HP 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

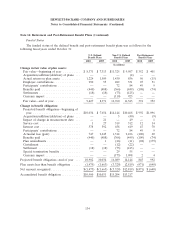

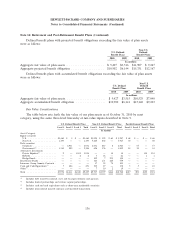

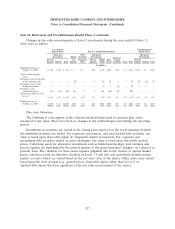

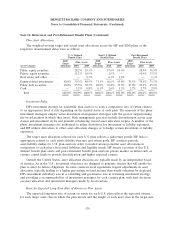

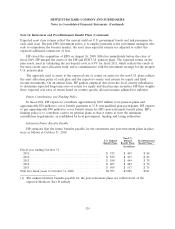

Note 16: Retirement and Post-Retirement Benefit Plans (Continued)

reform legislation is not expected to affect the cost of HP’s retiree welfare programs because the

subsidy offered by HP is fixed.

During fiscal year 2010, HP also announced the elimination of company-paid retiree life insurance

effective January 1, 2011.

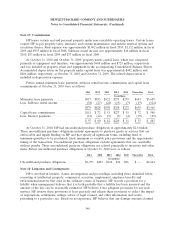

Defined Contribution Plans

HP offers various defined contribution plans for U.S. and non-U.S. employees. Total defined

contribution expense was $535 million in fiscal 2010, $568 million in fiscal 2009 and $548 million in

fiscal 2008. U.S. employees are automatically enrolled in the Hewlett-Packard Company 401(k) Plan

(the ‘‘HP 401(k) Plan’’) when they meet eligibility requirements, unless they decline participation.

Similar to HP, EDS offered participation in defined contribution plans for U.S. and non-U.S.

employees, including an EDS 401(k) Plan.

During fiscal 2008, HP matched employee contributions to the HP 401(k) Plan with cash

contributions up to a maximum of 6% of eligible compensation for U.S. employees hired prior to

August 1, 2008. For U.S. employees hired on or after August 1, 2008 HP matched employee

contributions up to a maximum of 4% of eligible compensation.

The employer match for the EDS 401(k) Plan was 25% of the employee contribution based on a

maximum contribution of 6% of the employee’s salary. Effective January 1, 2009, U.S. employees

participating in the EDS 401(k) Plan became eligible for a 4% matching contribution on eligible

compensation. Similar to the HP 401(k) Plan, contributions are invested at the direction of the

employee in various funds, although the EDS 401(k) Plan does not offer an HP stock fund.

Effective April 1, 2009, HP matching contributions under both the HP 401(k) Plan and the EDS

401(k) Plan were changed to a quarterly, discretionary, performance-based match of up to a maximum

of 4% of eligible compensation for all U.S. employees to be determined each fiscal quarter based on

business results. HP matching contributions may vary from 0% to 100% of the maximum 4% match,

based on such factors as quarterly earnings, market share growth, and performance relative to market

and economic conditions. HP’s matching contributions for each of the quarters in fiscal 2010 were

100% of the maximum 4% match. Effective November 2010, the quarterly employer matching

contributions in the HP 401(k) Plan and the EDS 401(k) Plan will no longer be discretionary, but will

be equal to 100% of an employee’s contributions, up to a maximum of 4% of eligible compensation.

Effective January 31, 2004, HP designated the HP Stock Fund, an investment option under the HP

401(k) Plan, as an Employee Stock Ownership Plan and, as a result, participants in the HP Stock Fund

may receive dividends in cash or may reinvest such dividends into the HP Stock Fund. HP paid

approximately $7 million, $8 million, and $9 million in dividends for the HP common shares held by

the HP Stock Fund in fiscal 2010, 2009, and 2008, respectively. HP records the dividends as a reduction

of retained earnings in the Consolidated Statements of Stockholders’ Equity. The HP Stock Fund held

approximately 22 million shares of HP common stock at October 31, 2010.

131