HP 2010 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 15: Stockholders’ Equity (Continued)

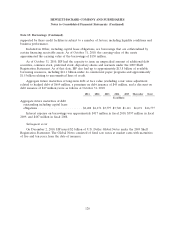

Comprehensive Income

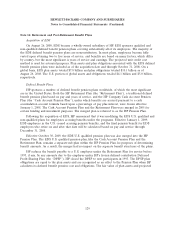

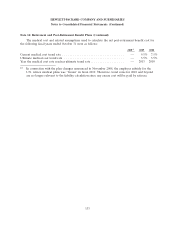

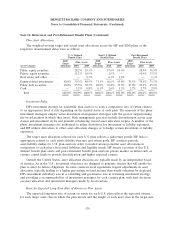

The changes in the components of other comprehensive income, net of taxes, were as follows for

the following fiscal years ended October 31:

2010 2009 2008

In millions

Net earnings .............................................. $8,761 $ 7,660 $8,329

Net change in unrealized gains (losses) on available-for-sale securities:

Change in net unrealized gains (losses), net of tax of $9 million in fiscal

2010, net of tax of $11 million in fiscal 2009 and net of tax benefit of

$7 million in fiscal 2008 ................................... 16 17 (17)

Net unrealized (gains) losses reclassified into earnings, with no tax effect

in fiscal 2010, fiscal 2009 and fiscal 2008 ....................... — (1) 1

16 16 (16)

Net change in unrealized gains (losses) on cash flow hedges:

Unrealized gains (losses) recognized in OCI, net of tax of $119 million in

fiscal 2010, net of tax benefit of $362 million in fiscal 2009 and net of

tax of $468 million in fiscal 2008 ............................ 250 (540) 808

(Gains) losses reclassified into income, net of tax of $149 million in fiscal

2010, net of tax of $187 million in fiscal 2009 and net of tax benefit of

$34 million in fiscal 2008 .................................. (282) (431) 58

(32) (971) 866

Net change in cumulative translation adjustment, net of tax of $31 million

in fiscal 2010, net of tax of $227 million in fiscal 2009 and net of tax

benefit of $476 million in fiscal 2008 ........................... 28 304 (936)

Net change in unrealized components of defined benefit plans, net of tax

benefit of $83 million in fiscal 2010, $905 million in fiscal 2009 and

$42 million in fiscal 2008 .................................... (602) (2,531) (538)

Comprehensive income ...................................... $8,171 $ 4,478 $7,705

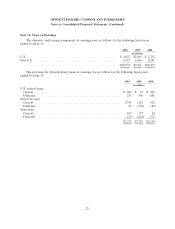

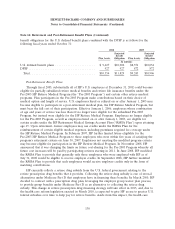

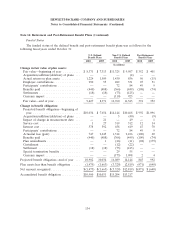

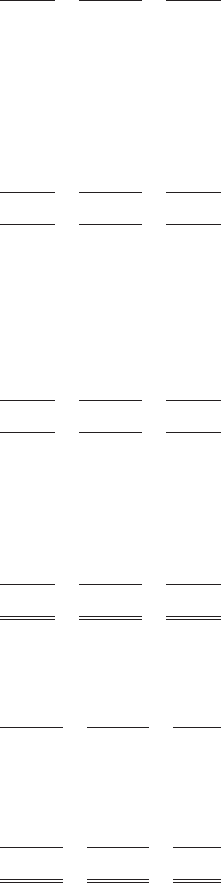

The components of accumulated other comprehensive loss, net of taxes, were as follows for the

following fiscal years ended October 31:

2010 2009 2008

In millions

Net unrealized gain (loss) on available-for-sale securities .............. $ 20 $ 4 $ (12)

Net unrealized (loss) gain on cash flow hedges ..................... (201) (169) 802

Cumulative translation adjustment .............................. (431) (459) (763)

Unrealized components of defined benefit plans .................... (3,225) (2,623) (92)

Accumulated other comprehensive loss ........................... $(3,837) $(3,247) $ (65)

128