HP 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

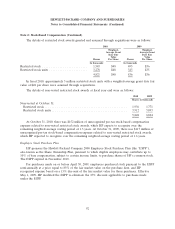

Note 2: Stock-Based Compensation (Continued)

the release of the restrictions. Such awards generally vest one to three years from the date of grant.

During that period, ownership of the shares cannot be transferred. Restricted stock has the same cash

dividend and voting rights as other common stock and is considered to be currently issued and

outstanding. Restricted stock units have dividend equivalent rights equal to the cash dividend paid on

restricted stock. Restricted stock units do not have the voting rights of common stock, and the shares

underlying the restricted stock units are not considered issued and outstanding. However, shares

underlying restricted stock units are included in the calculation of diluted earnings per share (‘‘EPS’’).

HP expenses the fair market value of restricted stock awards, as determined on the date of grant,

ratably over the period during which the restrictions lapse.

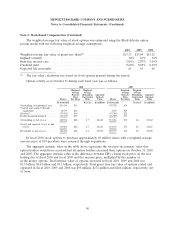

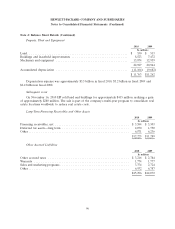

Performance-based Restricted Units

HP estimates the fair value of a target PRU share using the Monte Carlo simulation model, as the

TSR modifier contains a market condition. The following weighted-average assumptions were used to

determine the weighted-average fair values of the PRU awards for fiscal years ended October 31:

2010 2009 2008

Weighted-average fair value of grants per share ..................... $57.13(1) $40.56(2) $40.21(3)

Expected volatility(4) ......................................... 38% 35% 26%

Risk-free interest rate ........................................ 0.73% 1.34% 3.13%

Dividend yield ............................................. 0.64% 0.88% 0.70%

Expected life in months ....................................... 22 30 33

(1) Reflects the weighted-average fair value for the third year of the three-year performance period

applicable to PRUs granted in fiscal 2008, for the second year of the three-year performance

period applicable to PRUs granted in fiscal 2009 and for the first year of the three-year

performance period applicable to PRUs granted in fiscal 2010. The estimated fair value of a target

share for the third year for PRUs granted in fiscal 2009 and for the second and third years for

PRUs granted in fiscal 2010 will be determined on the measurement date applicable to those

PRUs, which will be the date that the annual cash flow goals are approved for those PRUs, and

the expense will be amortized over the remainder of the applicable three-year performance period.

(2) Reflects the weighted-average fair value for the second year of the three-year performance period

applicable to PRUs granted in fiscal 2008 and for the first year of the three-year performance

period applicable to PRUs granted in fiscal 2009.

(3) Reflects the weighted-average fair value for the first year of the three-year performance period

applicable to PRUs granted in fiscal 2008.

(4) HP uses historic volatility for PRU awards as implied volatility cannot be used when simulating

multivariate prices for companies in the S&P 500.

88