2,887,633,210

Conversion of ECB None Note

9

2005.09 10 450,000,000 4,500,000,000 357,015,985 3,570,159,850

Capitalization of profits None Note

10

2006.08 10 550,000,000 5,500,000,000 436,419,182 4,364,191,820

Capitalization of profits None Note

11

2007.04 10 550,000,000 5,500,000,000 432,795,182 4,327,951,820

Capital reduction : Cancel None Note

12

lation of Treasury Shares

2007.09 10 650,000,000 6,500,000,000 573,133,736 5,731,337,360

Capitalization of profits None Note

13

2008.08 10 1,000,000,000 10,000,000,000 755,393,856 7,553,938,560

Capitalization of profits None Note

14

2009.02 10 1,000,000,000 10,000,000,000 745,393,856 7,453,938,560

Capital reduction : Cancel None Note

15

lation of Treasury Shares

2009.08 10 1,000,000,000 10,000,000,000 796,020,844 7,960,208,440

Capitalization of profits None Note

16

2009.11 10 1,000,000,000 10,000,000,000 788,935,844 7,889,358,440

Capital reduction : Cancel None Note

17

lation of Treasury Shares

2010.04 10 1,000,000,000 10,000,000,000 773,935,844 7,739,358,440

Capital reduction : Cancel None Note

18

lation of Treasury Shares

Note 1: Approval Document No. : The 23 July 1998 Letter No. Taiwan-Finance-Securities-I-59976 of the Securities and Futures Commission (SFC), Ministry of Finance.

Note 2: Approval Document No. : The 21 July 2000 Letter No. Taiwan-Finance-Securities-I-59899 of the Securities and Futures Commission (SFC), Ministry of Finance

Note 3: Approval Document No. : The 13 April 2001 Letter No. Taiwan-Finance-Securities-I-118901 of the Securities and Futures Commission (SFC), Ministry of Finance

Note 4: Approval Document No. : The 30 April 2002 Letter No. Taiwan-Finance-Securities-I-119837 of the Securities and Futures Commission (SFC), Ministry of Finance

Note 5: Approval Document No. : The 28 July 2003 Letter No. Taiwan-Finance-Securities-I-0920133959 of the Securities and Futures Commission (SFC), Ministry of Finance

Note 6: Approval Document No. : The 06 November 2003 Letter No.Taiwan-Finance-Securities-I-0920146220 of the Securities and Futures Commission (SFC), Ministry of Finance

Note 7: Approval Document No. : The 16 January 2004 Letter No. Taiwan-Finance-Securities-I-0920162653 of the Securities and Futures Commission (SFC), Ministry of Finance

Note 8: Approval Document No. : The 09 July 2004 Letter No. Finance-Supervisory-Securities-I-0930130457 of the Securities and Futures Bureau of the Financial Supervisory Commission Executive Yuan

Note 9: Approval Document No. : The 14 January 2003 Letter No. Taiwan-Finance-Securities-I-09100169047 of the Securities and Futures Commission (SFC), Ministry of Finance

Note 10: Approval Document No. : The 12 July 2005 Letter No. Financial-Supervisory-Securities-I-0940128133 of the Securities and Futures Bureau of the Financial Supervisory Commission Executive Yuan

Note 11: Approval Document No. : The 06 July 2006 Letter No. Financial-Supervisory-Securities-I-0950128723 of the Securities and Futures Bureau of the Financial Supervisory Commission Executive Yuan

Note 12: Approval Document No. : The 25 January 2007 Letter No. Financial-Supervisory-Securities-III0960004848 of the Securities and Futures Bureau of the Financial Supervisory Commission Executive Yuan

Note 13: Approval Document No. : The 12 July 2007 Letter No. Financial-Supervisory-Securities-I-0960036213 of the Securities and Futures Bureau of the Financial Supervisory Commission Executive Yuan

Note 14: Approval Document No. : The 25 June 2008 Letter No. Financial-Supervisory-Securities-I-0970031749 of the Securities and Futures Bureau of the Financial Supervisory Commission Executive Yuan

Note 15: Approval Document No. : The 16 December 2008 Letter No. Financial-Supervisory-Securities-III0970068202 of the Securities and Futures Bureau of the Financial Supervisory Commission Executive Yuan

Note 16: Approval Document No. : The 9 July 2009 Letter No. Financial-Supervisory-Securities-III0980034309 of the Securities and Futures Bureau of the Financial Supervisory Commission Executive Yuan

Note 17: Approval Document No. : The 8 October 2009 Letter No. Financial-Supervisory-Securities-III0980053814 of the Securities and Futures Bureau of the Financial Supervisory Commission Executive Yuan

