HP 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

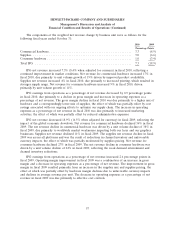

at the end of fiscal 2010. Our debt-equity ratio decreased by 0.07x in fiscal 2009 due primarily to the

net repayment of $2.0 billion in debt.

Our weighted-average interest rate reflects the average effective rate on our borrowings prevailing

during the year; it factors in the impact of swapping some of our global notes with fixed interest rates

for global notes with floating interest rates. For more information on our interest rate swaps, see

Note 10 to the Consolidated Financial Statements in Item 8, which is incorporated herein by reference.

The lower weighted-average interest rates over the past three years is a result of the combination of

lower market interest rates and swapping some of our fixed interest obligations associated with some of

our fixed global notes for variable rate obligations through interest rate swaps in a declining rates

environment.

For more information on our borrowings, see Note 13 to the Consolidated Financial Statements in

Item 8, which is incorporated herein by reference.

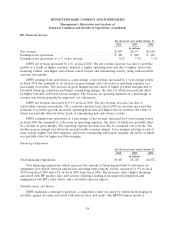

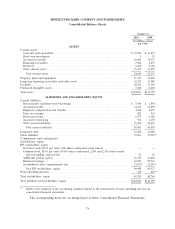

Available Borrowing Resources

At October 31, 2010, we had the following resources available to obtain short-term or long-term

financings if we need additional liquidity:

At October 31, 2010

In millions

2009 Shelf Registration Statement(1) .................................... Unspecified

Commercial paper programs(1) ........................................ $12,100

Uncommitted lines of credit(1) ........................................ $ 1,500

Revolving trade receivables-based facilities(2) .............................. $ 175

(1) For more information on our available borrowings resources, see Note 13 to the Consolidated

Financial Statements in Item 8, which is incorporated herein by reference.

(2) For more information on our revolving trade receivables-based facilities, see Note 4 to the

Consolidated Financial Statements in Item 8, which is incorporated herein by reference.

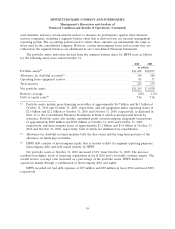

Credit Ratings

Our credit risk is evaluated by three independent rating agencies based upon publicly available

information as well as information obtained in our ongoing discussions with them. The ratings for the

fiscal year ended October 31, 2010 were:

For the fiscal year ended October 31, 2010

Standard & Poor’s Moody’s Investors Fitch Ratings

Ratings Services Service Services

Short-term debt ratings ....................... A-1 Prime-1 F1

Long-term debt ratings ....................... A A2 A+

We do not have any rating downgrade triggers that would accelerate the maturity of a material

amount of our debt. However, a downgrade in our credit rating would increase the cost of borrowings

under our credit facilities. Also, a downgrade in our credit rating could limit our ability to issue

commercial paper under our current programs. If this occurs, we would seek alternative sources of

64