HP 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

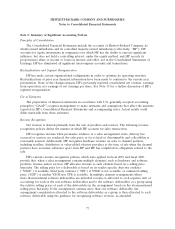

Note 1: Summary of Significant Accounting Policies (Continued)

Stock-Based Compensation

Stock-based compensation expense for all share-based payment awards granted is determined

based on the grant-date fair value. HP recognizes these compensation costs net of an estimated

forfeiture rate, and recognizes compensation cost only for those shares expected to vest on a

straight-line basis over the requisite service period of the award, which is generally the vesting term of

the share-based payment awards. HP estimated the forfeiture rate based on its historical experience for

fiscal grant years where the majority of the vesting terms have been satisfied.

Foreign Currency Transactions

HP uses the U.S. dollar predominately as its functional currency. Assets and liabilities

denominated in non-U.S. dollars are remeasured into U.S. dollars at current exchange rates for

monetary assets and liabilities and historical exchange rates for nonmonetary assets and liabilities. Net

revenue, cost of sales and expenses are remeasured at average exchange rates in effect during each new

reporting period, and net revenue, cost of sales and expenses related to the previously reported periods

are remeasured at historical exchange rates. HP includes gains or losses from foreign currency

remeasurement in net earnings. Certain foreign subsidiaries designate the local currency as their

functional currency, and HP records the translation of their assets and liabilities into U.S. dollars at the

balance sheet dates as translation adjustments and includes them as a component of accumulated other

comprehensive income (loss).

Taxes on Earnings

HP recognizes deferred tax assets and liabilities for the expected tax consequences of temporary

differences between the tax bases of assets and liabilities and their reported amounts using enacted tax

rates in effect for the year the differences are expected to reverse. HP records a valuation allowance to

reduce the deferred tax assets to the amount that is more likely than not to be realized.

Cash and Cash Equivalents

HP classifies investments as cash equivalents if the original maturity of an investment is ninety

days or less. Cash and cash equivalents consist primarily of highly liquid investments in time deposits

held in major banks and commercial paper. As of October 31, 2010 and 2009, the carrying value of

cash and cash equivalents approximates fair value due to the short period of time to maturity.

Investments

HP’s investments consist principally of time deposits, money market funds, commercial paper,

corporate debt, other debt securities, and equity securities of publicly-traded and privately-held

companies.

HP classifies its investments in debt securities and its equity investments in public companies as

available-for-sale securities and carries them at fair value. HP determines fair values for investments in

public companies using quoted market prices and records a charge to Interest and other, net when the

change in fair values is determined to be an other-than-temporary change. HP carries equity

investments in privately-held companies at cost or at fair value when HP recognizes an

other-than-temporary impairment charge.

81