HP 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

Operating Activities

Net cash provided by operating activities decreased by approximately $1.5 billion for fiscal 2010, as

compared to fiscal 2009. The decrease was due primarily to an increase in accounts and financing

receivables resulting from higher revenues in the fourth quarter and higher payments for account

payable activities, the impact of which was partially offset by the increase in net earnings. Net cash

provided by operating activities decreased by approximately $1.2 billion for fiscal 2009, as compared to

fiscal 2008. The decrease was due primarily to increased utilization of cash resources for payment of

operating liabilities such as accounts payable, other current liabilities and restructuring along with a

decrease in net earnings, the impact of which was partially offset by the increased generation of cash

resources through the utilization of operating assets such as inventory and other current assets along

with increased amortization expense.

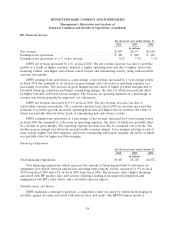

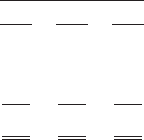

Our key working capital metrics are as follows:

October 31

2010 2009 2008

Days of sales outstanding in accounts receivable ........................... 50 48 45

Days of supply in inventory .......................................... 23 23 27

Days of purchases outstanding in accounts payable ......................... (52) (57) (52)

Cash conversion cycle .............................................. 21 14 20

Days of sales outstanding in accounts receivable (‘‘DSO’’) measures the average number of days

our receivables are outstanding. DSO is calculated by dividing ending accounts receivable, net of

allowance for doubtful accounts, by a 90-day average net revenue. Our accounts receivable balance was

$18.5 billion as of October 31, 2010.

Days of supply in inventory (‘‘DOS’’) measures the average number of days from procurement to

sale of our product. DOS is calculated by dividing ending inventory by a 90-day average cost of goods

sold. Our inventory balance was $6.5 billion as of October 31, 2010.

Days of purchases outstanding in accounts payable (‘‘DPO’’) measures the average number of days

our accounts payable balances are outstanding. DPO is calculated by dividing ending accounts payable

by a 90-day average cost of goods sold. Our accounts payable balance was $14.4 billion as of

October 31, 2010.

Our working capital requirements depend upon our effective management of the cash conversion

cycle, which represents effectively the number of days that elapse from the day we pay for the purchase

of raw materials to the collection of cash from our customers. The cash conversion cycle is the sum of

DSO and DOS less DPO.

The cash conversion cycle for fiscal 2010 increased by 7 days as compared to fiscal 2009. The

increase in DSO was due primarily to linearity and fewer cash discounts in the fourth quarter. DOS

remained flat year over year. The decrease in DPO was due primarily to a change in purchasing

linearity in the fourth quarter.

The cash conversion cycle for fiscal 2009 decreased by 6 days as compared to fiscal 2008. The

increase in DSO was due primarily to our improving penetration into the enterprise market which

tends to have a higher DSO profile, optimizing terms to drive shareholder value as well as more sales

in the month of October. The decrease in DOS was due to lower inventory levels driven primarily by

62