HP 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180

|

|

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

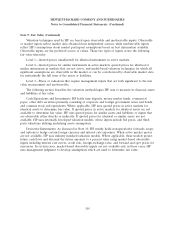

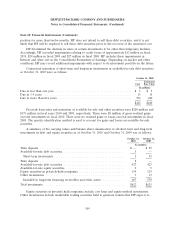

Note 9: Fair Value (Continued)

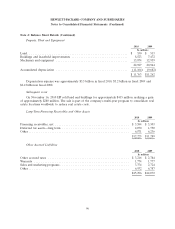

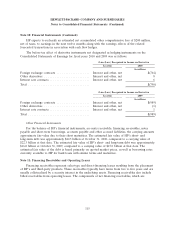

The following table presents HP’s assets and liabilities that are measured at fair value on a

recurring basis:

As of October 31, 2010 As of October 31, 2009

Fair Value Fair Value

Measured Using Measured Using

Total Total

Level 1 Level 2 Level 3 Balance Level 1 Level 2 Level 3 Balance

In millions

Assets

Time deposits ................... $— $6,598 $— $6,598 $ — $ 8,925 $— $ 8,925

Commercial paper ................ — — — — — 1,388 — 1,388

Money market funds ............... 971 — — 971 262 — — 262

Marketable equity securities .......... 11 3 — 14 7 3 — 10

Foreign bonds ................... 8 365 — 373 10 367 — 377

Corporate bonds and other debt securities . 3 6 50 59 5 5 36 46

Derivatives:

Interest rate contracts ............ — 735 — 735 — 375 — 375

Foreign exchange contracts ......... — 150 32 182 — 379 1 380

Other derivatives ............... — 5 6 11 — 1 — 1

Total Assets ................. $993 $7,862 $88 $8,943 $284 $11,443 $37 $11,764

Liabilities

Derivatives:

Interest rate contracts ............ $— $ 89 $— $ 89 $— $ 51 $— $ 51

Foreign exchange contracts ......... — 880 10 890 — 720 1 721

Other derivatives ............... — — — — — 2 — 2

Total Liabilities ............... $— $ 969 $10 $ 979 $— $ 773 $1 $ 774

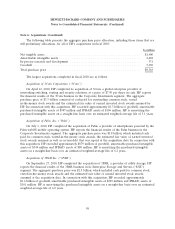

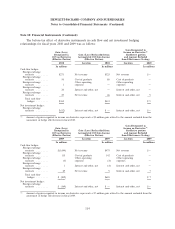

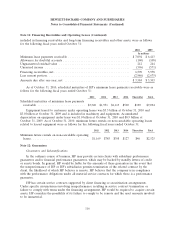

The following table presents the changes in Level 3 instruments in fiscal years 2010 and 2009 that

were measured at fair value on a recurring basis. The majority of the Level 3 balances consist of

106