HP 2010 Annual Report Download - page 76

Download and view the complete annual report

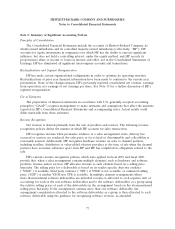

Please find page 76 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expense. The swap transactions generally involve the exchange of fixed for floating interest payments.

However, we may choose not to swap fixed for floating interest payments or may terminate a previously

executed swap if we believe a larger proportion of fixed-rate debt would be beneficial. In order to hedge

the fair value of certain fixed-rate investments, we may enter into interest rate swaps that convert fixed

interest returns into variable interest returns. We may use cash flow hedges to hedge the variability of

LIBOR-based interest income received on certain variable-rate investments. We may also enter into interest

rate swaps that convert variable rate interest returns into fixed-rate interest returns.

We have performed sensitivity analyses as of October 31, 2010 and 2009, using a modeling

technique that measures the change in the fair values arising from a hypothetical 10% adverse

movement in the levels of interest rates across the entire yield curve, with all other variables held

constant. The analyses cover our debt, investment instruments, financing receivables and interest rate

swaps. The analyses use actual maturities for the debt, investments and interest rate swaps and

approximate maturities for financing receivables. The discount rates we used were based on the market

interest rates in effect at October 31, 2010 and 2009. The sensitivity analyses indicated that a

hypothetical 10% adverse movement in interest rates would result in a loss in the fair values of our

debt, investment instruments and financing receivables, net of interest rate swap positions, of

$28 million at October 31, 2010 and $33 million at October 31, 2009.

Equity price risk

We are also exposed to equity price risk inherent in our portfolio of publicly traded equity

securities, which had an estimated fair value of $9 million at October 31, 2010 and $5 million at

October 31, 2009. We monitor our equity investments for impairment on a periodic basis. Generally, we

do not attempt to reduce or eliminate our market exposure on these equity securities. However, we

may use derivative transactions to hedge certain positions from time to time. We do not purchase our

equity securities with the intent to use them for speculative purposes. A hypothetical 30% adverse

change in the stock prices of our publicly traded equity securities would result in a loss in the fair

values of our marketable equity securities of approximately $3 million and $1 million at October 31,

2010 and 2009, respectively. The aggregate cost of privately-held companies, and other investments was

$163 million at October 31, 2010 and $142 million at October 31, 2009.

68