HP 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

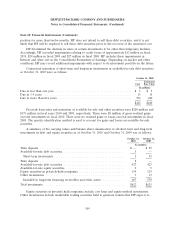

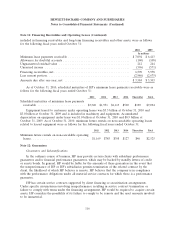

Note 9: Fair Value (Continued)

investment securities classified as available-for-sale with changes in fair value recorded in other

comprehensive income (‘‘OCI’’).

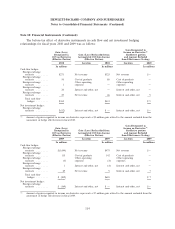

Fair Value Measured Using

Significant Unobservable Inputs

(Level 3)

Other Debt Derivative

Securities Instruments Total

In millions

Beginning balance at November 1, 2009 ........................ $36 $— $36

Total (losses) gains (realized/unrealized):

Included in earnings(1) ................................. (8) 2 (6)

Included in OCI ...................................... 14 67 81

Purchases, issuances, and settlements ........................ 8 (41) (33)

Ending balance at October 31, 2010 ........................... $50 $28 $78

The amount of total losses for the period included in earnings

attributable to the change in unrealized losses relating to assets still

held as of October 31, 2010 ............................... $(8) $ 2 $ (6)

(1) Included in Interest and other, net in the accompanying Consolidated Statements of Earnings.

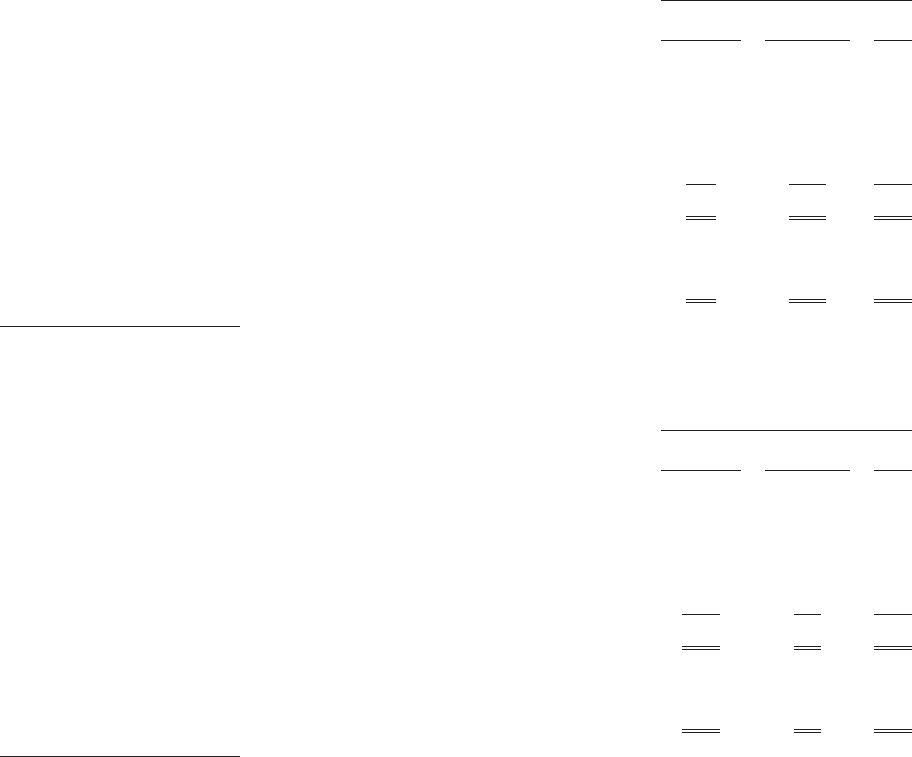

Fair Value Measured Using

Significant Unobservable Inputs

(Level 3)

Other Debt Derivative

Securities Instruments Total

In millions

Beginning balance at November 1, 2008 ........................ $64 $(1) $63

Total (losses) gains (realized/unrealized):

Included in earnings(1) ................................. (2) 2 —

Included in OCI ...................................... (25) (2) (27)

Purchases, issuances, and settlements ........................ (1) 1 —

Ending balance at October 31, 2009 ........................... $36 $— $36

The amount of total losses for the period included in earnings

attributable to the change in unrealized losses relating to assets still

held as of October 31, 2009 ............................... $ (2) $— $ (2)

(1) Included in Interest and other, net in the accompanying Consolidated Statements of Earnings.

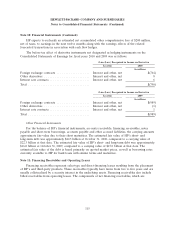

HP measures certain assets including cost and equity method investments at fair value on a

non-recurring basis. These assets are recognized at fair value when they are deemed to be

other-than-temporarily impaired. In fiscal years 2010 and 2009, HP recorded an impairment charge of

$5 million and $22 million, respectively.

107