HP 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

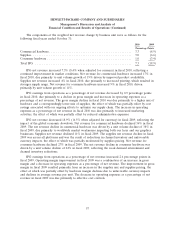

Interest and Other, Net

Interest and other, net improved by $216 million in fiscal 2010. The improvement was driven

primarily by lower currency losses on balance sheet remeasurement items, lower interest expenses on

debt balances due to lower interest rates, and a value-added tax refund, the effect of which was

partially offset by an increase to our litigation accruals.

Interest and other, net decreased by $721 million in fiscal 2009. The decrease was driven primarily

by higher interest expenses due to higher average debt balances principally related to the EDS

acquisition, lower interest income as a result of lower interest rates, and higher currency losses on

balance sheet remeasurement items. Additionally, there were higher gains from the sale of real estate

in fiscal 2008 as compared to fiscal 2009.

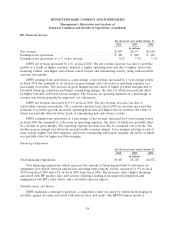

Provision for Taxes

Our effective tax rates were 20.2%, 18.6% and 20.5% in fiscal 2010, 2009 and 2008, respectively.

HP’s effective tax rate generally differs from the U.S. federal statutory rate of 35% due to favorable tax

rates associated with certain earnings from HP’s operations in lower-tax jurisdictions throughout the

world. HP has not provided U.S. taxes for all of its international earnings because HP plans to reinvest

some of those earnings indefinitely outside the United States.

The increase in the overall tax rate in fiscal 2010 was due primarily to a decrease in the income

tax benefits related to foreign earnings.

The decrease in the overall tax rate in fiscal 2009 was due primarily to the net income tax benefits

recorded for fiscal 2009 which were related to foreign net operating losses, adjustments to estimated

fiscal 2008 tax accruals upon filing the 2008 income tax returns, valuation allowance reversals for state

and foreign net operating losses, and other miscellaneous items.

For a full reconciliation of our effective tax rate to the U.S. federal statutory rate of 35% and

further explanation of our provision for taxes, see Note 14 to the Consolidated Financial Statements in

Item 8, which is incorporated herein by reference.

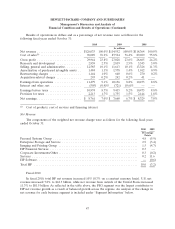

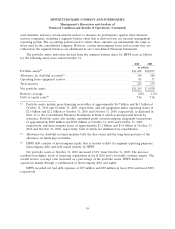

Segment Information

A description of the products and services, as well as financial data, for each segment can be

found in Note 19 to the Consolidated Financial Statements in Item 8, which is incorporated herein by

reference. We have realigned segment financial data for the fiscal years ended October 31, 2009 and

2008 to reflect changes in HP’s organizational structure that occurred at the beginning of the first

quarter of fiscal 2010. We describe these changes more fully in Note 19. We have presented the

business segments in this Annual Report on Form 10-K based on the distinct nature of various

businesses such as customer base, homogeneity of products and technology. The discussions below

include the results of each of our segments.

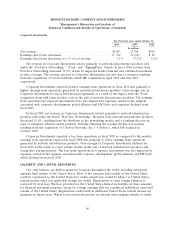

HP Enterprise Business

Services, ESS and HP Software are reported collectively as a broader HP Enterprise Business. We

describe the results of the business segments of the HP Enterprise Business in more detail below.

51