HP 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180

|

|

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

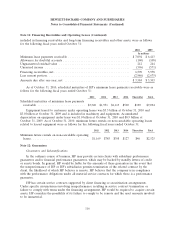

Note 13: Borrowings (Continued)

supported by these credit facilities is subject to a number of factors, including liquidity conditions and

business performance.

Included in Other, including capital lease obligations, are borrowings that are collateralized by

certain financing receivable assets. As of October 31, 2010, the carrying value of the assets

approximated the carrying value of the borrowings of $130 million.

As of October 31, 2010, HP had the capacity to issue an unspecified amount of additional debt

securities, common stock, preferred stock, depositary shares and warrants under the 2009 Shelf

Registration Statement. As of that date, HP also had up to approximately $13.8 billion of available

borrowing resources, including $12.1 billion under its commercial paper programs and approximately

$1.5 billion relating to uncommitted lines of credit.

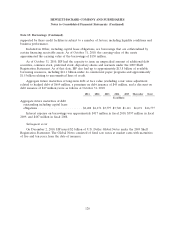

Aggregate future maturities of long-term debt at face value (excluding a fair value adjustment

related to hedged debt of $669 million, a premium on debt issuance of $45 million, and a discount on

debt issuance of $17 million) were as follows at October 31, 2010:

2011 2012 2013 2014 2015 Thereafter Total

In millions

Aggregate future maturities of debt

outstanding including capital lease

obligations ......................... $2,208 $4,272 $3,775 $3,720 $1,111 $1,691 $16,777

Interest expense on borrowings was approximately $417 million in fiscal 2010, $597 million in fiscal

2009, and $467 million in fiscal 2008.

Subsequent event

On December 2, 2010, HP issued $2 billion of U.S. Dollar Global Notes under the 2009 Shelf

Registration Statement. The Global Notes consisted of fixed rate notes at market rates with maturities

of five and ten years from the date of issuance.

120