HP 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 8: Restructuring Charges (Continued)

Summary of Restructuring Plans

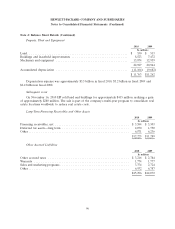

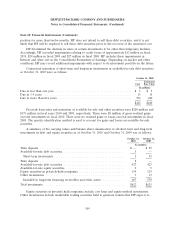

The adjustments to the accrued restructuring expenses related to all of HP’s restructuring plans

described above for the twelve months ended October 31, 2010 were as follows:

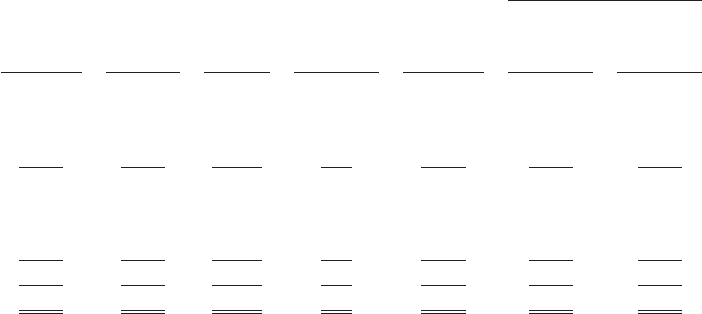

As of October 31, 2010

Fiscal Non-cash Total costs Total

Balance, year 2010 settlements Balance, and expected

October 31, charges Cash and other October 31, adjustments costs and

2009 (reversals) payments adjustments 2010 to date adjustments

In millions

Fiscal 2010 acquisitions . . $ — $ 64 $ (20) $ — $ 44 $ 64 $ 88

Fiscal 2010 ES Plan:

Severance ......... $ — $ 630 $ (55) $45 $ 620 $ 630 $ 761

Infrastructure ....... — 20 (6) (10) 4 20 231

Total ES Plan ....... $ — $ 650 $ (61) $35 $ 624 $ 650 $ 992

Fiscal 2009 Plan ....... $ 248 $ (5) $ (177) $ (9) $ 57 $ 292 $ 292

Fiscal 2008 HP/EDS Plan:

Severance ......... $ 747 $ 236 $ (873) $(35) $ 75 $2,146 $2,146

Infrastructure ....... 419 193 (185) (19) 408 693 1,239

Total HP/EDS Plan . . . $1,166 $ 429 $(1,058) $(54) $ 483 $2,839 $3,385

Total restructuring plans . . $1,414 $1,138 $(1,316) $(28) $1,208 $3,845 $4,757

During fiscal 2010, HP had completed payouts of restructuring liabilities associated with previous

restructuring actions and recorded a restructuring charge in fiscal 2010 of $6 million associated with

these actions. At October 31, 2009, HP had $51 million of restructuring liabilities associated with these

actions.

At October 31, 2010 and October 31, 2009, HP included the long-term portion of the restructuring

liability of $297 million and $356 million, respectively, in Other liabilities, and the short-term portion in

Accrued restructuring in the accompanying Consolidated Balance Sheets.

Note 9: Fair Value

HP adopted the provisions related to the fair value of nonfinancial assets and nonfinancial

liabilities in the first quarter of fiscal 2010 for the following major categories of nonfinancial items from

the Consolidated Balance Sheet: Property, plant and equipment; Goodwill; Purchased intangible assets;

Accrued restructuring; and the asset retirement obligations within Other accrued liabilities and Other

liabilities. The provisions of the accounting standard related to measuring fair value and related

disclosures are applied to nonfinancial assets and nonfinancial liabilities whenever they are required to

be measured at fair value, such as when accounting for a business combination, when evaluating and/or

determining impairment, or in accordance with certain other accounting pronouncements. Except for

assets and liabilities acquired in business combinations as discussed in Note 6, HP did not measure any

material nonfinancial assets and nonfinancial liabilities at fair value on a non-recurring basis in fiscal

2010.

Except for the provisions noted above, the accounting standard relating to fair value measurements

and disclosures became effective for HP beginning in fiscal 2009. This standard establishes a new

framework for measuring fair value and expands related disclosures. The framework requires fair value

to be determined based on the exchange price that would be received for an asset or paid to transfer a

liability (an exit price) in the principal or most advantageous market for the asset or liability in an

orderly transaction between market participants.

104