HP 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

improved inventory management. The increase in DPO was due primarily to a change in purchasing

linearity as business recovered through the fourth quarter.

Investing Activities

Net cash used in investing activities increased by approximately $7.8 billion for fiscal 2010 as

compared to fiscal 2009 due primarily to higher cash payments made in connection with fiscal 2010

acquisitions and decreased by approximately $10.1 billion for fiscal 2009 as compared to fiscal 2008 due

primarily to higher cash payments made in connection with fiscal 2008 acquisitions.

Financing Activities

Net cash used in financing activities decreased by approximately $3.8 billion for fiscal 2010, as

compared to fiscal 2009. The decrease was due primarily to a higher net issuance of commercial paper,

the impact of which was partially offset by increased repurchases of our common stock and lower

global debt issuance. Net cash used in financing activities increased by approximately $4.7 billion for

fiscal 2009, as compared to fiscal 2008. The increase was due primarily to higher net repayments of

commercial paper and debt, the impact of which was partially offset by decreased repurchases of our

common stock.

For more information on our share repurchase programs, see Item 5 and Note 15 to the

Consolidated Financial Statements in Item 8, which are incorporated herein by reference.

CAPITAL RESOURCES

Debt Levels

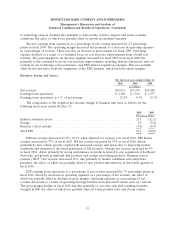

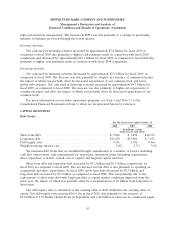

For the fiscal years ended October 31

2010 2009 2008

In millions, except

interest rates and ratios

Short-term debt ..................................... $ 7,046 $ 1,850 $10,176

Long-term debt ..................................... $15,258 $13,980 $ 7,676

Debt-equity ratio .................................... 0.55x 0.39x 0.46x

Weighted-average interest rate .......................... 2.0% 2.7% 3.6%

We maintain debt levels that we establish through consideration of a number of factors, including

cash flow expectations, cash requirements for operations, investment plans (including acquisitions),

share repurchase activities, overall cost of capital, and targeted capital structure.

Short-term debt and long-term debt increased by $5.2 billion and $1.3 billion, respectively, for

fiscal 2010 as compared to fiscal 2009. The net increase in total debt is due primarily to spending on

acquisitions and share repurchases. In fiscal 2009, short-term debt decreased by $8.3 billion and

long-term debt increased by $6.3 billion as compared to fiscal 2008. This was primarily due to the

replacement of short-term debt with long-term debt as capital market conditions improved from the

prior year, the impact of which was partially offset by a reclassification of $1 billion from long-term to

short-term.

Our debt-equity ratio is calculated as the carrying value of debt divided by the carrying value of

equity. Our debt-equity ratio increased by 0.16x in fiscal 2010, due primarily to the issuance of

$3.0 billion of U.S Dollar Global Notes in September and a $4 billion net increase in commercial paper

63