HP 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

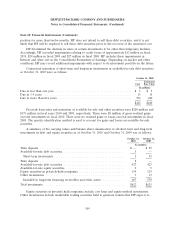

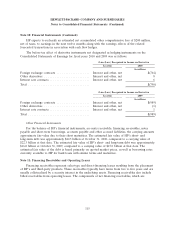

Note 11: Financing Receivables and Operating Leases (Continued)

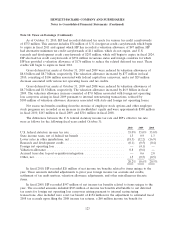

included in financing receivables and long-term financing receivables and other assets, were as follows

for the following fiscal years ended October 31:

2010 2009

In millions

Minimum lease payments receivable ................................... $7,094 $ 6,413

Allowance for doubtful accounts ...................................... (140) (108)

Unguaranteed residual value ........................................ 212 244

Unearned income ................................................ (596) (571)

Financing receivables, net ........................................... 6,570 5,978

Less current portion ............................................... (2,986) (2,675)

Amounts due after one year, net ..................................... $3,584 $ 3,303

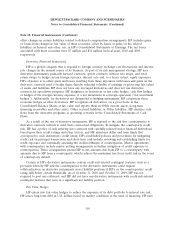

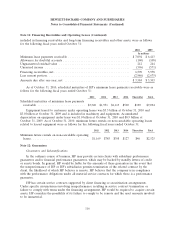

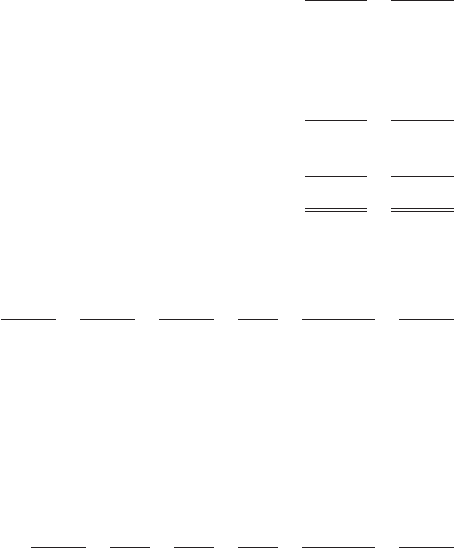

As of October 31, 2010, scheduled maturities of HP’s minimum lease payments receivable were as

follows for the following fiscal years ended October 31:

2011 2012 2013 2014 Thereafter Total

Scheduled maturities of minimum lease payments

receivable ........................... $3,320 $1,951 $1,113 $520 $190 $7,094

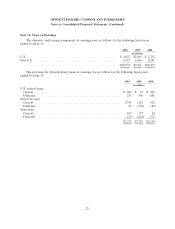

Equipment leased to customers under operating leases was $3.5 billion at October 31, 2010 and

$3.0 billion at October 31, 2009 and is included in machinery and equipment. Accumulated

depreciation on equipment under lease was $1.0 billion at October 31, 2010 and $0.9 billion at

October 31, 2009. As of October 31, 2010, minimum future rentals on non-cancelable operating leases

related to leased equipment were as follows for the following fiscal years ended October 31:

2011 2012 2013 2014 Thereafter Total

Minimum future rentals on non-cancelable operating

leases ................................. $1,169 $785 $398 $127 $46 $2,525

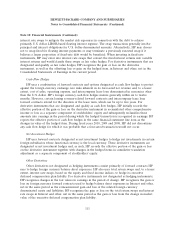

Note 12: Guarantees

Guarantees and Indemnifications

In the ordinary course of business, HP may provide certain clients with subsidiary performance

guarantees and/or financial performance guarantees, which may be backed by standby letters of credit

or surety bonds. In general, HP would be liable for the amounts of these guarantees in the event that

the nonperformance of HP or HP’s subsidiaries permits termination of the related contract by the

client, the likelihood of which HP believes is remote. HP believes that the company is in compliance

with the performance obligations under all material service contracts for which there is a performance

guarantee.

HP has certain service contracts supported by client financing or securitization arrangements.

Under specific circumstances involving nonperformance resulting in service contract termination or

failure to comply with terms under the financing arrangement, HP would be required to acquire certain

assets. HP considers the possibility of its failure to comply to be remote and the asset amounts involved

to be immaterial.

116