Note 18: Approval Document No. : The 9 March 2010 Letter No. Financial-Supervisory-Securities-III0990010834 of the Securities and Futures Bureau of the Financial Supervisory Commission Executive Yuan

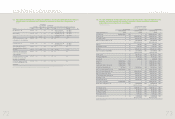

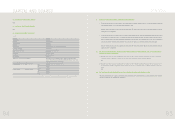

04/30/2010 Unit: Share

Authorized Capital

Type of stock Outstanding shares Unissued Shares Total Remark

Common Stock

773,935,844 226,064,156 1,000,000,000

16,000,000 shares are reserved for the holders of stock warrants, preferred shares with

warrants, or corporate bonds with warrants to exercise their stock warrants.

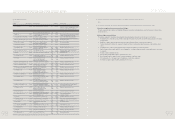

(II) Shareholder Structure:

04/20/2010

Shareholder structure

Government Financial Other Juridical Foreign Institutions & Domestic

Number Agencies Institutions Persons Natural Persons Natural Persons Total

Number of shareholders

224312 1,105 56,379 57,822

Shareholding

396,651 16,374,109 147,290,870 403,500,101 206,374,113 773,935,844

Shareholding

0.05% 2.12% 19.03% 52.13% 26.67% 100.00%

(III) Diffusion of ownership:

Each share having a par value of NT$10 04/20/2010

Shareholder Ownership (Unit: share) Number of Shareholders Ownership Ownership(%)

1~999 13,943 2,803,568 0.36%

1,000~5,000 37.149 65,971,043 8,53%

5,001~10,000 3,459 24,823,436 3.21%

10,001~15,000 1,118 13,659,876 1.76%

15,001~20,000 514 9,133,767 1.18%

20,001~30,000 462 11,326,412 1.46%

30,001~40,000 245 8,598,775 1.11%

40,001~50,000 139 6,310,419 0.82%

50,001~100,000 285 20,431,500 2.64%

100,001~200,000 199 28,496,218 3.68%

200,001~400,000 111 31,685,581 4.09%

400,001~600,000 58 28,502,001 3.68%

600,001~800,000 22 15,124,772 1.95%

800,001~1,000,000 25 22,463,327 2.90%

Over 1,000,001 93 484,605,149 62.63%

Total 57,822 773,935,844 100.00%

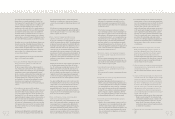

(IV) List of principal shareholders:

04/20/2010

Shares

Name of principal shareholders Current Shareholding Percentage

Way-Chih Investment Co., LTD. 39,745,389 5.14%

Way-Lien Technology Inc. 37,027,602 4.78%

Cher Wang 24,736,896 3.20%

Euro Pacific Growth Fund Special Account under custodial administration of Chase Manhattan Bank 23,818,155 3.08%

Hon-Mou Investment Co., Ltd. 22,168,049 2.86%

HTC Depositary Receipts Special Account under custodial administration of Citibank N.A. 20,594,375 2.66%

Wen-Chi Chen 20,309,651 2.62%

Capital Revenue Founder Company Investment Special Account under custodial administration of Chase Manhattan Bank 18,346,975 2.37%

World Capital Growth and Revenue Fund Company Investment Special Account under custodial administration of Chase Manhattan Bank

14,119,075 1.82%

New Vision Fund Company Investment Special Account under custodial administration of Chase Manhattan Bank 13,377,193 1.73%

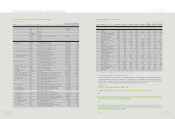

(V) Provide share prices for the past two fiscal years, together with the company's net worth per share, earnings per share, dividends per

share, and related information:

Item 2008 2009 01/01/2010 ~ 03/31/2010

Market price per share Highest market price

888 543 383

Lowest market price

256 308.50 277.50

Average market price

576.90 390.74 342.80

Net worth per share (note) Before distribution

80.30 83.20 83.36

After distribution

53.66 (

note)

(

note)

Earnings per share Weighted average shares (thousand shares)

754,148 788,940 783,430

Earnings per share

37.97 28.71 6.38

Retroactively adjusted earnings per share

36.16 (

note)

(

note)

Dividends per share Cash dividends 27

26 (

note)

-

Stock dividends Dividends from retained earnings

0.05 0.05 (

note)

-

Dividends from capital surplus

---

Accumulated undistributed dividend

---

Return on investment Price/Earnings ration

15.19 13.61 -

Price/Dividend ratio

21.37

15.03

(

note)

-

Cash dividend yield

4.68%

6.65%

(

note)

-

Note : Pending 2010 shareholders' approval