HP 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

judgment is required to determine both probability and the estimated amount. We review these

provisions at least quarterly and adjust these provisions to reflect the impact of negotiations,

settlements, rulings, advice of legal counsel, and updated information. Litigation is inherently

unpredictable and is subject to significant uncertainties, some of which are beyond our control. Should

any of these estimates and assumptions change or prove to have been incorrect, it could have a

material impact on our results of operations, financial position and cash flows. See Note 18 to the

Consolidated Financial Statements in Item 8 for a further discussion of litigation and contingencies.

ACCOUNTING PRONOUNCEMENTS

In June 2009, the FASB issued a new accounting standard related to the consolidation of variable

interest entities. It eliminates the quantitative approach previously required for determining the primary

beneficiary of a variable interest entity and requires ongoing qualitative reassessments of whether an

enterprise is the primary beneficiary of a variable interest entity. This new standard also requires

additional disclosures about an enterprise’s involvement in variable interest entities. We will adopt this

new accounting standard in the first quarter of fiscal 2011. We do not expect the adoption of this

standard will have a material effect on our consolidated financial statements.

CONSTANT CURRENCY PRESENTATION

Revenue from our international operations has historically represented, and we expect will

continue to represent, a majority of our overall net revenue. As a result, our revenue growth has been

impacted, and we expect will continue to be impacted, by fluctuations in foreign currency exchange

rates. In order to provide a framework for assessing how each of our business segments performed

excluding the impact of foreign currency fluctuations, we present the year-over-year percentage change

in revenue performance on a constant currency basis, which assumes no change in the exchange rate

from the prior-year period. This constant currency disclosure is provided in addition to, and not as a

substitute for, the year-over-year percentage change in revenue on an as-reported basis.

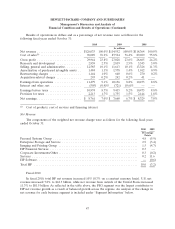

RESULTS OF OPERATIONS

The following discussion compares the historical results of operations on a GAAP basis for the

fiscal years ended October 31, 2010, 2009, and 2008. Unless otherwise noted, all comparative

performance data included below reflect year-over-year comparisons.

46