Google 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

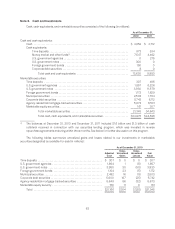

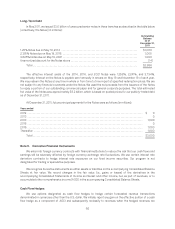

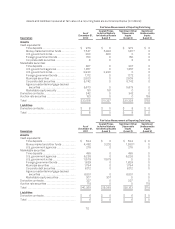

Long-Term Debt

In May 2011, we issued $3.0 billion of unsecured senior notes in three tranches as described in the table below

(collectively, the Notes) (in millions):

Outstanding

Balance

as of

December 31,

2011

1.25% Notes due on May 19, 2014 .......................................................... $1,000

2.125% Notes due on May 19, 2016 ......................................................... 1,000

3.625% Notes due on May 19, 2021 ......................................................... 1,000

Unamortized discount for the Notes above ................................................... (14)

Total ................................................................................ $2,986

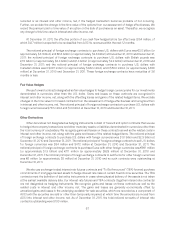

The effective interest yields of the 2014, 2016, and 2021 Notes were 1.258%, 2.241%, and 3.734%,

respectively. Interest on the Notes is payable semi-annually in arrears on May 19 and November 19 of each year.

We may redeem the Notes at any time in whole or from time to time in part at specified redemption prices. We are

not subject to any financial covenants under the Notes. We used the net proceeds from the issuance of the Notes

to repay a portion of our outstanding commercial paper and for general corporate purposes. The total estimated

fair value of the Notes was approximately $3.2 billion, which is based on quoted prices for our publicly-traded debt

as of December 31, 2011.

At December 31, 2011, future principal payments for the Notes were as follows (in millions):

Years ended

2012 ........................................................................................ $ 0

2013 ........................................................................................ 0

2014 ........................................................................................ 1,000

2015 ........................................................................................ 0

2016 ........................................................................................ 1,000

Thereafter ................................................................................... 1,000

Total .................................................................................... $3,000

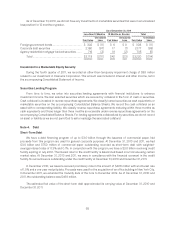

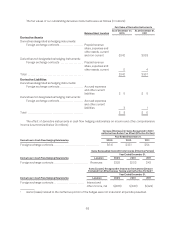

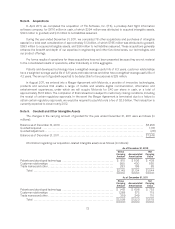

Note 5. Derivative Financial Instruments

We enter into foreign currency contracts with financial institutions to reduce the risk that our cash flows and

earnings will be adversely affected by foreign currency exchange rate fluctuations. We use certain interest rate

derivative contracts to hedge interest rate exposures on our fixed income securities. Our program is not

designated for trading or speculative purposes.

We recognize derivative instruments as either assets or liabilities on the accompanying Consolidated Balance

Sheets at fair value. We record changes in the fair value (i.e., gains or losses) of the derivatives in the

accompanying Consolidated Statements of Income as interest and other income, net, as part of revenues, or to

accumulated other comprehensive income (AOCI) in the accompanying Consolidated Balance Sheets.

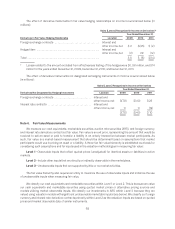

Cash Flow Hedges

We use options designated as cash flow hedges to hedge certain forecasted revenue transactions

denominated in currencies other than the U.S. dollar. We initially report any gain on the effective portion of a cash

flow hedge as a component of AOCI and subsequently reclassify to revenues when the hedged revenues are

66