HP 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 14: Taxes on Earnings (Continued)

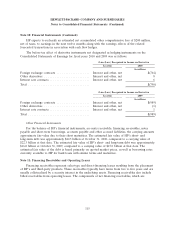

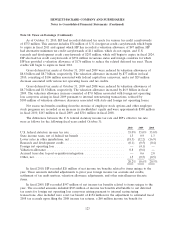

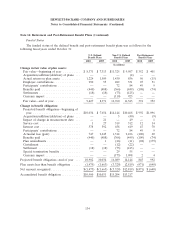

The total amount of gross unrecognized tax benefits was $2.1 billion as of October 31, 2010. A

reconciliation of unrecognized tax benefits is as follows:

Balance at November 1, 2007 ................................................ $2,271

Increases:

For current year’s tax positions ........................................... 101

For prior years’ tax positions ............................................. 739

Decreases:

For prior years’ tax positions ............................................. (751)

Statute of limitations expiration ........................................... (16)

Settlements with taxing authorities ......................................... (11)

Balance at October 31, 2008 ................................................ $2,333

Increases:

For current year’s tax positions ........................................... 115

For prior years’ tax positions ............................................. 626

Decreases:

For prior years’ tax positions ............................................. (762)

Statute of limitations expiration ........................................... (293)

Settlements with taxing authorities ......................................... (131)

Balance at October 31, 2009 ................................................. $1,888

Increases:

For current year’s tax positions ........................................... 27

For prior years’ tax positions ............................................. 347

Decreases:

For prior years’ tax positions ............................................. (120)

Statute of limitations expiration ........................................... (1)

Settlements with taxing authorities ......................................... (56)

Balance at October 31, 2010 ................................................ $2,085

Up to $680 million, $950 million and $1.0 billion of HP’s unrecognized tax benefits at October 31,

2008, 2009 and 2010, respectively, would affect HP’s effective tax rate if realized.

HP recognizes interest income from favorable settlements and income tax receivables and interest

expense and penalties accrued on unrecognized tax benefits within income tax expense. As of

October 31, 2010, HP had accrued a net $181 million payable for interest and penalties. During fiscal

2010, HP recognized net interest expense net of tax on net deficiencies of $66 million.

125